Inflation is No Longer in Stealth Mode

Economics / Inflation Jun 21, 2017 - 04:00 AM GMTBy: GoldCore

IHS Markit index shows UK households pessimistic about finances for 2017-18

IHS Markit index shows UK households pessimistic about finances for 2017-18- UK household finances remain under intense pressure from rising living costs

- 58 percent of respondents expected higher interest rates in 12 months time

- Inflation in the United Kingdom currently at near four-year high

- Prices up prices by 2.9pc year-on-year, biggest annual increase since June 2013

- In May consumer spending in the UK fell for the first time in almost four years

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. John Maynard Keynes, The Economic Consequences of the Peace (1919)

Inflation is taxation without legislation Milton Friedman

Inflation is no longer in stealth mode

Inflation at 2.9% and wage growth lagging behind has meant household consumers in the UK are under intense pressure from rising living costs.

The IHS Markit Index and Survey measures how people feel about their current situation. The June reading changed from 43.8 from 42.6, indicating that households are the most pessimistic about their finances than they have been in three months.

Reports have linked this to the latest Consumer Price Index readings combined with inflation and interest rate expectations. It is no surprise that with weakening economic indicators and an uncertain political outlook that sentiment is falling.

The fall in the British pound, following the 2016 Brexit vote, is seemingly being blamed for this fall in consumer confidence and climb in inflation. Prior to the referendum last June, official inflation was just 0.3%.

Whilst the pound has recovered slightly from it’s tumble post General Election, general sentiment regarding the currency and the general political and economic situation, is weak. Following the Brexit shock the fall in sterling pushed up the cost of imported goods.

Higher interest rates and inflation expectations

The IHS Market survey also showed that 58% of respondents expect the Bank of England’s Monetary Policy Committee (MPC) to raise interest rates in 12 months’ time. Following the Brexit vote, less than half of the number of people expected this to happen, suggesting consumers were unprepared for the economic hardship that was coming their way.

Consumers might not be wrong to expect a rate hike in the next year. Minutes from the MPC’s June meeting showed that three members (of eight) voted for a rate increase. Rates currently stand at 0.25%.

Usually the Bank of England would look to raise interest rates given the continuing climb above the inflation target. However, these results not only suggest the MPC will have to wait longer but that they will also be unable to inject more cash into the economy. This would perhaps not be a bad thing, in the long run.

One of the major products contributing to the increase in inflation this month was apparently package holidays, highlighting the growing cost of foreign travel at current sterling prices. The second product highlighted by the Office of National Statistics to be contributing to inflation was computer games.

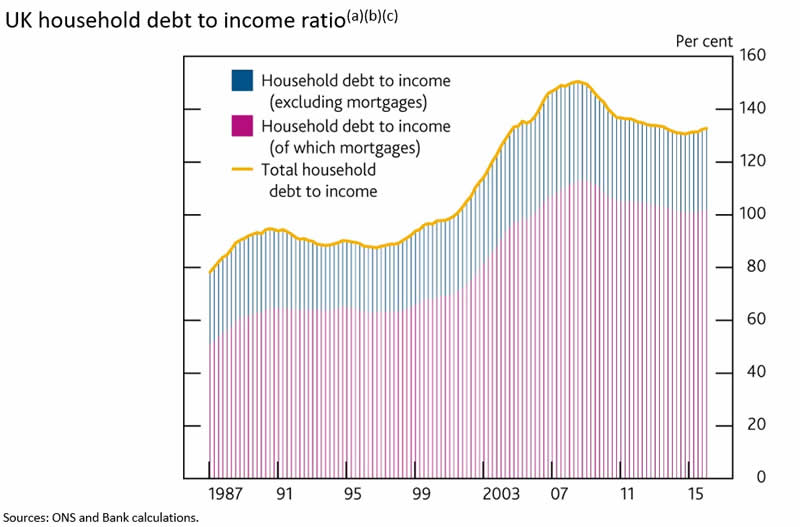

We’re fairly sure that consumers have been feeling the pinch regardless of whether they like a trip to Brittany or enjoy a late-night session of World of Warcraft. Wage growth consistently fails to keep up with inflation and the UK’s household debt to income ratio shows Brits are consistently spending more than they are earning.

There are some major long-term indicators that suggest consumers have been suffering from climbing inflation for some time. But, there has been little official recognition of this, in other words we have been experiencing stealth inflation.

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit-man” Ronald Reagan

Inflation no longer so stealthy

Whilst Brexit, a hung parliament and the subsequent weak pound are being blamed for the rise in inflation and fall in consumer sentiment, make no mistake that inflation has been making its way into the market in a variety of ways for many years now. It is also at a much higher level than the Consumer Price Index would have us believe.

The first example is the CPIH which a measure of how much manufacturers are having to pay for raw materials and energy. Prices were up 15.6% in a year, in April and 11.6% in May. How this really feeds through to consumers though is not just through price rises as is measured by the CPI, but by what we call a stealth form of inflation – a fall in quality and increase in price.

“…[inflation] will lead to a decline in the quality of goods and of service to consumers, since consumers often resist price increases less when they occur in the form of downgrading of quality.” Murray Rothbard, What Has Government Done to Our Money?

