US Dollar and Gold Markets Update

Commodities / Gold and Silver 2017 Feb 06, 2017 - 12:42 PM GMTBy: SurfCity

As longer Cycles typically dominate shorter ones, this update will provide both longer and shorter views on the USD and Gold. Why the two together? Obviously due to the negative correlation. No correlation works all the time, however, and I fully expect to see periods where the USD and Gold rise and perhaps fall together. That said, the correlation has been fairly strong over the past year so I find it best to sometimes cover these assets together.

As longer Cycles typically dominate shorter ones, this update will provide both longer and shorter views on the USD and Gold. Why the two together? Obviously due to the negative correlation. No correlation works all the time, however, and I fully expect to see periods where the USD and Gold rise and perhaps fall together. That said, the correlation has been fairly strong over the past year so I find it best to sometimes cover these assets together.

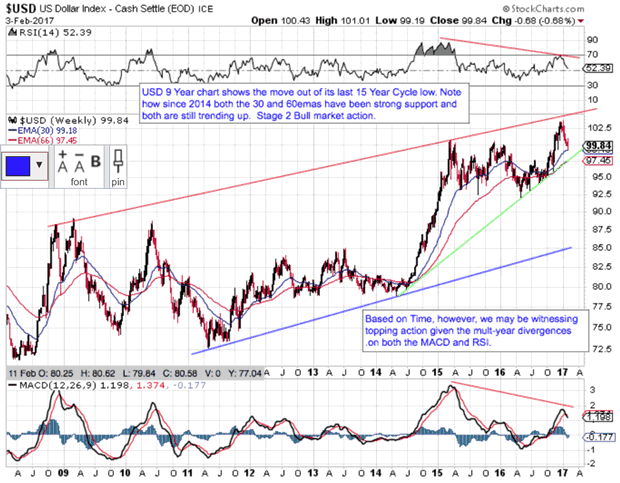

USD Longer Cycles: According to Weinstein's Price Based Market Stage Model, I have the USD in "Stage 2 Bull" for all of its longer Cycles (i.e. Yearly, 3 Year Cycle and 15 Year Super Cycle). Nearer term, I have it looking for a short term Trading or Daily Cycle low (TCL or DCL). Based on TIME, however, we may be very close to its 15 Year Super Cycle top (now in year 9 of the move out of its last 15 year Low)

My first long 4 year weekly USD chart clearly shows Price above both the 30 wema nd 66 wema. Both EMAs are trending up confirming Stage 4 Bull Market. Based on Time, however, I am expecting the USD to find its 15 Year Super Cycle top in 2017. It may have already topped or it may have one more push left.

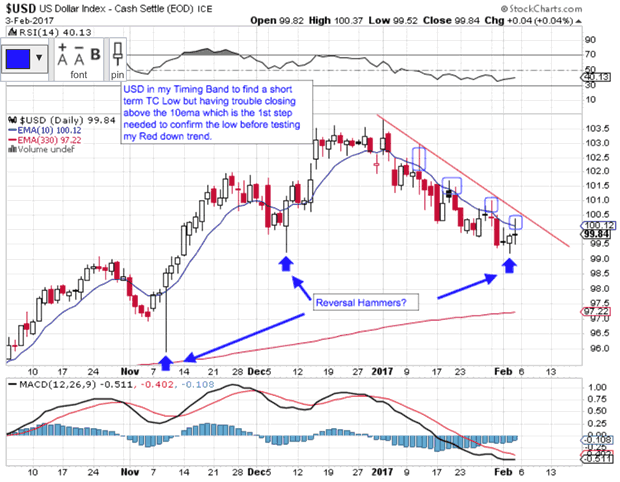

My second chart is a short term daily showing I am expecting a short term Trading Cycle low at any time. Was Thursday's reversal hammer the initial signal? Time will tell but the next step is a close above the 10ema.

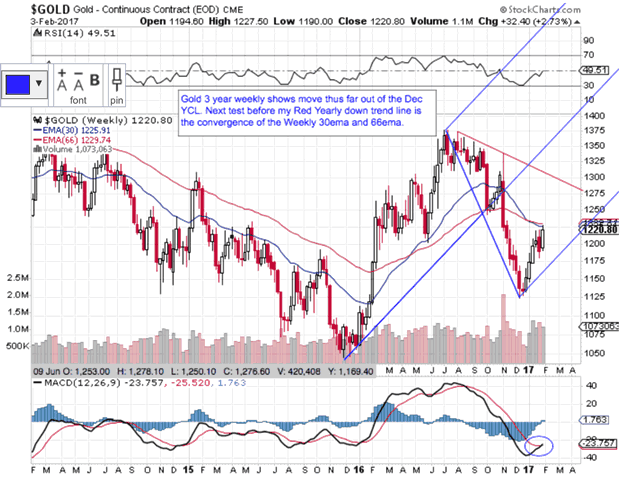

Gold's Longer Cycles: While my bias is to have Gold in a Bull Market, gold is at a critical point in its move out of the December YCL. According to Weinstein's Price Based Market Model, Gold is most like in "Stage 1 Basing." You could also argue either Stage 4 Bear or Stage 2 Bull but based on the Price action against these weekly ema's on my first 3 year chart, Gold is at a critical stage that will solidify one of these stages over the next 3-4 weeks.

Cycle Views by length: 4-year Cycle; Stage 1 Basing, Yearly Cycle; ~ Stage 2 Bull, Intermediate Cycle (4-5 months); Bullish, Trading or Daily Cycle (23-30 days); Bullish but perhaps choppy, especially if the USD starts bouncing out of a DCL or TCL.

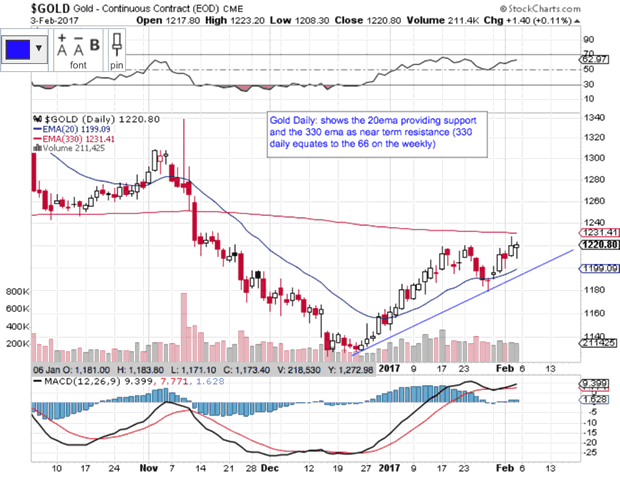

My first 3 year weekly chart on Gold shows why the Price action is critical here over the next few weeks. Price has clearly made a nice move out of the December YCL, had a 38% retrace and is moving up again. But the next resistance on this weekly chart is the confluence of both the 30 weekly ema and the 66 ema (Weinstein stuff again). My second chart is a daily close up of the action out of the YCL. Price is now wedging between the 20ema on the daily as support and the 330 ema above as resistance (note the 300ema on the daily is the same as the 66ema on the weekly).

If the 330ema provide some resistance as the USD bounces, we may yet get another opportunity to add some mining stocks on weakness.

By Surf City

Everything about Cycle Investing

© 2017 Surf City - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.