Is Stagflation Stalking? The Answer Is Critical To Your Financial Health!

Economics / Stagflation Mar 13, 2017 - 05:22 AM GMTBy: Gordon_T_Long

It is important to anticipate whether Stagflation is stalking because the yield curve will start pricing it in which will place equity yields, earnings and PE growth multiples at risk.

It is important to anticipate whether Stagflation is stalking because the yield curve will start pricing it in which will place equity yields, earnings and PE growth multiples at risk.

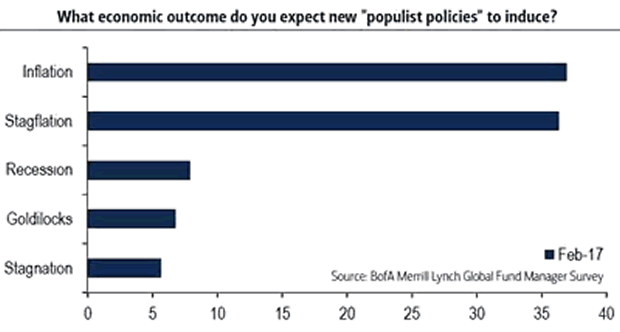

We believe there are clear signs of stagflation already occurring and according to the recent Global Fund Manger Survey, many believe if we don't already have elevated Inflation and an emerging period of stagflation, we can soon expect it!

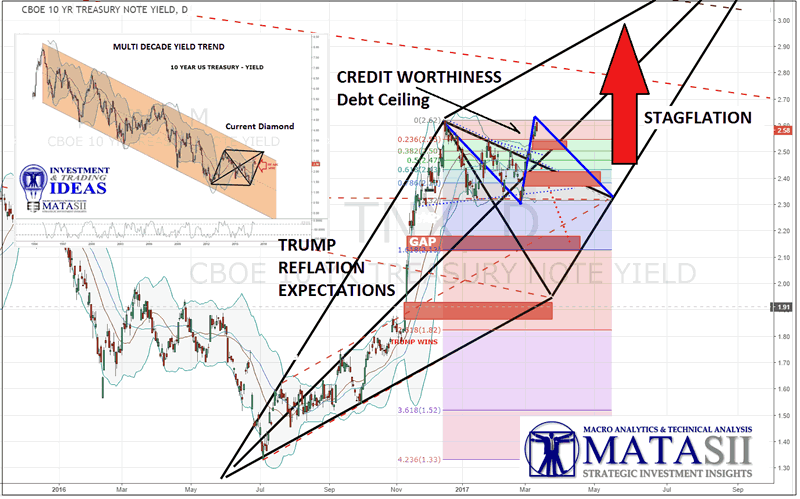

Yield Curve

What is particularly critical to the equities market is how the yield curve will react differently regarding whether it anticipates increasing Inflation through Reflation or Stagflation. If it views reflation the yield curve will shift up but also steepen as long-term yields increase faster than short term yields. If it sees stagflation because the drivers for inflation also impede economic growth, then the yield curve also shifts upward but instead can be expected to flatten. The longer-term yields rise slower than the short term yields.

In both case yields rise which places pressures on equities but the shape of the yield curve has the most profound impact on equity prices. In the last 5 years 71% of equity index increases are a result of P/E multiple expansion from 10X to 18X. This places PE multiple of the S&P 500 currently in the 90 percentile of historical valuations relative to the last 40 years. Anticipating what may occur is presently of the utmost importance to smart investors.

The 10 Year US Treasury Yield lifted violently on the Trump victory and reflation policy expectations. After a brief consolidation it has again aggressively moved up but it is important to view this as part of three reasons bond yields increase - 1- Economic growth rate, 2- Inflation and 3-Creditworthiness. The current Treasury yield lift in my judgment is more about the pending congressional US debt ceiling hurdles and potential Creditworthiness factors than reflation or stagflation concerns.

