Stocks About To Collapse Or Rally To All-Time Highs?

Stock-Markets / Stock Markets 2016 Mar 06, 2016 - 08:27 PM GMTBy: InvestingHaven

It really is as black-and-white for stock markets: stocks will either collapse in a 2008-alike fashion or shine soon at all-time highs, at least that is what our data points are telling us. Let’s review our key indicators in order to forecast which scenario is playing out right now.

It really is as black-and-white for stock markets: stocks will either collapse in a 2008-alike fashion or shine soon at all-time highs, at least that is what our data points are telling us. Let’s review our key indicators in order to forecast which scenario is playing out right now.

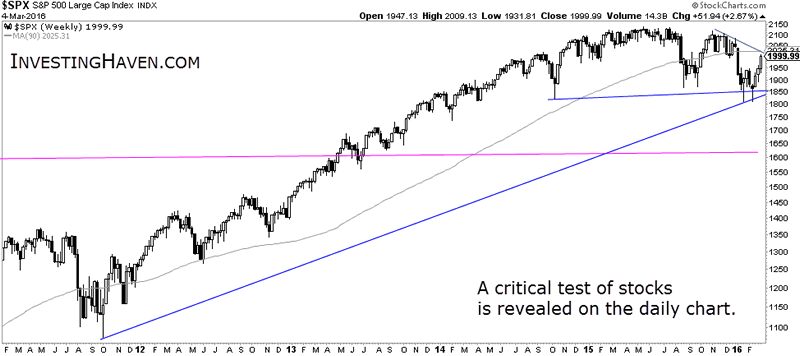

The first chart is the daily of the S&P 500, the bellwether among U.S. stocks. The chart reveals nothing shocking, as this chart pattern is obvious to any investor: the 1850 level was tested several times, and the down-sloping trendline is about to get restested. We observe a triangle pattern, with resistance at 2000 points and support around 1850 points. Since 1.5 year the S&P 500 is moving in that channel, and it is ripe to choose a direction (the latest in two months).

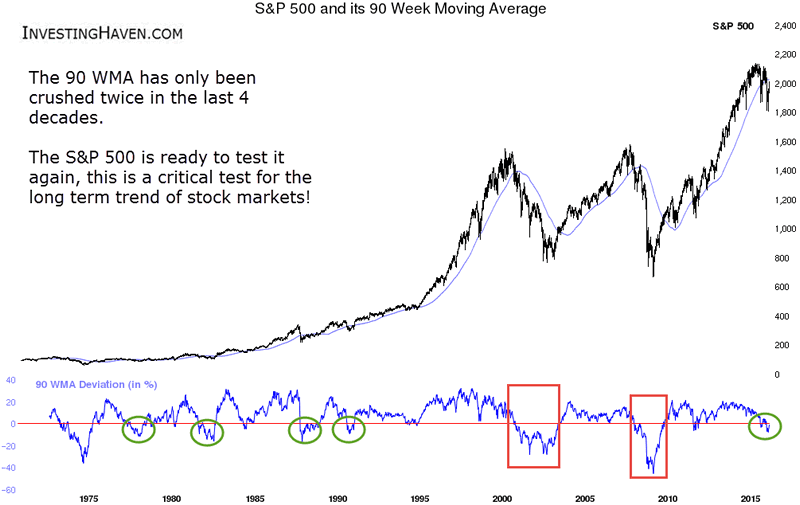

The daily chart did not reveal much useful insights about future direction, so we turn to the weekly. Readers know that we only have one technical indicator in our methodology, being the 90 week moving average, which determines the long term trend. The next chart (lower pane) shows how the 90 WMA was structurally breached only twice in the last four decades. Especially in 2008, the S&P 500 retested its 90 WMA unsuccessfully, before starting the big collapse. Note how today we are very close to a retest of the 90 WMA.

The weekly chart reveals that we are at a make-or-break level, and it basically confirms the message from the daily. That does not happen often, so we consider this price level of huge (secular) importance!

To get a clue of future price direction, we have to dig deeper than the price charts.

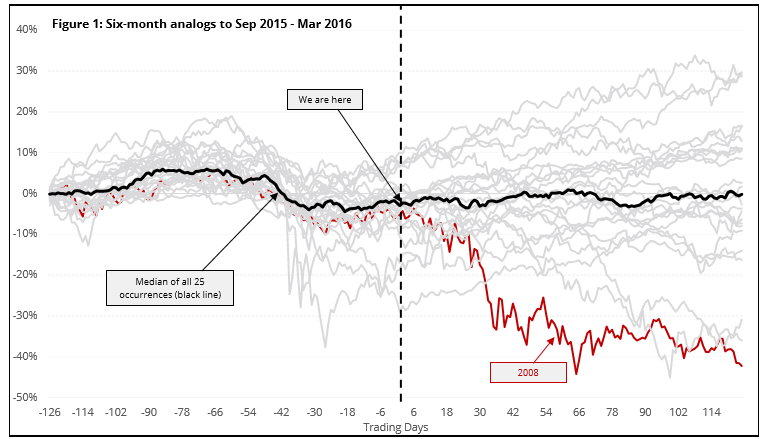

One method to understand whether we are in a 2008-style scenario is to apply correlation analysis. According to Sentimentrader, if we focus on the past six months, then the time period from February to August 2008 is a close match, with an 84% correlation to the six months from last September through today. That’s the 2nd-highest correlation among any six-month period since 1928.

