Two Months Ago, theThe Only Thing That Grows Is Debt

Interest-Rates / Global Debt Crisis 2016 Jun 08, 2016 - 04:44 PM GMTBy: Raul_I_Meijer

Two months ago, there was a referendum in Holland about an association agreement between the EU and Ukraine. A relatively new Dutch law states that with an X amount of signatures a referendum can be ‘forced’ by anyone. Before, during and -especially- after the vote, its importance was -and is actively being- pooh-poohed by both the Dutch government and the EU. That in itself paints the issue better than anything else. Both the call and the subsequent support for the referendum stem from resistance against exactly that attitude.

Two months ago, there was a referendum in Holland about an association agreement between the EU and Ukraine. A relatively new Dutch law states that with an X amount of signatures a referendum can be ‘forced’ by anyone. Before, during and -especially- after the vote, its importance was -and is actively being- pooh-poohed by both the Dutch government and the EU. That in itself paints the issue better than anything else. Both the call and the subsequent support for the referendum stem from resistance against exactly that attitude.

The Dutch voted No to the EU/Ukraine agreement. It was with a turnout not much above the validity threshold, but a large majority of those who did vote agreed they want no part of the deal. This puts Dutch PM Rutte in an awkward position, he can’t be seen ignoring the population. Well, at least not openly. The EU can’t validate the agreement, and with Holland still holding the chair of the Union until July 1, a meeting on the topic has been pushed forward until the last weekend of June. With Rutte still in charge, but only just, and with the June 23 UK Brexit vote decided.

Brussels is frantically looking for a way to push through the agreement despite the Dutch vote, and likely some sort of bland compromise will be presented, which Rutte’s spin doctors will put into words that he can -with a straight face- claim honor the vote while at the same time executing what that same vote specifically spoke out against.

The EU will claim that since 27 other nations did ‘ratify’ the agreement, the 67% of the 32% of Dutch voters who bothered to show up should not be able to block it. As they conveniently fail to mention that nobody in the other 27 countries had a chance to vote on the issue. Just imagine a Brexit-like vote in all 28 EU nations on June 23. Brussels knows very well what that would mean. There’s nothing it finds scarier than people having an active say in their lives.

All this is a mere introduction for what is a ‘western world wide’ trend that hardly anybody is able to interpret correctly. It what seems to many to be a sudden development, votes like the Dutch one are ‘events’ where people vote down incumbents and elites. But these are not political occurrences, or at least politics doesn’t explain them.

In the US, there’s Trump and Bernie Sanders. In Britain, the Brexit referendum shows a people that are inclined not to vote FOR something, but AGAINST current political powers. In Italy, a Five-Star candidate is set to become mayor of Rome, something two Podemos affiliated -former- activists have already achieved in Barcelona and Madrid.

All across Europe, ‘traditional’ parties are at record lows in the polls. As is evident when it comes to Brexit, but what when you look closer is a common theme, anything incumbents say can and will be used against them. (A major part of this is that the ’propaganda power’ of traditional media is fast coming undone.)

The collapse of the system doesn’t mean people swing to the right, as is often claimed, though that is one option. It means people swing outside of the established channels, and whoever can credibly claim to be on that outside has a shot at sympathy, votes, power, be they left or right. Whatever else it is they may have in common, first and foremost they’re anti-establishment.

To understand the reason all this is happening, we must turn our heads and face economics. Or rather, the collapse of the economy. Especially in the western world – the formerly rich world-, there is no such thing as separate political and economic systems anymore (if there ever were). There is more truth in Hazel Henderson’s quote than we should like: “economics [..] has always been nothing more than politics in disguise”.

What we have is a politico-economic system, with the former media establishment clinging to (or inside?!) its body like some sort of embedded parasite. A diseased triumvirate.

With the economy in irreversible collapse, the politico part of the Siamese twin/triplet can no longer hold. That is what is happening. That is why all traditional political parties are either already out or soon will be. Because they, more than anything else, stand for the economic system that people see crumbling before their eyes. They represent that system, they are it, they can’t survive without it.

Of course the triumvirate tries as hard as it can to keep the illusion alive that sometime soon growth will return, but in reality this is not just another recession in some cycle of recessions. Or, at the very minimum this is a very long term cycle, Kondratieff style, . And even that sounds optimistic. The system is broken, irreparably. A new system will have to appear, eventually. But…

‘Associations’ like the EU, and perhaps even the US, with all the supranational and global entities they have given birth to, NATO, IMF, World Bank, you name them, depend for their existence on an economy that grows. The entire drive towards globalization does, as do any and all drives toward centralization. But the economy has collapsed. So all this will of necessity go into reverse, even if there are very powerful forces that will resist such a development.

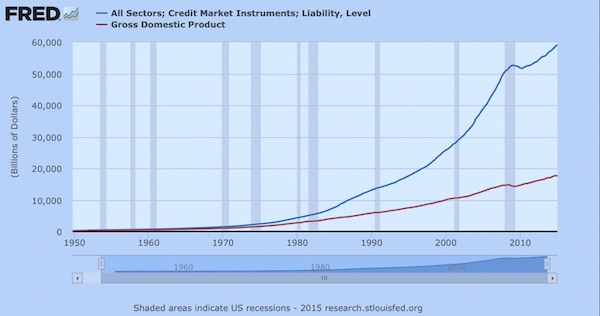

Despite what the media try to tell you, as do the close to 100% manipulated economic data emanating from various -tightly controlled- sources, the economy is not growing, and it hasn’t for years; the only thing that grows is debt. And you can’t borrow growth.

You can argue in fascinating philosophical debates about when this started, arguments can be made for Nixon’s 1971 abolishment of the -last vestiges of- the gold standard anywhere up to Clinton’s 1998 repeal of Glass-Steagall, or anything in between -or even after.

It doesn’t matter much anymore, the specifics are already gathering dust as research material for historians. The single best thing to do for all of us not in positions of politico/economic power is to recognize the irreversible collapse of the system. Since we all grew up in it and have never known anything else, that is hard enough in itself. But we don’t have all that much time to lose anymore.

The whole shebang is broke. This can easily be displayed in a US nominal debt vs nominal GDP graph:

That’s really all you need to know. That’s what broke the shebang. It is easy. And even if a bit more of the ‘surplus’ debt had been allowed to go towards the common man, it wouldn’t have made much difference. We’ve replaced growth with debt, because that is the only way to keep the -illusion of- the politico-economic system going, and thereby the only way for the incumbent powers to cling on to that power.

And that is where the danger lies. It’s not just that the vast majority of westerners will become much poorer than they are now, they will be forced to face powers-that-be that face the threat of seeing their powers -both political and economic- slip sliding away and themselves heading towards some sort of Marie-Antoinette model.

The elites-that-be are not going to take that lying down. They will cling to their statuses for -literally- dear life. That right there is the biggest threat we all face (including them). It would be wise to recognize all these things for what they really are, not for what all these people try to make you believe they are. Dead seriously: playtime is over. The elites-that-be are ready and willing to ritually sacrifice you and your children. Because it’s the only way they can cling on to their positions. And their own very lives.

It may take a long time still for people to understand the above, but it’s also possible that markets crash tomorrow morning and bring the facades of Jericho down with them. Waiting for that to happen is not your best option.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.