Stagflation

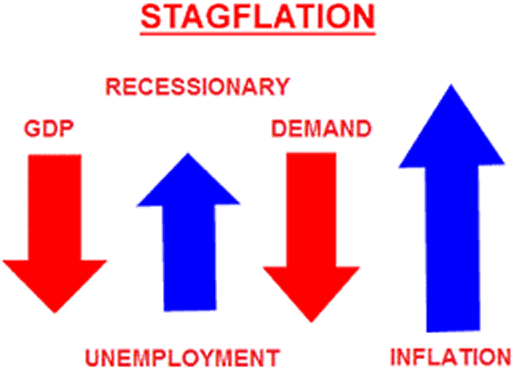

STAGFLATION: "Is persistent high inflation combined with high unemployment and stagnant demand in a country's economy"

Stagflation is very costly and difficult to eradicate once it starts, both in social terms and in budget deficits. It is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It raises a dilemma for economic policy, since actions designed to lower inflation may exacerbate unemployment, and vice versa. Historically, inflation and recession were regarded as mutually exclusive, the relationship between the two being described by the Phillips curve.

Economists offer two principal explanations for why stagflation occurs:

First (Think: '70's) stagflation can result when the productive capacity of an economy is reduced by an unfavorable supply shock that causes an increase in the price of oil for an oil-importing country. Such an unfavorable supply shock tends to raise prices at the same time that it slows the economy by making production more costly and less profitable. Milton Friedman famously described this situation as "too much money chasing too few goods".

Second (Think today), both stagnation and inflation can result from inappropriate macroeconomic policies. For example, central banks can cause inflation by allowing excessive growth of the money supply, and the government can cause stagnation by excessive regulation of goods markets and labor markets. Excessive growth of the money supply, taken to such an extreme that it must be reversed abruptly, can be a cause. Both types of explanations are offered in analyses of the global stagflation of the 1970s: it began with a huge rise in oil prices, but then continued as central banks used excessively stimulative monetary policy to counteract the resulting recession, causing a runaway price/wage spiral.

Let's consider the four elements of stagflation, 1- Inflation, 2- Unemployment, 3- Demand and 4- GDP Growth to see whether this is a real possibility for the US.

1 - Inflation

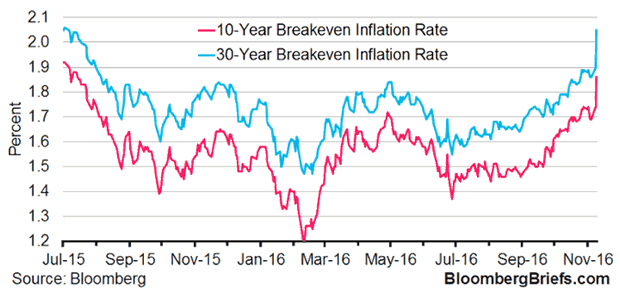

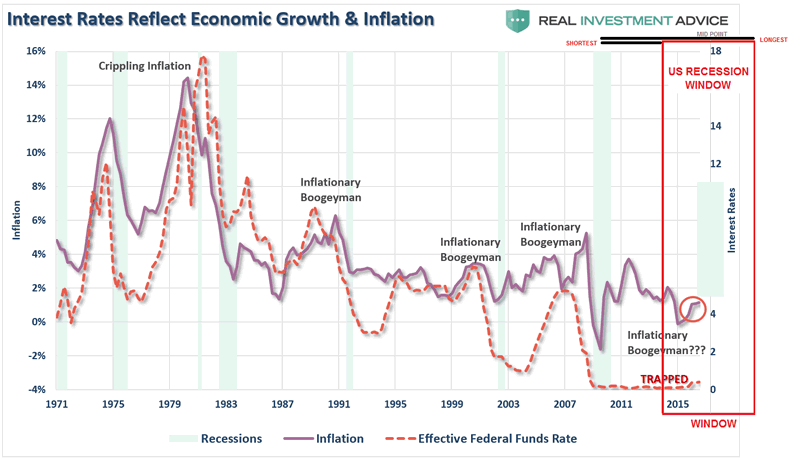

According to The Federal Reserve, entrusted with monitoring and managing Inflation pressures in the economy, until recently it is has been low and well below the Fed's 2% target. But the times they are a changing!

