Stock Market Euphoria, China's Dumping of Treasuries Ignite Recession Concerns

Stock-Markets / Stock Market 2017 Mar 07, 2017 - 06:44 AM GMTBy: The_Gold_Report

Citing the uncertainty caused by China dumping U.S. Treasuries, an impending debt ceiling crisis, the upcoming French elections, and more, Wealth Research Group editor Lior Gantz advises investors to make sure their portfolios are diversified.

Citing the uncertainty caused by China dumping U.S. Treasuries, an impending debt ceiling crisis, the upcoming French elections, and more, Wealth Research Group editor Lior Gantz advises investors to make sure their portfolios are diversified.

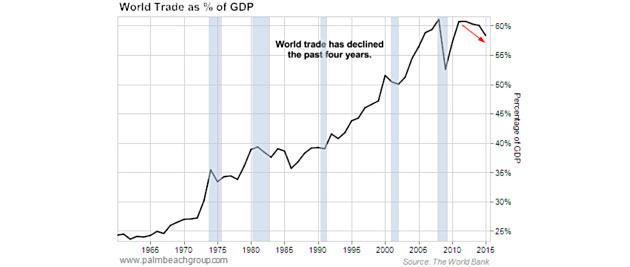

Each of the last five major U.S. recessions were preceded by a shrinking global trade as a percentage of GDP.

Peak globalization might go down in history as May 7, with the French elections, and it could signal the first major crash since 2008.

We've been following closely the euphoric Trump Trade—my personal portfolio is full of Chaos Hedges.

Global trade has declined six times over the past 50 years, and the U.S. entered a recession in five of those periods. The grey areas in the chart above represent recessions.

Global trade has become more than 25% of the $70 trillion in economic growth the world has seen since the 1950s.

Today, trade makes up 50% of world GDP.

This divide between countries benefiting from globalization and those who are exploited has gotten too big, and now this is backfiring on global politics.

The last big dip in trade was in 2009. The Great Recession came next.

The S&P 500 lost almost half its value during the recession, as well as the brutal crash of European and Japanese stocks by 62%, and the Chinese stocks that took a 74% hit.

We have reached peak globalization, and this is a monumental change in the roots of our economy.

Trump Policies Fit with Peak Globalization

Trump is threatening to walk away from free trade deals and place tariffs on imports instead.

The last time the U.S. imposed tariffs on a large scale was in 1930, and it made the Great Depression longer than it should have been.

Tariffs are import taxes, and they shrink the global trade.

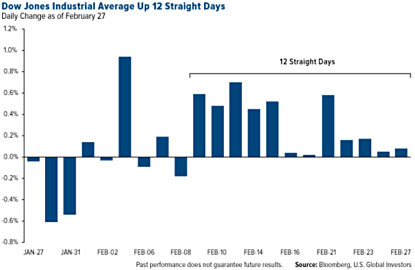

We should be on high alert, as peak globalization isn't our only challenge. This euphoria is going to lead to many problems, and this type of bullishness hasn't been seen in 30 years.

But underneath this façade of a roaring bull market in stocks, every investor needs to remember one thing: The U.S. government is broke, and this fragile system of debt is a boiling pot.

There are only a few opportunities that are cheap and undervalued.

Later this week, we will be announcing our top Cobalt stock for 2017 for members of our free 365 Wealth newsletter.

It is making all-time highs on supply shortages, and after looking at 43 companies, we found the one that has a CEO who is the No. 1 authority on the global cobalt market.

As opposed to critical minerals, I am bearish on political stability.

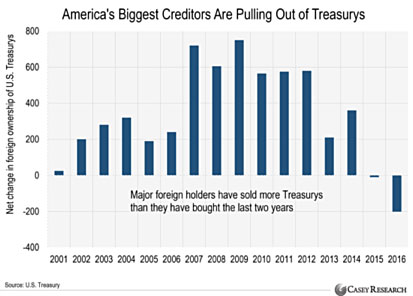

Foreign creditors are selling U.S. government debt like never before.

