US Dollar Head & Shoulders Triggered. What's Next?

Stock-Markets / Financial Markets 2018 Sep 19, 2018 - 05:49 PM GMT SPX made its final high yesterday afternoon. The top-to-top time was 12.9 days, fitting my thesis that the impulsive decline and retracement fits in Cyclical time. This morning’s futures are lower, indicating that a new impulse may be underway, although it may remain shallow for the better part of the day. There is a potential Head & Shoulders formation that, when triggered, may send the SPX beneath its smaller Broadening Wedge.

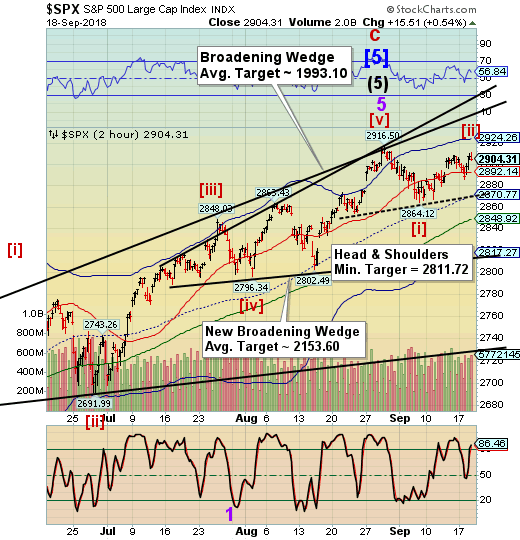

SPX made its final high yesterday afternoon. The top-to-top time was 12.9 days, fitting my thesis that the impulsive decline and retracement fits in Cyclical time. This morning’s futures are lower, indicating that a new impulse may be underway, although it may remain shallow for the better part of the day. There is a potential Head & Shoulders formation that, when triggered, may send the SPX beneath its smaller Broadening Wedge.

ZeroHedge reports, “Global equities rallied for a second day on Wednesday with US futures flat while European shares edged higher following a strong session in Asia as safe-havens such as US Treasurys and the Japanese yen dropped to multi-week lows as investors bet the escalating U.S.-China trade spat would inflict less damage than feared.”

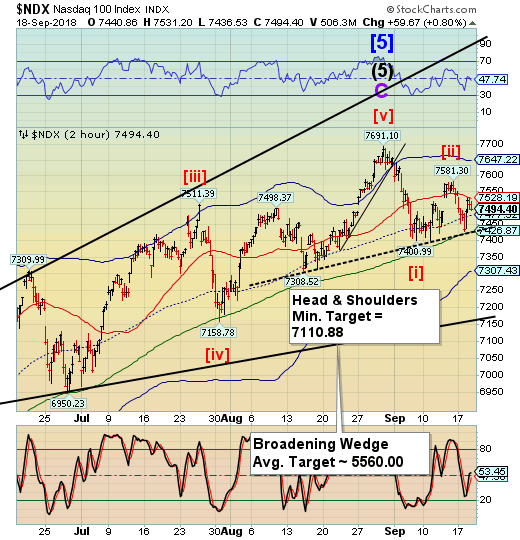

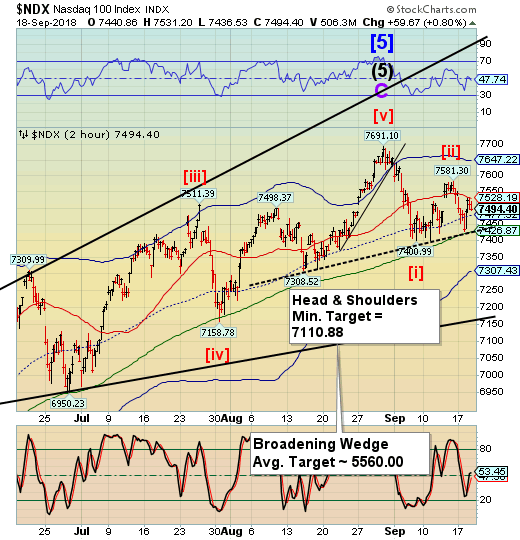

NDX futures are lower this morning as well, after being repelled at Short-term resistance at 7528.19. It also has a potential Head & Shoulders formation that, when triggered, may send it beneath its own Broadening Wedge pattern.

CNBC reports, “China could target U.S. tech stocks as part of the ongoing trade war, according to the top equity strategist at Goldman Sachs.

Peter Oppenheimer told CNBC's "Street Signs" on Tuesday that China may impose tariffs on industry components that could have an effect on supply chains.

U.S.Technology firms could be first in the firing line, Goldman's chief global equity strategist added.

"The target may be technology companies that have been the main driver of the equity bull market that we have seen in the U.S. and beyond," Oppenheimer said.”

VIX futures are nominally down this morning, after closing beneath the 50-day Moving Average at 12.81. The breakout above the 50-day Moving Average creates the buy signal, while the pullback affords a better entry for those wishing to go long the VIX.

VIX ETFs are making a new Master Cycle low. They are in a window where a further low may be made, but should be complete by the end of the week, if not sooner.

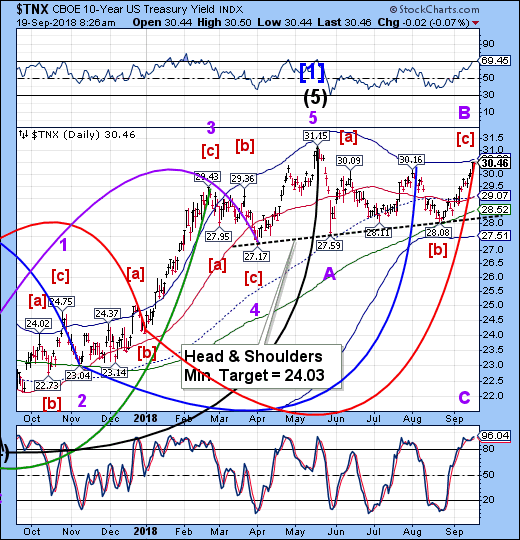

TNX appears to be probing the Cycle Top at 30.63, but hasn’t quite reached it yet. The futures show TNX at .20 higher than the cash index, but that is due to a time premium on the new expiration date, which is December 21. As you can see, SPX, NDX and TNX all have Head & Shoulders formations that haven’t been triggered yet.

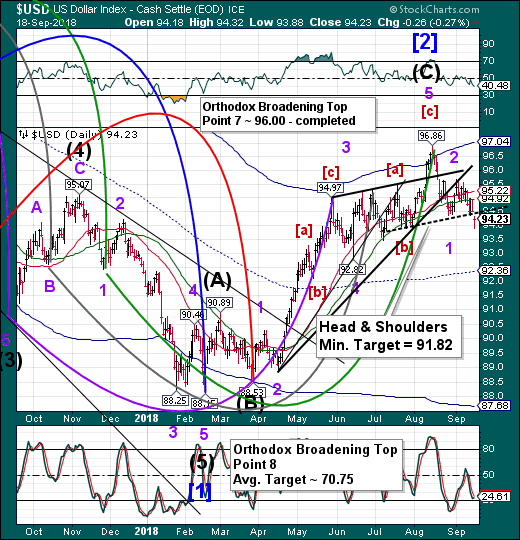

USD has triggered its own Head & Shoulders formation which suggests that the others are not far behind. It appears that the USD futures have already tested the underside of the neckline and may be resuming the decline. The Cycles Model suggests a strong decline may ensue over the next week. I have mentioned several times that the USD is the controlling asset. Where it goes, the stocks and treasury yields will follow.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.