US Election 2016 - Why Your Vote Doesn’t Count

ElectionOracle / US Presidential Election 2016 Sep 16, 2016 - 07:30 PM GMTBy: David_Galland

Dear Parade-Goers,

Dear Parade-Goers,

In our quest for perpetual summer, this week we are transitioning back to our Argentine home. As a result, I intend to be brief, though there are a couple of observations I want to share related to the pending US presidential election.

On the musical front, I am still mostly stuck on Dire Straits, a group I haven’t paid much attention to until recently. As the parade begins, I am teeing up the entire album of their greatest hits.

Sticker Shock

In preparing for our departure, we drove into the big city for some last-minute shopping. This being Vermont, the big city hereabouts is not very big: Burlington’s population is a meager 42,000.

While driving here and there between stores, I noticed something. Actually, I noticed something missing: there were zero bumper stickers in support of Hillary. Likewise, I didn’t see a single lawn sign either.

In sharp contrast, in the last two elections the displays in favor of Obama were seemingly everywhere.

To be fair, there are no bumper stickers or signs for Trump either, but given Vermont is the most liberal of states, it is somewhat understandable though the complete absence of signage is still remarkable.

Now, I realize this is Bernie territory and so his subjugation by the Clinton Clan has been a bitter disappointment. But it seems to me there’s more to it than that.

While I confess to previously believing Trump had no chance in this election, the monumental level of apathy for Hillary in Vermont leads me to believe he has a chance after all, something the polls are starting to reflect.

That’s because, come hell or high water, the pro-Trump crowd—though understandably reserved in displaying their affections publicly—are going to show up en force to pull the levers come election day.

I have witnessed no similar level of enthusiasm from those resigned to vote for Mrs. Clinton. Their only arguments at this point revolve around their fervent dislike of The Donald, and one hears nothing about how much they dream of the day when President Clinton takes the reins of world power.

The clear health challenges Mrs. Clinton faces—and her once again demonstrated willingness to lie about those challenges—tip the scales for the popular vote further toward Trump.

However, for reasons I’ll explain momentarily, that doesn’t mean he’ll be the next US president.

Before moving on, I’d be interested in hearing from any dear readers about the presence (or lack thereof) of bumper stickers and lawn signs in your neck of the woods. Drop me a line at david@garretgalland.com if you think of it.

Think Your Vote Will Decide the Election? Think Again.

This week I came across an article in which the author, Jason Brennan, explains how the Founding Fathers created the Electoral College specifically because they didn’t trust we the people.

According to Brennan, the Founding Fathers thought the populace emotionally and intellectually incapable of handling the responsibility of selecting the president.

Based on the words of one of those Founding Fathers, Alexander Hamilton, Brennan is right.

“It was equally desirable that the immediate election should be made by men most capable of analyzing the qualities adapted to the station and acting under circumstances favorable to deliberation, and to a judicious combination of all the reasons and inducements which were proper to govern their choice. A small number of persons, selected by their fellow citizens from the general mass, will be most likely to possess the information and discernment requisite to so complicated an investigation.”

Alexander Hamilton, The Federalist, No. 68

The “small number of persons” Hamilton refers to is, of course, the Electoral College.

In fact, the US election process is structured so that when you pull the lever for your favorite presidential candidate this November, you are actually voting for electors selected by the Democratic and Republican party. For the most part, the electors are chosen from among influential state party officials.

And, for the record, in 21 states those electors have the legal right to vote for whomever they want, popular vote be damned.

Which is why, in three US presidential elections—the latest being Bush/Gore in 2000—the candidate who won the popular vote was not made president. In two other elections, a tie led to the president being selected in the House of Representatives. In other words, in 5 out of 43 or, rounded up, 12%, of US presidential elections, the victors have arrived in office in some fashion other than winning the popular vote.

Given the fact that the Democratic Party electors have their teeth set against Trump, and that they are joined in their distaste for him by a sizable percentage of Republican officials, this election could very well be one of those decided not by the popular vote, but by the electors.

In support of that idea, Jason Brennan doesn’t try very hard to hide his view that if Trump does win the popular vote, the Electoral College should override that vote.