Since this time last year inflation expectations have been increasing steadily and rose even more dramatically with the Trump Presidential victory. The Trump spike was a result of his proposed economic stimulus programs such as Infrastructure and Defense.

However, it is isn't just expectations that have been increasing, but also actual price tags.

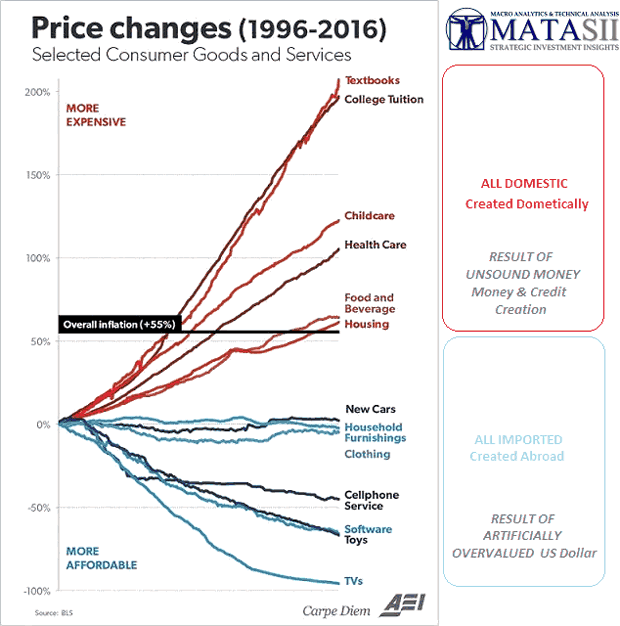

Some price increases have been much higher than how such measures as the CPI tabulates inflation.

From a long term historical perspective (if you believe government statistics) the inflation rate is still relatively low.

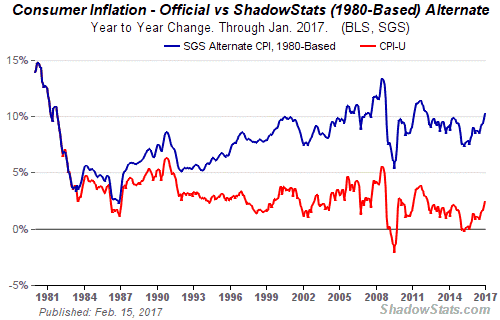

However, taking out "special" government adjustments such as "Substitution", "Hedonics" and "Imputation" along with the other changes that have been made by the government since the early 80's, we see the real picture.

ShadowStats.com which tracks inflation closely show that in fact if we consider inflation in terms of how the government calculated it in 1980 (before interest rates started falling abruptly) you find it approximates 10% per annum! I personally believe this much more closely matches what the average US household would suggest they are experiencing.

CONCLUSION: We DEFINITELY have inflation and it is worse than the Federal Reserve acknowledges or is actually aware!

2 - Unemployment

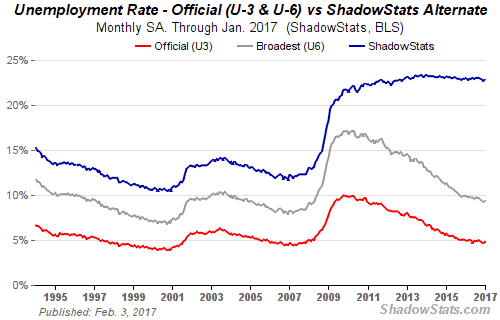

According to the government narrative we have low unemployment with concerns about a tight labor market. This is pure fabrication or minimally misinformation and distortion of the facts. John Williams at ShadowStats again shows the reality.