Last year, China alone sold $188 billion worth of U.S. Treasury bills. That’s the most it's ever sold in one year.

Japan's unwinding its Treasury position, too. It sold about 2.4 trillion yen ($21 billion) worth of U.S. debt in December.

Japan and China are America's biggest creditors. Together, they own more than $2 trillion worth of U.S. government debt.

According to its own calculations, the government is $20 trillion in debt. That's twice as much debt as it had a decade ago.

Trump wants to spend $1 trillion rebuilding America's aging infrastructure and cut taxes, but foreign governments are switching to two-year bonds and aren't willing to finance long-term debts any longer.

Since the 1980s, Treasury bond prices have basically gone straight up. This is changing now, and this is the worst time to own bonds in the last 46 years.

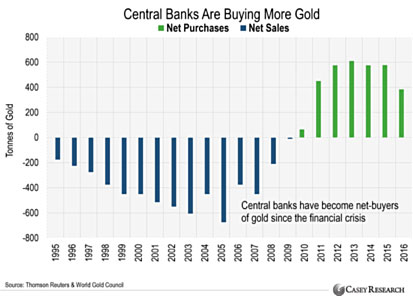

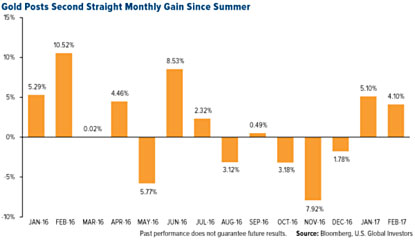

Instead of showing up at the auctions, central banks are loading up on gold.

In fact, the governor of Kyrgyzstan's central bank, Tolkunbek Abdygulov, expressed his "dream" to see all six million citizens of the Central Asian country own at least 100 grams, or 3.5 ounces, of physical gold.

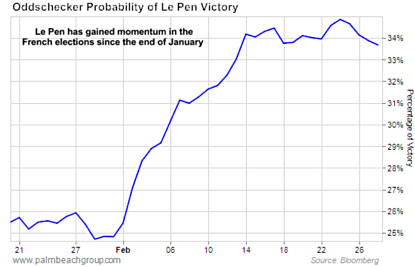

The two major events to pay attention to now are the debt ceiling, which is approaching its climax on March 15, and the French election on May 7.

Like Trump, French leading candidate Le Pen is campaigning with the attitude of restoring borders to their firmness.

The average Frenchman is just as sick of their government as Americans were.

France is suffering from a socialistic nightmare, which has caused the unemployment rate to rise above 10%.

Gold rose to its peak in 2016, as Brexit dominated headlines, and now we could be headed to a Frenchxit—France could be withdrawing from the European Union (EU).

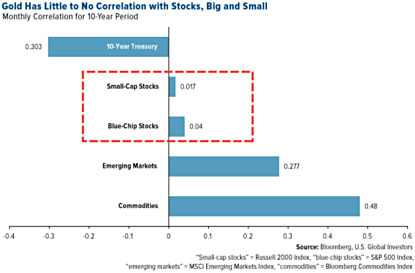

Gold has finished up for January and February, and what is important to understand about physical bullion is just how much diversification it adds to the portfolio.

Gold is literally uncorrelated to all financial assets. It rises from genuine fear and uncertainty, as well as times of negative interest rates, like Germany's -0.94% bond yield.

A French exit from the EU would mean a full-blown global crisis.

The EU is the world's biggest economy, with a GDP of nearly $19.1 trillion.

If the EU collapses, trade wars would be next.

With Trump's budget speech, the debt ceiling approaching decision time on March 15, a likely Federal Reserve rate hike, and the French elections in two months, this is a time to make sure your holdings are diversified, as the euphoric feeling always spells trouble in the end.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Charts provided by Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.