“The worry is that three months after the correlation ended in August 2008, the S&P had lost 30% of its value. But the time period with the highest similarity to our current market was in December 1978, with a whopping 90% correlation. Three months after that, the S&P was 3% higher. Not gangbusters, but not a collapse, either.”

The above chart, above all, confirms once again that stocks have arrived at a make-or-break level.

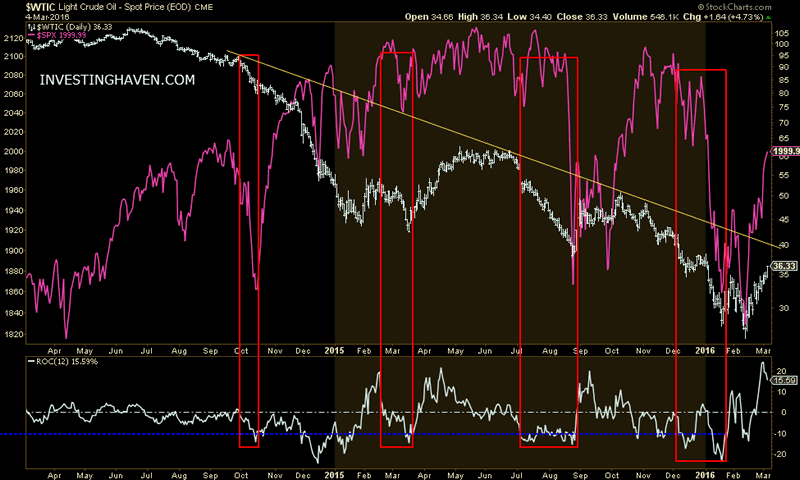

Further to correlation analysis, we consider intermarket dynamics a very important datapoint. Here it becomes interesting. As we have said repeatedly, weakness in stocks has primarily been driven by the collapse in crude oil (read here and here). Back in January, we observed that each time crude fell more than 10% in less than 12 trading days, stocks corrected sharply. That is shown by the red rectangles in the next chart. In other words, volatility in crude has spill over effects to stocks.

When combing all charts above, we conclude that stock investors should be closely watching crude in the coming weeks. If crude corrects sharply (i.e. -10% in less than 12 trading days), and stocks move below the important 1850 level, then a 2008 scenario is likely unfolding. If stocks continue their rally, and crude stabilizes or surges, then the stock bull market is continuing.

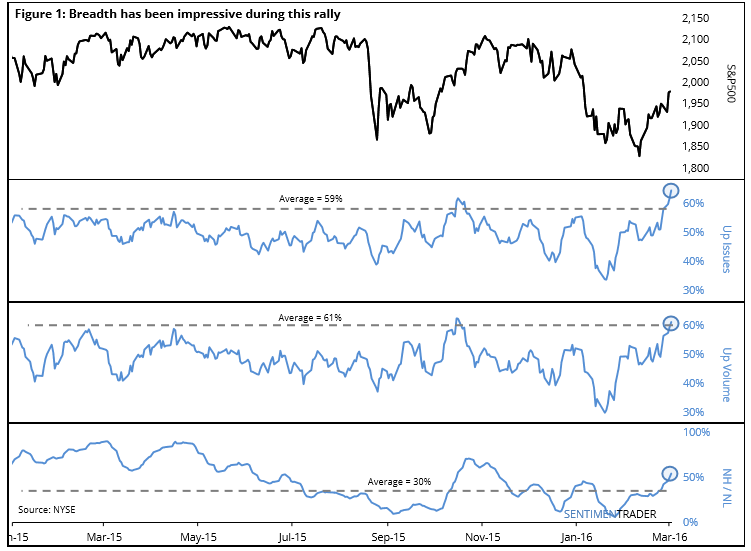

Our last data point is market breadth. So far, the stock market rally has gone 14 days. Over that span, on an average day, 65% of securities on the NYSE have risen, 61% of the volume has gone into those rising stocks, and new 52-week highs have exceeded 52-week lows. That is according to Sentimentrader analysis. “If we go back to 1957 and look at every other time the S&P has rallied at least 5% over 13 days from a 52-week low, we can see if our current rally really is weaker than average. Turns out it isn’t. The current rally exceeds the average when using Up Issues, Up Volume, or New Highs / New Lows. In fact,this rally ranks 5th-strongest out of 26.”

All in all, we conclude that stock markets have arrived at an important inflection point, which will really determine whether the secular bull market that started in 2009 has ended or will continue. Market breadth reveals that buying pressure is strong, suggesting that the ongoing rally in stock markets is for real. Crude oil will be the key determinant in the coming weeks, as outlined above. If stocks are able to stabilize and move above 2000, then we are confident the great stock bull market is continuing. Data points are mostly underpinning the latter scenario is unfolding, suggesting “buy the dips” should be the most profitable path.

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.