Has Chicago Reached Debt Boiling Point?

Interest-Rates / US Debt Feb 16, 2016 - 05:30 PM GMTBy: Rodney_Johnson

In the 1890s Charles Dana, editor of the New York Sun, referred to Chicago as the “Windy City.” Chicago was one of many cities competing to host the World’s Fair, and clearly the writer intended the double entendre to apply to the city’s weather as well as its mouthy politicians.

In the 1890s Charles Dana, editor of the New York Sun, referred to Chicago as the “Windy City.” Chicago was one of many cities competing to host the World’s Fair, and clearly the writer intended the double entendre to apply to the city’s weather as well as its mouthy politicians.

When it comes to Chicago’s weather, anyone who has visited “Chi-town” (as the city is known in CB-lingo) can attest to the screaming wind off of Lake Michigan. It howls for what seems like days at 40 mph, carrying with it sub-zero temperature in the winter.

As for Chicago’s politicians, spouting hot air just happens to be a trait common to people in that profession.

But now it might be time to paint some more of them with that broad brush.

Chicago Schools Are Dead Broke

There you have it. The Chicago Public School system (CPS) is broke. Even after Mayor Rahm Emanuel took a knife to the CPS budget last summer, cutting away almost half a billion in spending, the system still faces a $500 million shortfall.

District officials have come up with the brilliant solution to fund their operations by issuing bonds, as if that will bring in more tax revenue or lower their expenses. Bond buyers would have the promise that CPS will use its “full faith and credit” to repay the bonds.

There’s only one problem. It’s a lie, and the district officials know it.

The term “full faith and credit” means that a borrower will use all assets available to repay a debt. But Chicago’s school system, in the footsteps of Detroit two years ago and now Puerto Rico, has no intention of foregoing other expenses to pay bondholders.

Hook, Line, and Sinker

Their plan, just like Detroit and Puerto Rico, is to con whomever they can into giving the system cash. They have one goal: hold off bankruptcy just one more day, until there’s not another sucker willing to take the bait.

In this case, the bait is pretty tempting. The Chicago Public School system is offering an 8.5% yield on a municipal bond, which equates to a 12.3% taxable yield at a 35% tax rate.

With property as valuable as Chicago’s backing such an offering, Chicago’s school system is counting on investors to give into greed, rather than the fear of non-payment. Many of them will. But just as I warned investors away from Puerto Rico’s last bond offering, they should stay away from this piece of kryptonite.

The sad part of the situation in Chicago is that it didn’t have to happen. The sadder part is that the same story is unfolding around the country.

The Likely Suspects

The tale starts like so many others: with pensions. Many years ago the Chicago school system granted generous pension benefits to its employees. But then the city, which operates the school system, didn’t keep up with its end of the funding.

From 1995 to 2004, the city of Chicago didn’t contribute one nickel to the school district’s pension system, even though it is responsible for a portion of contributions in addition to what employees put in.

In the mid-2000s the city got back on track, but by that time the system had a significant shortfall. Then the financial crisis of 2008 hit, crushing the value of the pension and also weighing on the city’s ability to make its obligatory payments.

To give itself some breathing room, the city granted itself a “pension holiday” from 2011 to 2013, allowing for smaller payments than it should have made. Today the city of Chicago must contribute about $700 million to the CPS pension system, an amount that’s increasing by roughly 7% per year.

For a school system that is running half a billion dollars in the red, that’s simply an unworkable number.

Failed Attempts

The city tried to cut pension benefits (a mixture of lower payments, longer vesting, and higher employee contributions), but a judge found that the changes violated the state constitution.

According to that document, any state contractual benefit, such as pensions, that has been earned or offered in the future, can’t be reduced. This leaves employees like teachers and administrators in a strong legal position to demand every cent they were promised.

But the city can’t pay. So it has turned to the state.

Governor Rauner won’t write a blank check to Chicago’s public school system. He’s willing to bail it out, but only if the city turns over control and the legislature agrees to let the school system and the city of Chicago declare bankruptcy.

Hmm.

In a nutshell…

The CPS has zero chance of paying its pension obligations.

The city won’t raise taxes high enough to make good on its debts.

The state will come in only if these entities can declare bankruptcy and discharge at least some of their debts. Typically that means reduced bond payments instead of harming employees or retirees, just like Detroit.

And yet the school system wants to sell new bonds backed by its “full faith and credit.

Right.

What's Really Scary...

While the situation in Chicago is close to a boiling point, the same factors are percolating in school districts, cities, counties, and states across the country.

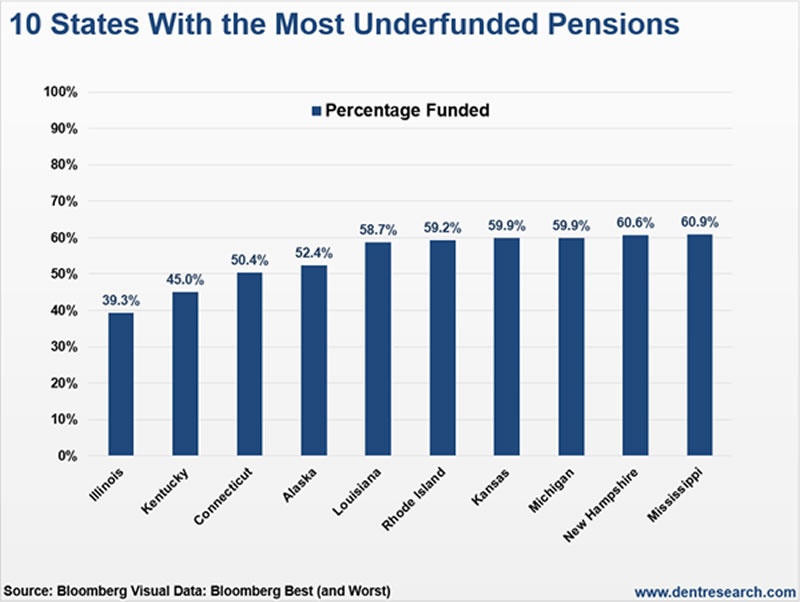

Just look at this top 10 list of the states with the most underfunded pensions.

The state that tops the list is Illinois, home of the Windy City itself. As of 2014, only two states have fully solvent pension systems: South Dakota and Wisconsin.

That’s why it’s so important to research potential bond investments extensively before you put your money down. You don’t want to end up relying on the “full faith and credit” of the next Detroit.

Rodney

Follow me on Twitter ;@RJHSDent

By Rodney Johnson, Senior Editor of Economy & Markets

Copyright © 2016 Rodney Johnson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.