“[Trump’s] not the first candidate without policy experience or to use inflammatory rhetoric and lob classless insults at his opponents. Nevertheless, we should be glad the Electoral College is in place. Given how much power the U.S. president has, it’s comforting to know that if voters make a truly horrific choice come November, our elected representatives have the power to rescue us from their mistakes.”

As the Electoral College is likely to become a lively topic of conversation over the next few months, you might want to read up on it.

While I’m sure you can readily find alternative sources of information, to get you started, below are a couple of links to useful resources on the mechanics of the Electoral College.

How members of the Electoral College are selected

Drums of War

A longish but interesting video landed in my email box this week. It’s a candid interview with Lawrence Wilkerson, a former national security advisor in the Reagan administration as well as a former assistant to Colin Powell.

In the interview, which you can watch by clicking here, Wilkerson pulls back the curtain on the cozy relationship between the Pentagon and war-mongering industrialists. Among other revelations, Wilkerson shares that upward of 70% of all retiring generals settle into high six-figure jobs in the defense industry.

That interview popped into my mind after I came across an article entitled US military: Iranian behavior getting worse in Persian Gulf.

In the article, the author quotes a number of military officers and politicians engaging in a bit of chest thumping about the swarms of small Iranian boats they claim have been “harassing” the US fleet stationed in the Persian Gulf. Which, for the record, is called the “Gulf of Iran” by the International Hydrographic Organization—the organization charged with officially charting the world’s bodies of water.

A couple of relevant quotes from the article:

Military officials say there is no question that the behavior is getting worse.

“We've seen an uptick in confrontations by Iranian vessels in the Arabian Gulf,” Army Gen. Joseph Votel, the top U.S. commander in the region, said on Aug. 30. U.S. military officials refer to the Persian Gulf as the Arabian Gulf.

Votel also issued a rare warning to Iranian forces: “Ultimately if they continue to test us we're going to respond and we're going to protect ourselves and our partners.”

The last confrontation occurred just last Sunday, when seven Iranian fast attack boats confronted a U.S. Navy coastal patrol boat in international waters in the Persian Gulf.

When one of the Iranian vessels stopped directly in the path and within about 100 yards of the USS Firebolt, the U.S. vessel had to swerve to avoid a collision, defense officials said.

The confrontations are fueling anger on Capitol Hill and providing new arguments for lawmakers to enact anti-Iran legislation.

Of course, this game of naval chicken in the Persian Gulf has the potential to trigger yet another conflict in the Middle East. Particularly if General Votel’s “response” is to blow the Iranian boats out of the water.

Perhaps by using the Navy’s new Death Star weaponry. Quoting Reuters.

In 2014, the U.S. Navy fitted a new, large laser gun to the amphibious ship USS Ponce, which is permanently stationed in the Persian Gulf, where it acts as an at-sea base for helicopters, small boats and special operations forces. Big, slow and otherwise lightly armed, Ponce was uniquely vulnerable to the guard corps boat swarms.

The so-called Laser Weapon System, aimed by an operator holding a video-game-style controller, shoots a 30-kilowatt laser over a distance of several miles. As LaWS doesn't fire conventional missiles or bullets, instead drawing power from a generator, it essentially never runs out of ammunition. Perfect for wiping out a swarm.

Once the shooting begins, it’s anyone’s guess as to how the situation might unfold. Death Star lasers notwithstanding, given the relatively cramped quarters in the Gulf, there is the potential for significant loss of US lives to Iranian ground-to-sea missiles. Which, of course, would lead to retaliation and a bonanza for the US military-industrial-political establishment.

Speaking as someone who thinks the US military should only be deployed in defense of national borders, it concerns me that the US government continues to find reasons to patrol the Persian Gulf in the service of Middle Eastern dictators. At the top of that list, I would put Saudi Arabia.

“But we need their oil!” some dear readers might protest.

