Stock Market Elliott Wave Count, Economic Cycle and Equities Cycle

Stock-Markets / Stocks Bear Market Jun 02, 2016 - 03:08 PM GMTBy: Chris_Vermeulen

As you know a picture is worth 1000 words so consider this short yet detailed post a juicy 2000+ word report on the current state of the stock market and economic cycle.

As you know a picture is worth 1000 words so consider this short yet detailed post a juicy 2000+ word report on the current state of the stock market and economic cycle.

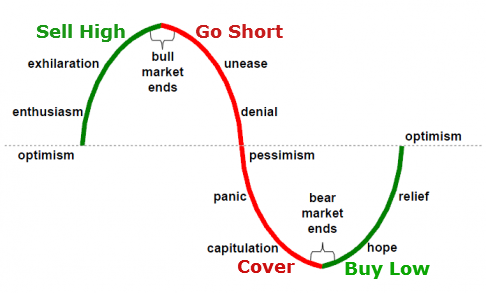

The charts below I think will help you see where the US stock market and economic cycles appear to be.

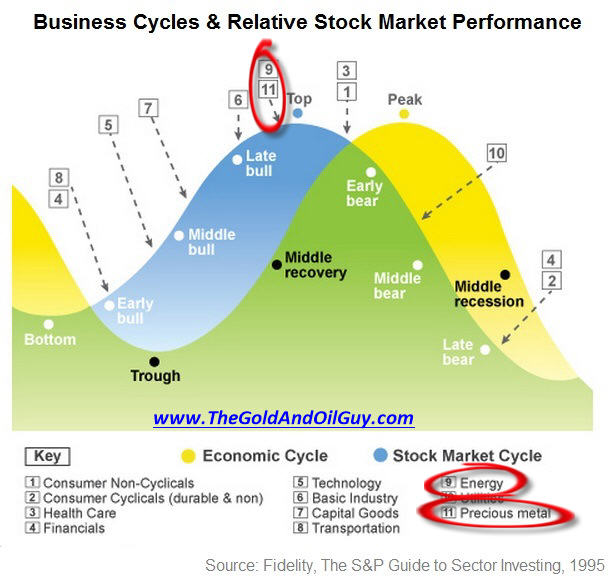

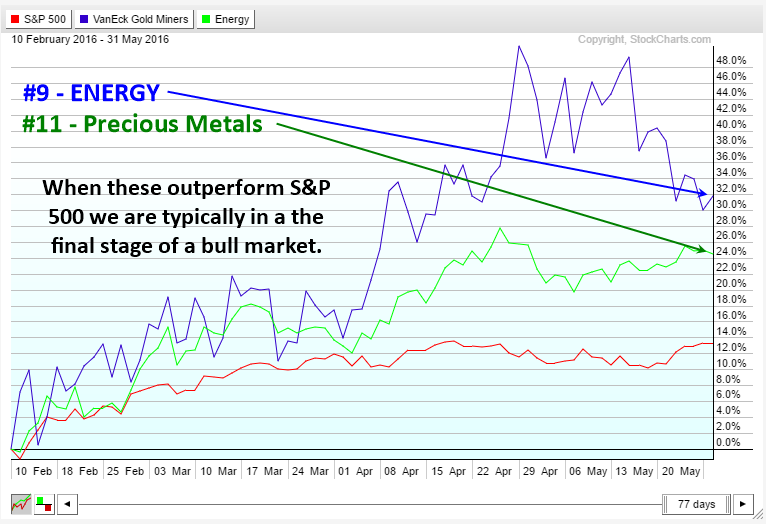

The first image shows two cycles, the blue one is the stock market cycle and which sectors typically outperform during specific times within the cycle. Here you will see that during the late stages of a bull market the safe haven plays become the preferred choice for investors – Energy and Precious Metals.

Typically, the stock market tops before the economic (business) cycle does. Why? Because investors can see sales starting to slow and that earnings will start to weaken and share prices will fall, so the market participants start selling shares before the masses see and hear about a weakening economy. The stock market usually moves 3-9 months before the economic cycle change I known by the masses.

Stock Market Topping According to Sector Analysis

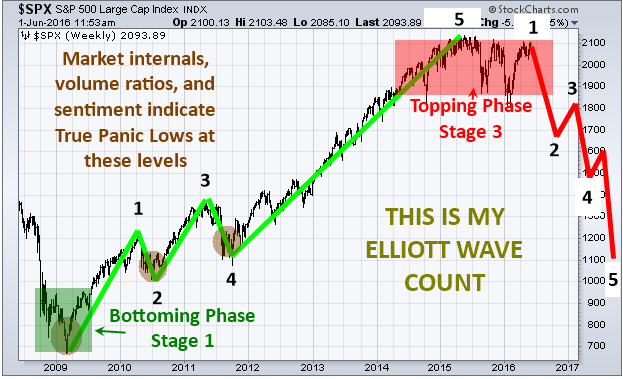

Elliott Wave Count – My Educated Guess

Elliott wave theory is a tough strategy to follow. Meaning, if you gave the same chart to 5 different people you would likely have 3 or 5 very different wave counts.

Recently I have seen a flurry of EW charts on the SP500 wave count which I do not think are correct. When I do Elliott Wave counts I like to use more than just price. I look into things deeper and use the market internals, volume flows, and overall market sentiment during those times. They must all be screaming extreme FEAR in the market in order for me to count it as a wave low.

Fear is much easier to read and time than greed. So based on waves of fear and I can plot the rest of the waves. By doing this, I feel it gives a truer reading of significant highs and lows we should use in our analysis.

See my analysis below for a visual…

Stock Market & Economic Cycle Conclusion:

In short, the current market analysis, in my opinion, is still very bearish and this could actually be the ultimate last opportunity to get short the market near the highs before we dive into a full blown bear market in the next 3-5 months.

I will admit, the market is trying VERY hard to convince us it wants to go higher as it flirts with the recent highs for its second time in the past 8 months. I know it is doing its job because so many traders and investors are changing their tune from bearish to SUPER BULLISH.

I don’t see it that way JUST yet, but it could happen as the market can do and will do whatever it wants. But all my analysis (much more than what you see here) points to substantially lower prices over the next year.

To learn more and get my ETF swing trades and long term investing signals join me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.