Everyone you speak to can think of an example of this form of stealth inflation – decreasing quality with higher prices. The oft-quoted ‘they don’t make ‘em like they used to’ is more relevant today than it ever was.

Unfortunately there is no official measure of this form of inflation, only anecdotal evidence, conversations in the supermarket queue, at the school gates, with furniture salesman etc. Think back to when you first noticed an item of clothing falling apart or not washing properly and wondering why these things didn’t last anymore. It was a while back, certainly a long time before any official measures of inflation said anything was up.

This form of inflation is obvious however when you look at price versus size and how this has changed in recent years. Toilet and tissue paper companies are a good example. In a phenomenon known as ‘de-sheeting’ Kimberly-Clark’s 2013 Kleenex was advertised as 15% bulkier…but with 13% fewer sheets.

The US website consumerist.com joyfully calls this form of stealth inflation the Grocery Shrink Ray, a ‘phenomenon wherein an item sold at X price at a retailer shrinks in size but still costs X amount.’

The most recent example of this was the announcement by Toblerone’s manufacturers that the shape of the infamous pyramid bar would be changing. Mondelez, Tobelerone manufacturers, announced they would be reducing the bars from 170 grams to 150 grams in the UK which would affect the shape. ‘Uproar’ is not quite a strong enough word to describe the reaction from Toblerone fans. Despite the reduction in size, the RRP for the bars has not been reduced.

Mondelez’s justification for the change was due to an uptick in ‘many ingredients’ prices’, the company specifically blamed the drop of the euro against the Swiss franc in January, and an increase in cocoa prices over the last three years.

Staying with confectionary, a Missouri man has filed a federal lawsuit against Hershey’s whom he accuses ‘of under-filling the Reese’s box by around 29%, and the Whoppers box by 41% to mislead shoppers and make them believe that the box is more full than it is.’ The case was not dismissed by the judge.

This is not a new phenomenon. It has been seen repeatedly prior to major depressions. consumerist.com draws our attention to this 1916 (front-page) story in The Seattle Star, ‘“[Inspectors] went from bakery to bakery Thursday checking up on the bread situation…And here is what they found: ten-cent loaves of bread have shrunk from 32 ounces to 22 ounces, and standard 5-cent loaves, that used to weigh 16 ounces, now average 11 ounces.”

Toiler paper and sweets might seem like a fickle way to demonstrate the existence of inflation but the truth is that is because of the rising cost and falling quality of everyday goods that consumers are feeling down about the economy.

Conclusion – can doctors treat economic depression?

With wage growth refusing to keep up with rising price levels, the MPC refusing to tackle inflation and declining economic growth likely, the UK may be entering a period of stagflation. When a similar event occurred in the 1970s the period was long lasting and unmanageable.

We don’t know if we are heading into a similar period, but it would be imprudent to fail to prepare for such an event. In the meantime, it is obvious both officially and unofficially that inflation is very much here to stay for the foreseeable future and that is is affecting sentiment both at home and abroad.

Economic depression is usually defined as a sustained, long-term downturn in an economy. At the moment we are clearly look at the form of depression that precedes this – long-term, sustained downturn in economic mood and sentiment. As with an economic depression, there is no quick-fix or obvious treatment. Instead, we can only prepare ourselves for what might be coming.

Gold is a hedge against both inflation and stagflation. History shows it has preserved purchasing power over long periods of time. When compared with the prices of commodities denominated in a fiat currency, the prices of commodities such as oil when priced in gold remain relatively stable.

In contrast, the value of fiat only continues to fall thanks to inflation. It is near impossible to preserve your wealth when kept in such a form. This combined with the increased cost of day-to-day living means households will continue to struggle and the economic outlook for the UK will remain weak.

Readers would be wise to look at their portfolios and consider how it is set for a long-term period of economic depression and rising inflation, whether stealth or otherwise.

Gold Prices (LBMA AM)

20 Jun: USD 1,246.50, GBP 981.99 & EUR 1,117.24 per ounce

19 Jun: USD 1,251.10, GBP 976.86 & EUR 1,117.73 per ounce

16 Jun: USD 1,256.60, GBP 984.04 & EUR 1,124.03 per ounce

15 Jun: USD 1,260.25, GBP 992.57 & EUR 1,127.67 per ounce

14 Jun: USD 1,268.25, GBP 995.83 & EUR 1,131.41 per ounce

13 Jun: USD 1,261.30, GBP 992.26 & EUR 1,125.33 per ounce

12 Jun: USD 1,269.25, GBP 998.14 & EUR 1,131.28 per ounce

Silver Prices (LBMA)

20 Jun: USD 16.59, GBP 13.10 & EUR 14.88 per ounce

19 Jun: USD 16.67, GBP 13.02 & EUR 14.87 per ounce

16 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

15 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

14 Jun: USD 16.96, GBP 13.32 & EUR 15.14 per ounce

13 Jun: USD 16.82, GBP 13.21 & EUR 15.01 per ounce

12 Jun: USD 17.13, GBP 13.50 & EUR 15.27 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.