America's 50-Pound Ball and Chain

Stock-Markets / Stock Markets 2016 Oct 14, 2016 - 05:03 PM GMTBy: Clif_Droke

America's economic condition is truly a "tale of two cities." Upper middle class and wealthy earners have never been more flush thanks in large part to the record liquidity creation of the last eight years as well as to their financial market exposure.

America's economic condition is truly a "tale of two cities." Upper middle class and wealthy earners have never been more flush thanks in large part to the record liquidity creation of the last eight years as well as to their financial market exposure.

By contrast, the middle and lower classes have either stagnated or are struggling as perhaps never before, due in part to their under-exposure to the financial market but also to the erosion of their real estate wealth in the last 10 years.

The turmoil for the middle class began with the implosion of the real estate market in 2006 and accelerating with the events of the two years following. The deterioration of home values and the loss of employment imperiled the middle class during the crisis years, and while many the middle class have since recovered their overall fortunes have never complete rebounded to pre-2007 levels.

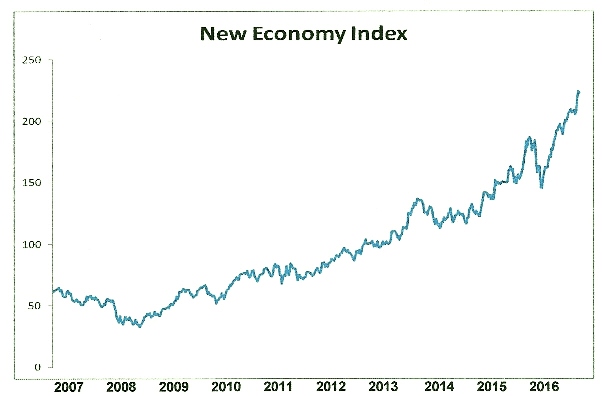

The upper classes meanwhile have shown remarkable recovery. One such reflection of their ebullience is the following graph which shows the New Economy Index (NEI). As can be seen here, the NEI has made a series of new all-time highs in 2016 and this is significant. It shows that consumers - mainly in the upper middle and upper classes - have been quite prolific with their spending. NEI is a forward-looking measure of the retail economy based on the leading publicly traded retailers, business service, and business transportation providers.

Notwithstanding the strength of the upper classes, there is at least one major impediment to a full-scale middle class recovery. A heavy burden is weighing down the middle class, a tax which hangs upon its neck like a 50-pound ball and chain. The tax in question is the healthcare mandate of the Affordable Healthcare Act (ACA). Under this grievous yoke, individuals and married couples making middle class incomes must pay anywhere from $700 to over $4,000 per year in taxes (for non-compliance) or for healthcare coverage, even if coverage isn't desired. The ACA has forced millions who previously didn't want or need health insurance (which to them is a liability) into buying it. If they refuse, they must pay a substantial penalty.

While pundits have argued that the ACA is "working" and has "fixed" the nation's healthcare crisis, they fail to specify for whom the law "works." It has certainly helped lower income individuals who had difficulty gaining access to healthcare previously. And it definitely doesn't hurt the rich, for whom the ACA tax burden is barely felt. Middle class wage earners and small business owners, however, are the ones who must shoulder the burden.

A cursory examination of the middle class economy will reveal that the healthcare taxes of the last 2-3 years have acted as a drag on consumer spending among middle class taxpayers. It has also inhibited small business hiring to a degree and has even forced some business owners to close shop.

Even for those taxpayers for whom the ACA isn't a debilitating burden, at the very least it provides a reason to restrain their discretionary spending. The impetus toward reduced spending is reflected in the exceptionally low monetary velocity, as well as in the diminished fortunes of several old-line retail companies. This can be seen in the following graph comparing the share prices of three major U.S. retailers: Macy's (M), Gap (GPS), and Wal-Mart (WMT).

An argument can also be advanced that the directionless stock market of the last two years is at least partly attributable to the reduced participation of retail investors in the middle class. There is no denying that retail interest in equities has dwindled appreciably since 2013 with a consequent loss of momentum. Powerful bull markets require heavy active participation from retail investors, otherwise the market turns into a veritable closed feedback loop with institutional interests trading among themselves. The end result is a stock market that goes nowhere like the NYSE Composite chart shown here.

The first priority of the next Presidential administration in 2017 should be to reform the ACA by lifting the crushing tax burden from the middle class. Doing so would remove a big obstacle in the path to full economic recovery. It would also provide the stock market a reason to finally break free from its restraints of the last two years. Here's hoping that the next President has teh wisdom to see it and the will to carry it out.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.