We’re Seeing More of Trump Reaction than Action

Politics / Immigration Feb 07, 2017 - 06:00 PM GMTBy: Harry_Dent

Look. Economy & Markets isn’t a political newsletter, and I typically stay away from talking about it – people are touchy on the subject, and it’s the quickest way to make enemies.

Look. Economy & Markets isn’t a political newsletter, and I typically stay away from talking about it – people are touchy on the subject, and it’s the quickest way to make enemies.

Yet I find myself writing about Trump again! It’s like I just can’t escape the man.

Of course, I can choose not to write about him, and instead write about any number of other important things… but I don’t think that would be valuable to you because everything that The Donald has done so far connects directly back to the research and the heart of our operation: demographics and cycles.

Really, it’s not about the man himself – love him or hate him. It’s about the environment we’re in right now… the economic winter season, where four power cycles – demographic, technological, geopolitical and boom/bust – have converged in a downward spiral.

Recently with the original Greece crisis, Brexit and Trump, it is becoming obvious that a near 100-year Globalization Cycle is peaking. Trump is just part of that natural cycle unfolding.

I saw it coming. Those who’ve followed me for a while saw it coming too. We may not have known the exact details of how this all plays out. But we knew it would be big and disruptive.

And if it was any other politician in that seat of power, making the moves that The Donald is making, they too would be the source of our… frustration, for lack of a better word.

Frustration because this is all so reactionary rather than “actionary.” Trump’s push to build a wall is the perfect example to illustrate this point with.

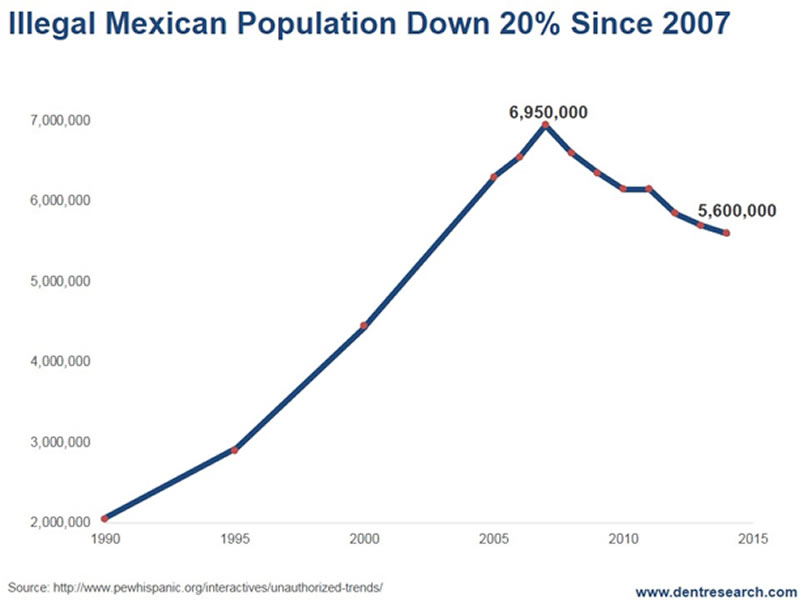

A wall may have been useful in the 1980s or early 1990s. Now it’s too late because there are actually more Mexican illegals leaving the U.S. than entering it. In fact, this reversal in the tide of illegal Mexican immigrants started back in 2007, after the Great Recession.

The Donald isn’t acting with this plan to build a wall. He’s reacting to a situation that doesn’t even exist anymore!

That’s why, at Dent Research, we’re more interesting in what consumers, technologies and businesses do. Government, politicians and policies seem to operate in a vacuum. I mean, seriously… even the Fed – an agency that is supposed to lead the economy – has reverted to data watching and being reactionary!

Here are the facts about the illegal Mexicans Trump is building a wall to keep out…

Immigration rates into the U.S. peaked in 1991 with a spike and surge from the Reagan amnesty program. Since 2007, they’ve been in sharp decline… a trend they’ll remain in for many years to come.

Would you look at that!

Since the Great Recession in 2008-09, more illegal Mexicans have been leaving than entering. That don’t feel as welcome, our economy and jobs aren’t as good… and maybe they miss their families back in Mexico.

Imagine how much this trend could fall further if we see a much worse downturn in the next three to six years, as I predict?

Trump is basically trying to build a wall for nobody… and he’s insulting the Mexican population and government, and many Americans, in the process.

In our Boom & Bust March issue I plan to discuss this immigration issue in greater detail and from all angles, including the clear disadvantages of illegal immigrants and how to turn those more positive… And Charles will have the details of the next model portfolio move we plan to make. So, don’t miss it.

Most Americans – including our President and his advisors – are dangerously ill-informed about the pros and cons of immigration: legal and illegal. We’ll give you the truth, rather than the politics. And then we’ll tell you what to do with that information to survive and prosper.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.