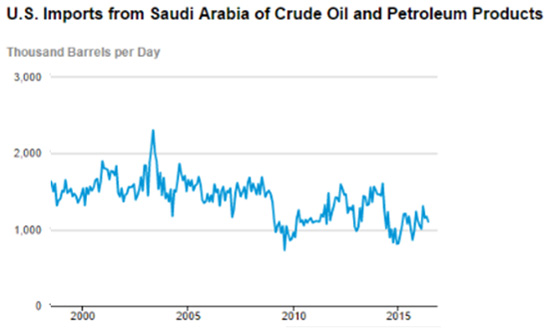

Nope. Thanks to the rise in US domestic production capabilities, as of 2013 the US has retaken the title of the world’s largest producer of petroleum and natural gas. Which helps explain why Saudi exports to the US have fallen by half since 2003.

Of all the oil imported by the US, just 14% originates from Saudi Arabia, with the vast majority coming from Canada, Mexico, and Venezuela. In the case of the latter, once the populace comes to its senses and hangs its current government officials by their heels from the nearest lamp posts, you can expect a jump in imports from Venezuela, which will reduce US reliance on the Middle East even further.

So, who receives the bulk of Saudi oil? That would be Asia with over 60%. In declining order of importance, it’s Japan, China, South Korea, and India, among others. Maybe they should be the ones playing chicken with the Iranians in Iran’s backyard?

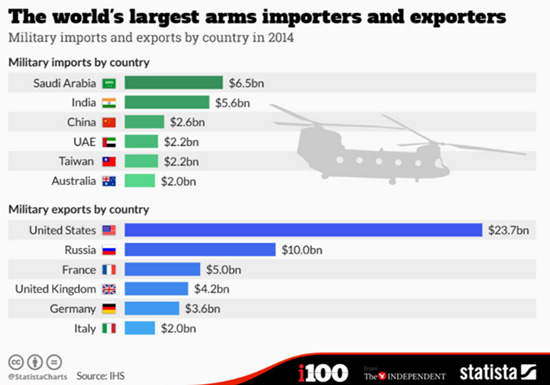

One might wonder why the US continues to play bodyguard for the Saudi royal family. The graphic pasted here might provide a clue.

There is no shortage of potential flashpoints around the world, and one can never tell where the next serious flare-up will occur.

One thing is sure, the more the US military, hand-in-glove with the armament industries and the politicians purchased with their steady donations, rambles around the world looking for trouble, the more likely it is it’ll find it.

The September Sell-Off

For those of you unfamiliar with the approach we take in our Compelling Investments Quantified, I’ll sum up by saying we pay almost no attention to market forecasts. Simply because no one knows what the markets will do in an hour, let alone a week, month, or year.

The latest example of the folly of paying attention to market forecasts occurred during and immediately after the September 9 sell-off when the MSFM (Main Street Financial Media) spilled over with expert commentary as to why the sell-off signaled the “beginning of the end,” with the arrival of the Four Horsemen of the Financial Apocalypse imminent.

Woe be to the woesayers, but Monday morning, September 12, Mr. Market woke up refreshed and feeling quite chipper, sending US stock markets soaring, with the DJIA up by 239 points.

Market action since then has been choppy, but I do hope none of you Parade-goers panicked and sold positions at a loss because of the predictions of modern-day Nostradamus-wannabes who draw deep conclusions based on short-term market action.

If so, I recommend you periodically look in the mirror and repeat the words, “No one can predict the future.” Including, for the record, Nostradamus.

That said, the market may well continue to stumble: that is a normal risk we all take by investing in stocks. But if you have invested in the right companies and at the right price, the inevitable correction is nothing but water off the proverbial duck’s back. Or, better, the opportunity to add great positions to your portfolio at better prices.

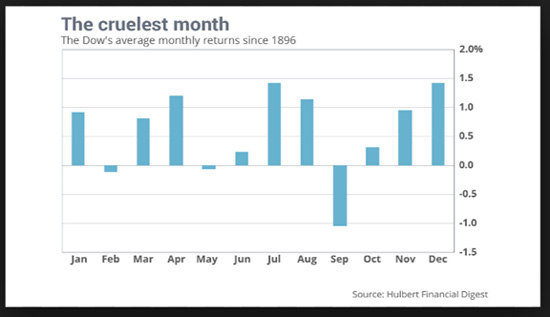

As to the potential for a further decline, it’s a matter of record that September is the cruelest month of all when it comes to stock market setbacks.

