If Trump Can’t Pull Off a Victory, Expect a Civil War

ElectionOracle / US Presidential Election 2016 Aug 23, 2016 - 06:39 PM GMTBy: Harry_Dent

Bernie Sanders may have conceded the democratic nomination to Hillary Clinton last month, but that doesn’t mean he’s going anywhere.

Bernie Sanders may have conceded the democratic nomination to Hillary Clinton last month, but that doesn’t mean he’s going anywhere.

Which I’ve been saying for months now. Win or lose, both Bernie Sanders and Donald Trump will have strong support groups for years to come. Especially when the economy turns south in the months and years ahead!

Days after endorsing Clinton, Sanders came out saying he’ll continue his “Revolution” with at least two new organizations. One called the “Sanders Institute” will push his political agenda… and another named “Our Revolution” will actually help put more progressive candidates into state and local office. He plans to endorse 100 candidates through the 2016 elections alone!

Like I said back in March – both men have effectively hijacked their respective political parties.

And even while Trump’s campaign for the presidency seems to be floundering as of late… don’t write him off just yet! Trump stands for something much greater at this point. And his movement’s still alive and kicking.

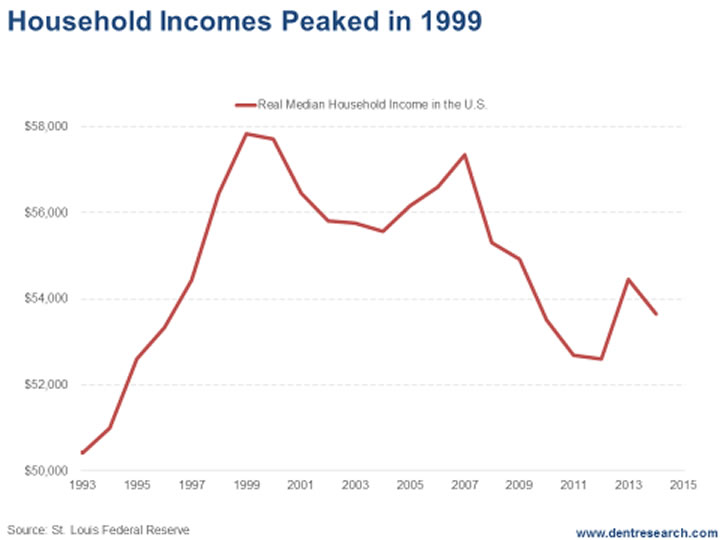

Trump’s movement is born out of a deep dissatisfaction among the middle and lower classes in this country. Their standard of living has gone nowhere since the early 1970s, and has actually gone down adjusted for inflation since 2000. Take a look:

As an electorate, you have a declining middle class split between the populist candidate on the Right… and the progressive one on the Left.

But lately, it almost seems like Trump doesn’t want to win. He completely refuses to listen to his campaign managers and voter feedback telling him to dial it back a notch.

Which begs the question: Is he trying to lose?

I wouldn’t go that far. I do believe he may want to be president. But I don’t think that’s his ultimate strategy.

Hell, if he lost, it would bring credence to his claim that “the system is rigged!”

But no – his ultimate strategy is to win the hearts and minds of the suffering middle class of this country. He’s saying exactly what they’re feeling – without political correctness or shame. To them, it’s those “damn foreigners’” fault.

Namely, the cheating Chinese and Japanese in their trade policies…

The lower-wage legal and illegal immigrants alike who put downward pressure on wages…

And yes, the foreign buyers (mostly Chinese) that push real estate prices up in our largest cities.

So no matter what he says or does – no matter how stupid or brilliant – Trump has the almost unwavering support of somewhere between 30-40% of the electorate.

And it may not be enough to win…

But it may be enough to start the next civil war in this country.

There’s a recent article in The Atlantic with a subtitle that reads: “If Trump loses, his consolation prize may be a whole new right-wing media juggernaut.”

He has recently entrusted his campaign to Stephen Bannon, the executive producer of the conservative media platform Breitbart News. And he’s also hired the now former Fox News boss, Roger Ailes (who’s shrouded in enough controversy of his own – like that matters to Trump and his supporters)!

Take this media-savvy trio… and you have the makings of a new conservative news station to rival Fox News – and continue delivering Trump’s message well after he’s lost the election!

Mark my words on that!

If Trump loses – and at this point it looks like he will – look for a new conservative media network led by the Donald himself!

But even so, this is only a drop in the bucket of the larger social revolution I see ahead.

When this next financial crisis unfolds, expect a wave of civil unrest that will split the country in half. I could see this beginning around the end of next year – during the worst economic storm we’ve seen since the dawn of the Great Depression!

After all, Trump has dubbed himself the “Brexit candidate” on more than one occasion. Don’t take that lightly. No one thought the UK could actually vote to leave the EU – right up until it did. And we have just as bad if not worse social and political division in this country.

I could even see a large part of the southeast, southwest and Rockies secede from the country, at least in part. They’d still be a trade zone, just with their own social laws. Combined with their economic frustrations, one too many social issues have simply pushed them over the edge. I really think the “transgender” issue is the straw that broke the camel’s back – at least for the most conservative sector of this country. And this was right after the Supreme Court did the unthinkable and made gay marriage legal – even in their own backyard.

But the larger point is that major shifts in politics are simply part of the natural cycle in the winter season bubble burst (see my 80-Year Four Season Economic Cycle). After the top 1% ran away with the punch bowl in the fall bubble boom season and social policies got as loose as they can get (like in the Roaring 20s), the tide turns back toward favoring the middle class and those who were forgotten.

Trump sees the writing on the wall. He sees the shift coming, and he’s using it to further his cause. All of this is far more predictable than anyone would assume – except for clueless economists and political pundits.

This greatest crash of your lifetime will come with more than just financial and economic challenges. Together with the Honorary David Walker, we’ll discuss some of these challenges at this year’s Irrational Economic Summit at the PGA National Resort in Palm Beach, FL. Make sure you don’t miss it – we have plenty to discuss!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.