Silver Bullion Has Key New Player – China Replaces JP Morgan

Commodities / Gold and Silver 2016 May 04, 2016 - 02:10 PM GMTBy: GoldCore

The silver bullion market has a key new player – Enter the Dragon. The Shanghai Futures Exchange in China is replacing JP Morgan bank and its clients as the most significant new source of demand according to a very interesting blog with some great charts and tables published by SRSrocco Report yesterday.

The silver bullion market has a key new player – Enter the Dragon. The Shanghai Futures Exchange in China is replacing JP Morgan bank and its clients as the most significant new source of demand according to a very interesting blog with some great charts and tables published by SRSrocco Report yesterday.

According to the report:

The days of JP Morgan controlling the silver market may be numbered as a new player in the silver market has arrived. For the past several years, JP Morgan held the most silver on a public exchange in the world. While the LBMA may hold (or did hold) more silver, their stockpiles are not made public.

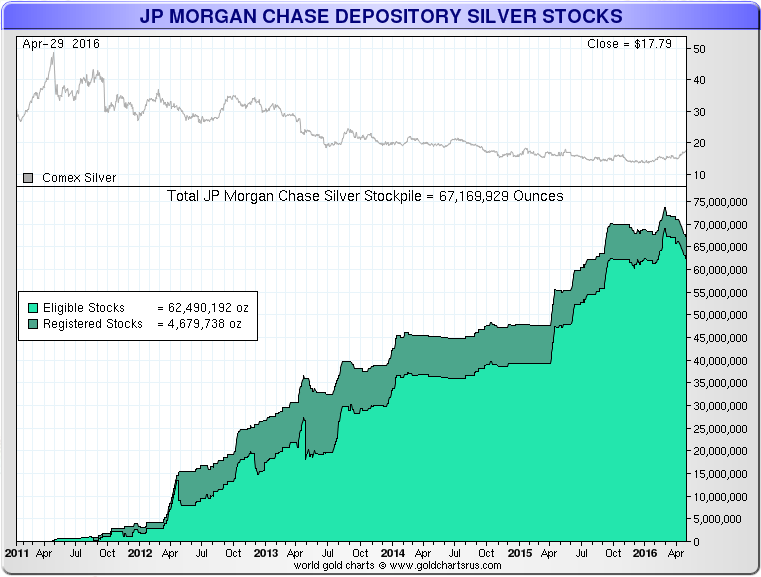

Regardless, JP Morgan held the most silver at nearly 74 million oz (Moz) in its warehouse, up until recently. Over the past two month, JP Morgan’s silver inventories have fallen nearly 7 Moz to 67.1 Moz today:

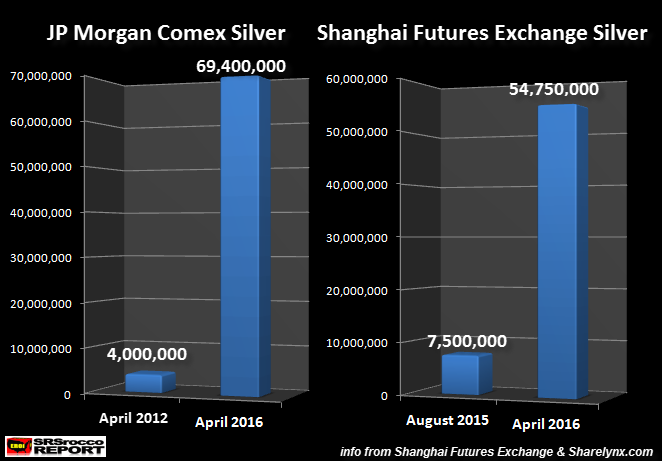

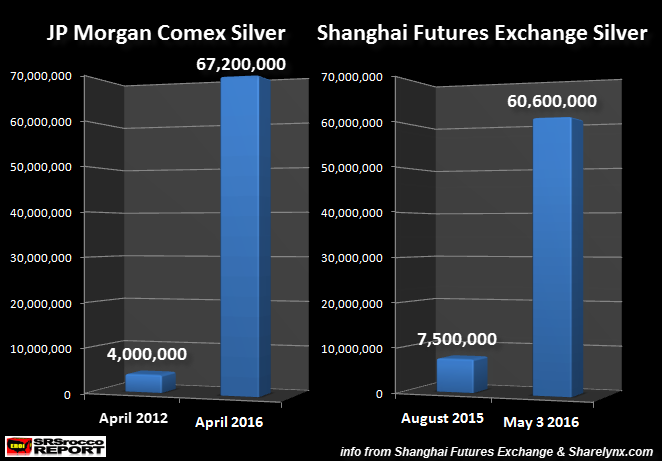

As I mentioned in my previous article, Why Are The Chinese Stockpiling Silver? Big Move Coming?, JP Morgan increased their silver inventories from 4 Moz in April 2011 to 69.4 Moz April 19, 2016. However, the Shanghai Futures Exchange silver inventories surged from 7.5 Moz in August 2015 to 54.7 Moz on April 19, 2016:

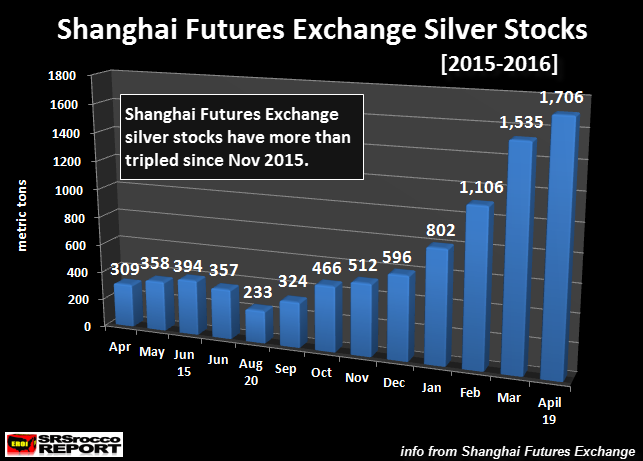

Basically, JP Morgan added an average 16.3 Moz of silver each year for the past years, whereas the Shanghai Futures Exchange added nearly 7 Moz per month. Furthermore, the majority of gains came since the beginning of 2016. Again, here is my previous Shanghai Futures Exchange silver stock chart from the article linked above:

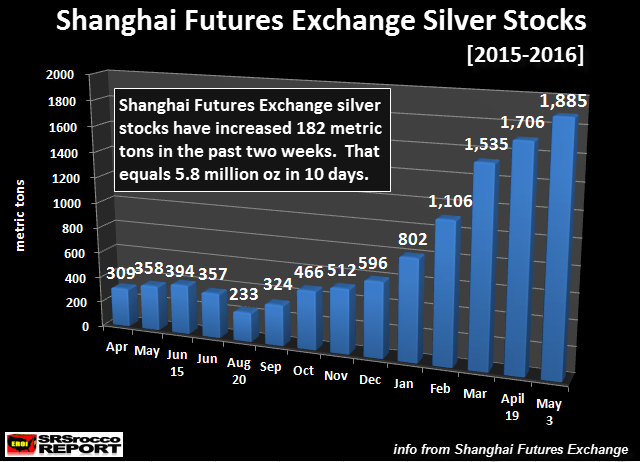

As we can see from this chart dated April 19th, the Shanghai Futures Exchange more than tripled their silver inventories since November 2015. What is even more interesting is the continued buildup over the past two weeks. Here is an updated chart based on data for May 3rd:

Over the past two weeks, the Shanghai Futures Exchange added another 179 metric tons (mt) or 5.8 Moz. Now, if we update the JP Morgan and Shanghai Futures Exchange silver stock chart (from above) we have the following:

Here we can see that JP Morgan’s total silver inventories have declined from 69.4 Moz to 67.2 Moz, while the Shanghai Futures Exchange silver stocks have increased from 54.7 Moz to 60.6 Moz. If the Shanghai Futures Exchange continues to add silver at this rate, it will surpass JP Morgan in a two to three weeks.

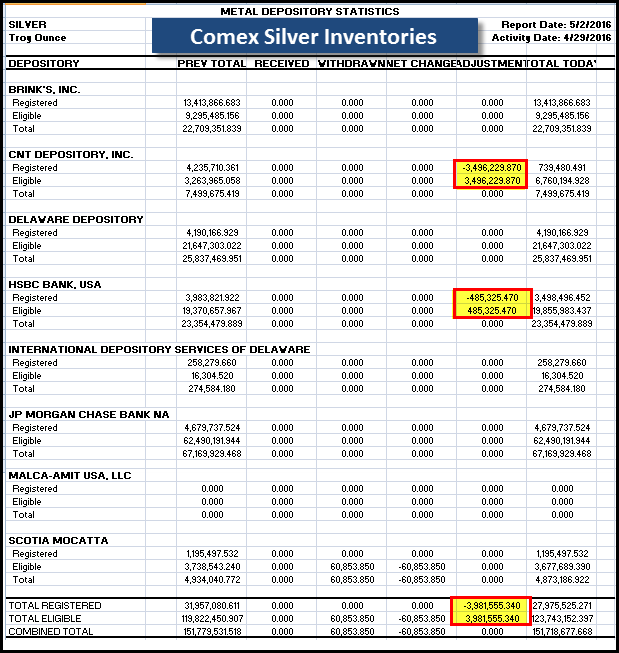

Comex Registered Silver Inventories Drop Nearly 4 Million Ounces Yesterday

When the CME Group published the recent silver inventory change on the Comex yesterday, nearly 4 Moz were transferred from the Registered to Eligible Category. The majority of the transfer came from the CNT Depository at nearly 3.5 Moz with 485,325 oz from HSBC:

Some analysts say these transfers really don’t mean much if the overall inventories stay the same. That may be true, but there was some reason the CNT Depository transferred 3.5 Moz of silver from their Registered Inventories to the Eligible.

That being said, the Chinese are adding a lot of silver to their Shanghai Futures Exchange warehouses. The build from 7.5 Moz in August 2015 to over 60 Moz of silver in the beginning of May puts JP Morgan’s four-year inventory growth to shame.

For whatever reason, silver inventories at the Shanghai Futures Exchange warehouses are increasing at a rapid pace while the Comex silver stocks continue to decline. Comex silver inventories were over 180 Moz in July 2015 and are now only 151 Moz. This is quite interesting as the Shanghai Futures Exchange inventories started to build from 7.5 Moz in August 2015 to the 60.6 Moz today.

It will be interesting to see how the exchange inventories and price action of silver play out over the next several months.

Enter the Dragon ! See SRSrocco report here

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.