Government 'Processing Error' Sinks U.S. Housing Market Reports for Entire Year

Housing-Market / US Housing Jan 05, 2016 - 03:26 AM GMTBy: Mike_Shedlock

Huge "Processing Error" in Government Housing Data

Huge "Processing Error" in Government Housing Data

When I saw some of the upwardly revised GDP estimates in 2015 I thought they were too good to be true, and that downward revisions were coming.

I had almost given up on that idea, but I was correct all along.

Last month, construction spending was reported to be up 1%. Today we see it was only 0.3%. Economists, being perpetual optimists, came up with a consensus estimate for this month of +0.7% The actual result is -0.4%, over a full percentage point below the consensus and nearly a pull point lower than the lowest estimate of +0.5%.

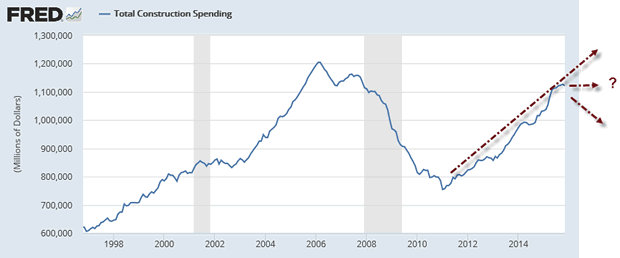

Construction spending had been a highlight of the U.S. economy but less so with November's report where the headline fell 0.4 percent, far below the Econoday consensus for plus 0.7 percent. The year-on-year gain for spending, at 10.5 percent, is the lowest since April last year. Today's report also includes sharp downward revisions to prior months, the result of a processing error going back to January last year. October's initial 1.0 percent monthly gain is now cut 7 tenths to 0.3 percent while September is now at plus 0.2 percent vs an initial plus 0.6 percent.

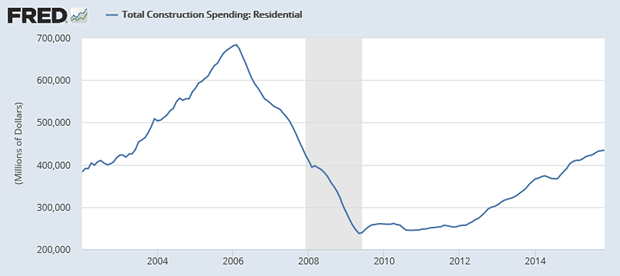

The processing error, unfortunately for the housing outlook, is centered in the residential component where prior strength has been cut back. Still, residential spending rose 0.3 percent for a second month in a row that follows September's very solid 1.2 percent gain. Spending on new single-family homes has been rising strongly with the year-on-year rate at a very solid plus 9.3 percent. Spending on multi-family homes did fall in November but has been in fact booming in prior months, up 24.5 percent year-on-year.

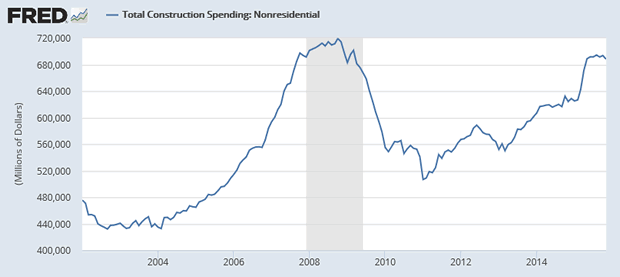

Spending on nonresidential construction has also been solid, down in November but with the year-on-year rate at plus 13.6 percent. Public spending has been led by the educational component, up 15.2 percent year-on-year, with highway spending behind at plus 5.6 percent.

A processing error of this size is rare for government data but even after the downward revisions, construction spending remains a central plus and a reminder that domestic demand is the economy's most important driver.

GDP Revisions Coming Up

As a result of the discovery of a "processing error", huge by even government standards, not only will GDP estimates for the current quarter sink, so will reported GDP from prior quarters.

Downward revisions are coming. The next GDP reports will reveal by how much.

Bloomberg puts a positive spin on things pointing out the year-over-year gains. The more important question is: Where to from here?

Total Construction Spending

Total Construction Spending: Nonresidential

Total Construction Spending: Residential

Breakdowns

- Total: $1.122 Trillion

- Residential: $431 Billion

- Nonresidential: $688 Billion

Nonresidential Breakdown

- Commercial: $69 Billion

- Highway and Street: $91 Billion

- Healthcare: $41 Billion

- Education: $91 Billion

- Religious: $3 Billion

- Manufacturing: $84 Billion

- Office: $59 Billion

- Amusement and Recreation: $21 Billion

- Sewage and Waste: $24 Billion

- Transportation: $4 Billion

- Power: $86 Billion

- Lodging: $22 Billion

- Water Supply: $13 Billion

- Communication: $22 Billion

- Public Safety: $9 Billion

- Conservation: $8 Billion

- Other: $41 Billion

Where to From Here?

It's difficult to judge many of those categories.

- The federal government did add a few more billion to highway funds for 2016, but that is a trivial amount in the grand scheme of things.

- Affordability of housing has dropped and millennials are struggling for numerous other reasons including rising healthcare costs and need to take care of aging boomer parents. Thus, I do not expect much out of new single-family construction.

- Manufacturing is weak. With a strong US dollar, there is no reason to believe a US manufacturing turn-around is on the horizon.

- Will taxpayers be willing to shoulder tax hikes for more schools?

- Do we have a growing need for office space? Lodging? Mall space? Will we build more anyway?

- Many big box retailers are struggling and minimum wage hikes will make employees more expensive to hire. Thus, I expect a slowdown in new retail stores and restaurants. In turn, that will reduce demand for shipping of merchandise to fill those stores, and it will reduce the need for new employees as well.

Certainly there are a lot of questions, but risks seem way skewed to the downside. It's looking more and more to me the economy has already peaked.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.