The Importance Of A Good Trading System in 2015

Stock-Markets / Financial Markets 2016 Jan 05, 2016 - 05:29 PM GMTBy: Harry_Dent

In this morning’s 5 Day Forecast, Adam O’Dell, our Chief Investment Strategist, gave Boom & Bust subscribers a snapshot of what 2015 was like for stocks, bonds and commodities.

In this morning’s 5 Day Forecast, Adam O’Dell, our Chief Investment Strategist, gave Boom & Bust subscribers a snapshot of what 2015 was like for stocks, bonds and commodities.

The picture was ugly!

So I’m going to show you too, but I’m going to let charts do the talking…

Since early 2006 we’ve seen a series of major bubble tops. It started with real estate. Then it was emerging market stocks in late 2007, commodities and oil in mid-2008, gold in late 2011, Treasury bonds in mid-2012, junk bonds in mid-2013, and finally stocks in mid-2015 (although the largest cap indices could still eke out a slight new high by late January, but that looks less likely now with the way stocks started today).

The result is that 2015 has the unpleasant distinction of being the first year since 2008 when none of the major sectors made gains… and unless you were following a good trading system like Boom & Bust, Cycle 9 Alert, Max Profit Alert, Treasury Profits Accelerator, Triple Play Strategy or Forensic Investor, you most likely didn’t make any money in the markets last year!

Let’s look at the details, from worst to… well… less bad…

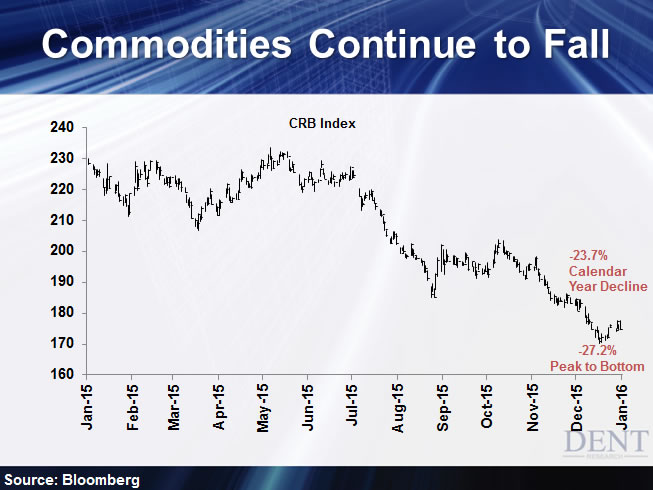

The leading loser continues to be commodities, which are down 23.7% for the calendar year (January to December 2015) and 27.2% from the high to the low for the year.

Oil was down 31.1% for the year and 45.7% from high to low.

Gold was down 10.5% and 19.7%, respectively.

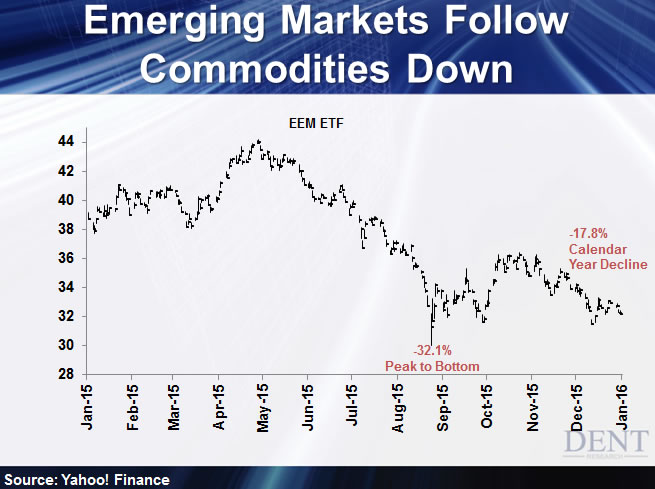

Emerging market stocks performed poorly too because most followed declining commodity prices. The EEM ETF was down 17.6% for the year and a whopping 32.1% from high to low.

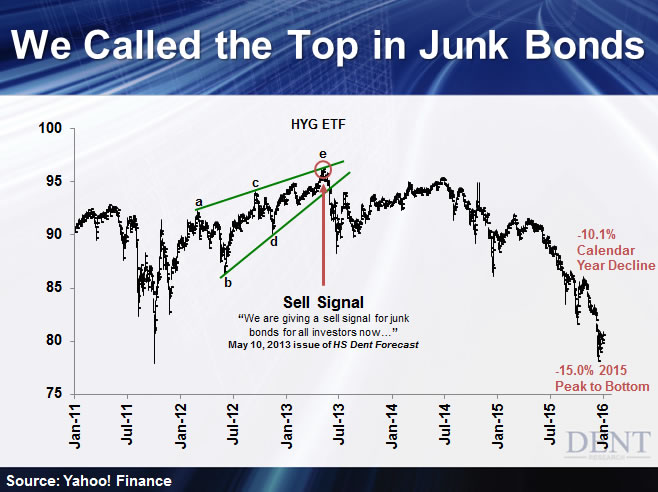

Then comes junk bonds, which were down 10.1% for 2015 and 15.0% at the extremes.

We can actually go back farther here and show how we clearly called the exact top in mid-2013! Junk bonds are down 17% since then and Boom & Bust subscribers have been able to profit from this decline.

Note: Junk bonds are typically the first to smell a recession or crisis ahead, so take this as a warning.

Then there were 10-Year Treasury bonds that only lost 4.9% for the year (about 2.9% when you adjust for an average yield of 2%). However, they lost a substantial 17.1% from top to bottom. Lance Gaitan, editor of Treasury Profits Accelerator, has created a system that identifies profit opportunities as the Treasury market fluctuates, regardless of how much they lose (or gain) over the long-term.

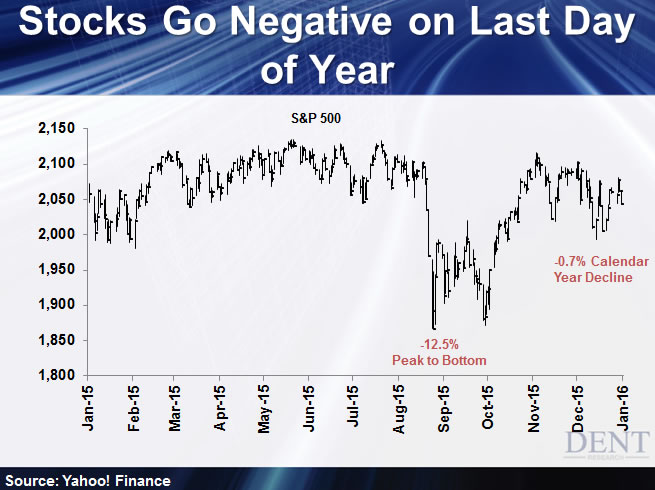

And finally stocks appeared to have topped in May with the S&P 500 declining in the last hour of the last day of the year just enough to be down 0.7% for the year and 12.5% at the extremes.

And stocks opened down very sharply on Monday January 4 – not boding well for 2016.

Two simple insights here…

When an artificial bubble goes straight up for over six years and finally stalls, it’s very likely peaking… and for good.

And when all of the bubbles of such an unprecedented period finally burst, there’s no place to hide – not even in real estate.

You can either play it safe and preserve your capital or start investing with the help of a proven trading system that can make gains in falling and increasingly volatile markets. We have put together a range of such systems to meet different risk tolerances and investment styles…

So now is the time to get serious about getting out of buy-and-hold strategies and into something that can actually help you make money this year… a year, I’ll add, that is likely to be the worst year for stocks since 1931.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.