Unemployment vs Inflation - May the Phillips Curve Rest in Peace

Economics / Economic Theory Mar 21, 2016 - 02:00 PM GMTBy: Michael_Pento

In 1958, economist William Phillips claimed there was a historical inverse relationship between the rate of unemployment and the corresponding rate of inflation. His conclusion was that full employment (whatever that means) was inflationary. He illustrated his claim through a chart referred to as the Phillips Curve.

In 1958, economist William Phillips claimed there was a historical inverse relationship between the rate of unemployment and the corresponding rate of inflation. His conclusion was that full employment (whatever that means) was inflationary. He illustrated his claim through a chart referred to as the Phillips Curve.

The 1970's stagflation outbreak in the U.S, which featured high unemployment coupled with inflation, dispelled Phillip's broad correlation between those two conditions. This led many Keynesian economists to embrace a new, yet even more fatuous model called NAIRU, or the non-accelerating inflation rate of unemployment. This theory argued that the relationship between unemployment and inflation only presents itself when unemployment falls below its natural rate.

However, NAIRU provided little guidance as to what level of employment propels an economy into the hypothetical inflation vortex. Despite the fact this specious model has never been borne out in actual historical data, it remains peculiarly ingrained in the psyche of all modern-day central bankers.

But the truth is that inflation has nothing to do with how many people are employed. Inflation is solely the market's reaction to a lack of confidence in the purchasing power of a nation's currency.

NAIRU and the Phillips Curve are merely Keynesian red herrings used to convince the citizenry that central banks are not the primary culprits behind the growing trenchant wealth gap and the constant erosion in living standards of the middle class. To prove the point that inflation isn't the product of too many people working we can view the current inflation battle in Brazil.

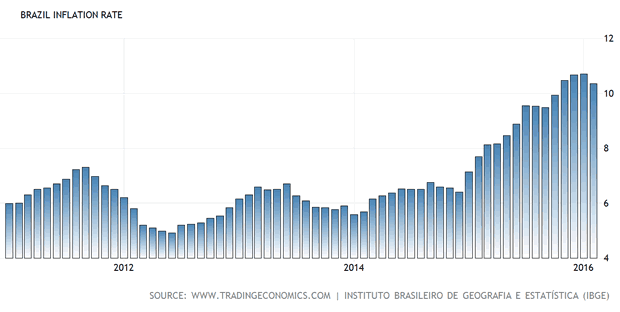

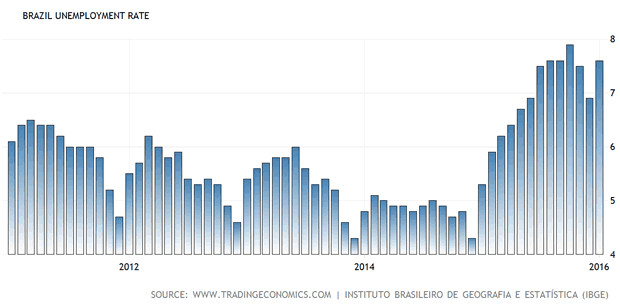

Since 2014, Brazil's inflation has jumped from about 6%, to over 10%. If the Phillips Curve were correct, we would expect that unemployment in Brazil had plummeted during this same time-period; and that the inflation Brazils is experiencing is a byproduct of all the new paychecks entering the economy. However, this is not the case; since 2014 the unemployment rate has nearly doubled, going from a little over 4%, to almost 8%

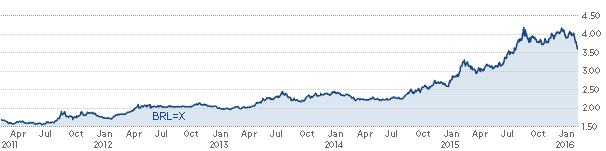

It is evident the newly employed are not the cause of rising inflation in Brazil. Rather, inflation has come -- as it always does--through an erosion in the market's valuation of a fiat currency's purchasing power. In 2014, it took two Brazilian real to buy one US dollar, today it takes nearly four real to buy one US dollar.

US$/Brazilian Real

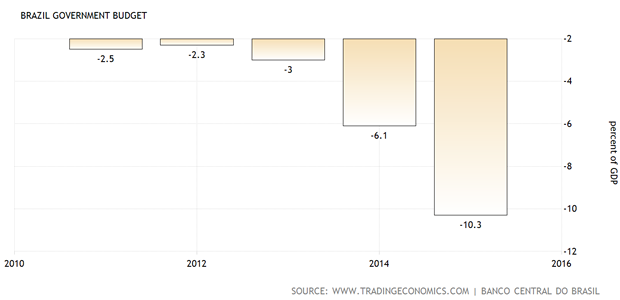

The decline in the real is more likely a result of the market's reaction to Brazil's economic mess: credit-rating agencies have downgraded Brazil's debt to junk status. Joaquim Levy, the finance minister, appointed to stabilize the public finances, quit in December of 2015 after less than a year in the job. Brazil's economy is predicted to shrink by 2.5-3% in 2016. Brazil's governing coalition has been plagued by scandals including bribery surrounding Petrobras, a state-controlled oil company, and the president is facing impeachment proceedings in Congress. Add overspend on the upcoming Olympic Games to this mess and it's easy to see why Brazil's budget deficit has ballooned over the past few years.

There it is once again. The same dynamic has proven itself throughout economic history: growth comes from productivity and a thriving labor force, which is a good thing that does not lead to inflation. And just as high unemployment does not lead to low inflation, low unemployment does not lead to a rise in inflation. To illustrate this we can look at the United States, where the unemployment and inflation rate have been moving in tandem.

US Unemployment Rate

Consumer Price Inflation

Economic history is replete with such examples that prove the Phillips curve is a specious theory that should be suffering from rigor mortis. Brazil is just the latest case study. The truth is a dangerous bought with Inflation has never, will never, and can never be the product of prosperity. Inflation is all about debt that becomes intractable, which forces the central bank into perpetual debt monetization and an expanding money supply. Sadly, this is where we are headed in China, Japan, Europe and the U.S.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.