The ShadowStats Alternate Unemployment Rate for January 2017 is 22.9%.

'

'

We presently have a labor force participation level at historically low levels with nearly 100 million working age adults not in the work force and many with jobs not able to to get sufficient hours to support a middle class life style.

As Presidential candidate observed at a campaign rally in front of 30,000 people. "If the unemployment rate was really 5% do you think we would really have this many people here!" Do you believe government statistics or "your lying eyes"?

CONCLUSION: We have high a very high unemployment and under-utilization of the American workforce.

3 - Demand

What we have in the US is "Artificial Demand" rather than "Stagnant Demand". The difference being that the former temporarily camouflages the later - but only temporarily as in reality we have "Stagnant Demand" being camouflaged by massive credit expansion and low finance rates. This only brings demand forward creating a demand void in the future.

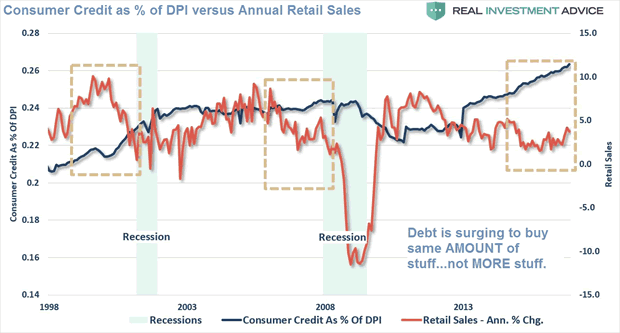

Consider that Consumer Credit is rising rapidly in comparison to Disposable Income. In other words we are borrowing increasingly to make ongoing purchases but those purchases are not increasing. Debt is surging to buy the same amount of stuff -- not more. In reality real economic demand is shrinking and is only presently artificially being supported.

CONCLUSION: We have Weak Demand being supported by high levels of credit in relationship to disposable income.

4 - Growth

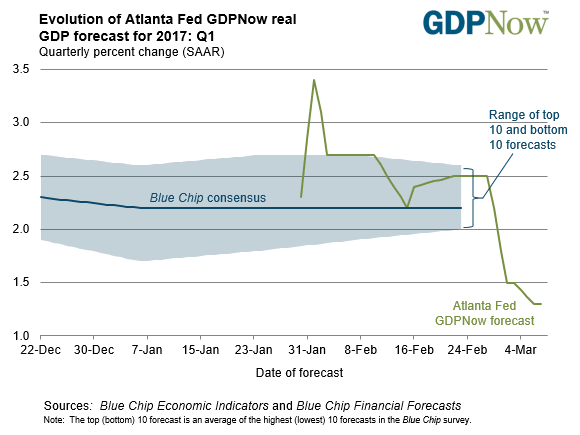

How can the US current GDP levels seen to be anything other than terribly weak! Thus far this quarter 1Q17 is tracking at 1.8%

The common narrative is that the US is entering a golden age in its economy and that this growth will drive stocks ever higher. The reality is that GDP growth has collapsed. The third quarter of last year (3Q16) was the quarter everyone thought signaled a new beginning with growth of 3.5%. However, the very next quarter’s growth (4Q16) collapsed to 1.9%.

Put simply, growth is NOT coming soon if at all. Even Trump’s top economic advisor has admitted that GDP growth of 3% is unlikely until the end of 2018.

CONCLUSION: We have historically weak economic growth

Summary

It is hard not to conclude that we are already living in a period of STAGFLATION which the markets have yet to fully recognize (may we suggest "Cognitive Dissonance"?).

There is little way out other than praying for the Trumponomic Economic miracle that the markets are so clearly euphoric about! Of course I have never found prayer as a reliable approach to investment strategy!

Signup for notification of the next MACRO INSIGHTS

Gordon T. Long

Publisher - LONGWave

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2017 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.