Looking at My US Housing Market “Doomsday” Map

Housing-Market / US Housing Apr 07, 2018 - 10:19 PM GMTBy: Harry_Dent

Jeff was a small business owner in New Hampshire. One Tuesday afternoon, his neighbor called…

Jeff was a small business owner in New Hampshire. One Tuesday afternoon, his neighbor called…

“You need to get home NOW! There’s a dumpster in your yard, a padlock on your door, and a bunch of guys are ransacking your house!”

Completely panicked, Jeff dropped everything and raced home. When he got there, he found most of his family’s possessions either in a heap in the front yard or tossed inside the dumpster.

Without warning or notice, the bank had foreclosed his house and sold it at auction just a few days earlier. In a single afternoon, the life he’d worked so hard to build for his wife and three daughters was gone!

It’s a story we heard all too often following the 2008 housing crisis.

Unfortunately, despite what you’re hearing from the mainstream media about real estatetoday – how it’s booming and can only go up from here –it’s a story we’re going to start hearing again and again in the coming years.

Some people have benefited from the record breaking bull market and housing recovery. But it’s been mostly the richest Americans who own most of the financial assets.

Hundreds of millions of Americans who don’t belong to the 1%, who were crushed in the last crisis, haven’t been able or willing to participate in the recovery. For them, things haven’t gotten better. They’ve gotten worse.

And this map proves it…

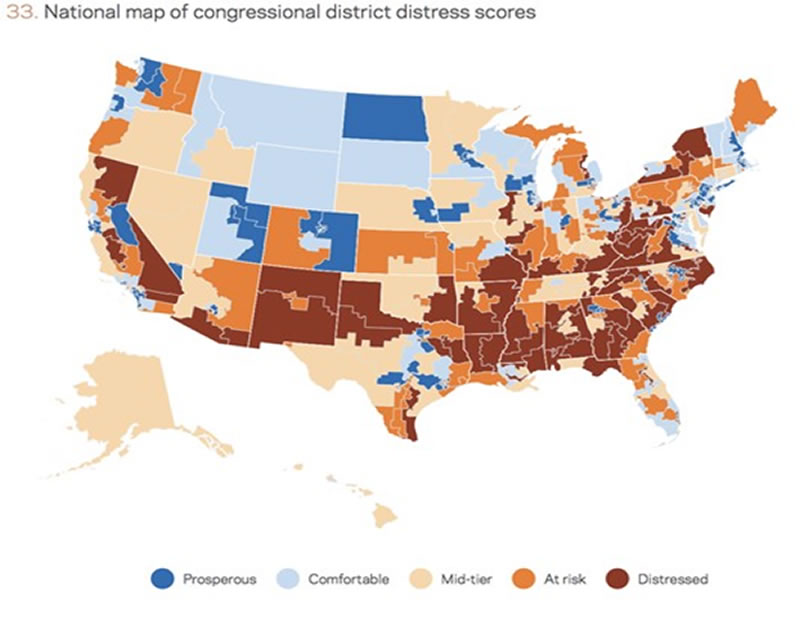

See all that blue?

It’s not who voted for Hillary. Instead, those are the prosperous parts of America where there’s been strong economic growth, new jobs, rising home values, and higher pay over the past two decades.

It’s no surprise that most of that prosperity is concentrated in the fast-growing western cities and tech hubs… like San Francisco, Seattle, and Austin, TX.

But see all that orange and red?

That’s the other America this “recovery” left behind… the old industrial cities that were once the engine of our economy.

Where today, residents are more likely to die sooner, have more frequent health problems, flat or decreasing home values, and earn less money with fewer job opportunities.

Where more than 38 million American households can’t afford their housing… an increase of 146% over the past 16 years.

Where nearly seven million homeowners are either underwater on their mortgage, or barely above break even.

Where one in five households are currently broke or in debt.

And possibly the scariest statistic of them all…

Where nearly half of all Americans say they don’t have enough money to cover a $400 emergency expense. That means even a tiny bump in the road, like an unexpected medical expense, the loss of a job or decrease in pay, a slight increase in the everyday cost of living, or an increase in their mortgage interest rate would send millions spiraling into the same situation as Jeff.

And that 1%? They’re in for a shellacking of their own because they are so heavily invested in over inflated financial assets.

So, forget all the fake news you’re hearing about the real estate market being safe again because of the shortage of inventory and record home starts…

Forget about the record highs in the stock market…

And most definitely forget about all the promises the White House and Congress have made.

The truth is, we’re already starting to see the cracks deepening in stocks and in this fake “housing recovery” all across America. And that’s why I’ve written my newest eBook, Real Estate Doomsday: How to Protect and Grow Your Wealth During the Greatest Real Estate Crash in History. In it, I explore those cracks to show you how unstable this situation really is, and I detail which real estate markets across the country face the highest risk.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.