On that topic, here’s a snippet from a previous edition of this service, presented in the context that sell-offs should be used to buy already undervalued stocks, cheaper.

And I quote.

Speaking of October, it has an undeserved reputation as a month where crashes occur. In actual fact, September is more crash prone.

The key thing is to view any weakness over the summer, or significant corrections, as opportunities to pick up great stocks at bargain basement prices. Viewed that way, the May to November period becomes your annual Shopping Season.

If you’re interested in discovering undervalued stocks to add to your portfolio—in other words, if you are interested in becoming a serially successful investor by following the same blueprint Warren Buffett used to create his fortune—you could do a lot worse than trying our Compelling Investments Quantified.

In the September edition, we’ll provide all the details on the ultimate consumer staples stock, not a household name, even though many of you consume their products on a daily basis. The stock currently yields 4.28%, roughly twice that of the average S&P 500 stock.

Despite being financially sound, due to regulatory nonsense, it is (temporarily) selling close to its 52-week low. This is exactly the kind of stock you should load up on in corrections, confident that a year or so down the road, you’ll be sitting on market-beating profits.

Here’s more on our fully-guaranteed, no-risk trial offer.

A Final Word (for This Week) on the Election

The following quote is from So Long and Thanks for All the Fish by Douglas Adams.

In it, Ford Prefect explains to Arthur Dent why a robot said, “Take me to your lizards.”

“It comes from a very ancient democracy, you see...”

“You mean, it comes from a world of lizards?”

“No,” said Ford, who by this time was a little more rational and coherent than he had been, having finally had the coffee forced down him, “nothing so simple. Nothing anything like to straightforward. On its world, the people are people. The leaders are lizards. The people hate the lizards and the lizards rule the people.”

“Odd,” said Arthur, “I thought you said it was a democracy.”

“I did,” said Ford. “It is.”

“So,” said Arthur, hoping he wasn’t sounding ridiculously obtuse, “why don’t the people get rid of the lizards?”

“It honestly doesn’t occur to them,” said Ford. “They’ve all got the vote, so they all pretty much assume that the government they’ve voted in more or less approximates to the government they want.”

“You mean they actually vote for the lizards?”

“Oh yes,” said Ford with a shrug, “of course.”

“But,” said Arthur, going for the big one again, “why?”

“Because if they didn’t vote for a lizard,” said Ford, “the wrong lizard might get in. Got any gin?”

Here Come the Clowns

What Should I Call YOU? How about “Moron”? I am sure that in my formative youth, my parents would have regularly rolled their eyes at my longish hair and cavalier attitude toward life. Therefore, my grousing about certain aspects of those who aspire to political correctness may just be a sign of my inability to get in sync with the times.

To better understand today’s grousings, I would urge you to click the link below to read a helpful poster the administration at Vanderbilt University put together to help faculty members navigate the “new” pronouns.

Here’s one telling quote, with a helpful suggestion on how a faculty member should introduce themselves to new people they meet.

Offer your name and pronoun in faculty meetings, committees, and other spaces where students may not be present.

• “I’m Steve and I use he/him/his pronouns. What should I call you?” (or…)

• “My pronouns are they/them/theirs. May I ask yours?”

Here’s the full slate of contrived constructs of politically correct claptrap.

Here’s a Twist. You may have heard about David Seaman, the long-term Huffington Post writer who was fired a few weeks back for writing an article suggesting that Hillary’s health was a legitimate concern.

Well, following Hillary’s collapse at the 9/11 ceremony, he posted a surprisingly candid and honest commentary on how his fellow members of the media are pulling the oars hard to get Clinton elected.

Coincidentally, he also mentions the lack of Clinton bumper stickers. This video is definitely worth watching.

And with that, I will sign off for the week.

Until next time, when I will be writing you from beautiful La Estancia de Cafayate, thanks for reading!

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.