Lightening-Fast COT Reversal: Now Fairly Bearish For Gold And Silver

Commodities / Gold and Silver 2017 Aug 22, 2017 - 12:19 PM GMTBy: John_Rubino

That didn’t take long at all. Just a few weeks after the Commitment of Traders (COT) Reports for gold and silver turned positive – setting off a nice rally in both metals’ prices – this indicator has flipped back to strongly negative.

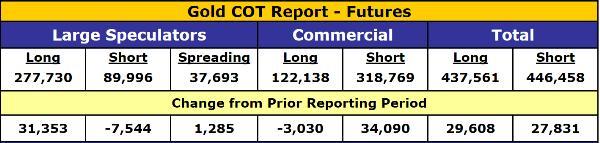

In gold especially, speculators (always wrong at big turning points) have loaded up on long futures contracts while closing out their short positions. The commercials (always right at big turning points) have done the opposite, closing out long positions and going aggressively short.

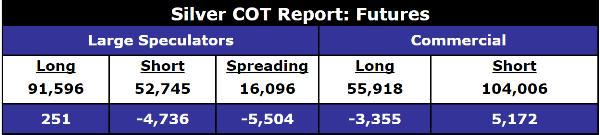

In the week ended August 15, the gold speculators and commercials got about 10% more long and short, respectively. That’s a big one-week move, and brings the imbalance between good and bad positions to nearly 3-to-1 bearish. The trends in silver, while not as extreme, still point in a bearish direction.

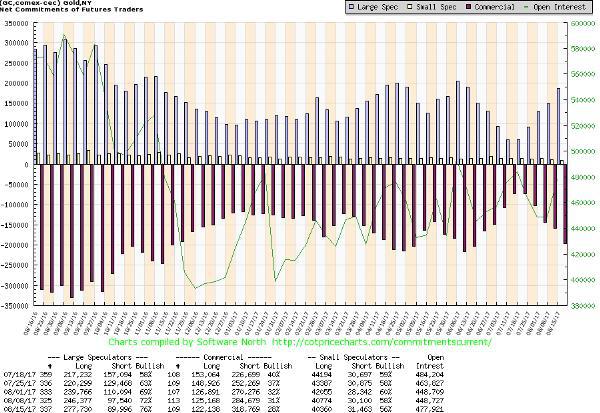

Here’s the action presented graphically, with the silver lines on the top half of the chart representing speculator long positions and the purple bars below indicating commercial shorts. Note the leisurely pace of previous months, and contrast it with the v-shaped move that just took place. Not sure what that means, other than that speculators hoping to ride a longer upswing might be disappointed.

It’s important once again to note that the COT report is not a day-trading tool. Historically it’s been a pretty good indicator of the general trend over the following six or so months. But it has nothing to say about tomorrow or the day after. So it’s irrelevant for stackers and other long-term accumulators. But it is useful for someone who has their eye on a given gold/silver mining stock and is looking for a good entry point – which in this case might be a few months in the future.

Another point that bears repeating is the temporary nature of this indicator. Eventually, fundamentals in the form of surging demand for physical precious metals will swamp the paper market. Gold and silver will soar regardless of which futures players are long or short.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.