Will Miners Save Gold?

Commodities / Gold and Silver 2018 Dec 21, 2018 - 04:02 PM GMTBy: Arkadiusz_Sieron

The price of gold cannot decline and stay below the gold production costs. Myth or fact? We invite you to read our today’s article about the mining costs and find out whether they provide a floor for gold prices.

The price of gold cannot decline and stay below the gold production costs. Myth or fact? We invite you to read our today’s article about the mining costs and find out whether they provide a floor for gold prices.

So if the central bank demand for gold is not able to boost the price, then maybe mines will help? We refer here to the popular narrative that the price of the yellow metal cannot decline below its cost of production. But do gold production costs really set a floor for bullion prices?

We sincerely doubt it. If we were unkind, we would have asked “which production costs”? Each mining company produces at different level of costs. In 2017, they ranged from to $620 to $1000, depending on the region, according to the GFMS Gold Survey 2018. But these costs differ also within these regions, depending on type of mine, the quality of gold ore, local taxes and regulations, and on myriad of other factors. So at which level is the floor: $620 or $1000?

Another issue is how to calculate these costs. Should we include depreciation? Or general and administrative expenditures? And what if gold is a by-product? As you probably know, the industry reports both the cash costs – which is the cost to mine gold-bearing rocks, process the ore, and sell the gold – and the all-in sustaining cost, which also include sustaining capital and G&A expenses, but not project capital expenditures.

Please also note that companies have a lot discretion in classifying what are these sustaining costs. The costs we provided above were cash costs. Meanwhile, the all-in sustaining costs ranged from $750 to almost $1,200. So we now have four numbers – which one should we use?

But let’s assume that the lowest of them creates the floor for gold prices. What are the forces that allegedly prevent the price of gold from sliding below the cost of production? Well, the idea is simple: when prices are below costs, the production becomes unprofitable. The producers go bankrupt, so the supply drops, which increases the price.

Fair enough, this is how the law of supply operates. We do not question this. We are economists, after all. But there is one small problem. Gold’s supply is so unique that the mechanism described above does not practically apply. Why? To understand this, you have to close your eyes and imagine what would happen if all oil producers ceased their production. Let me guess: you have pictured rising prices and social unrest. And rightly so. The reason is that without the oil production we would quickly run out of oil. Of course, people are wise enough to put some oil into reserve. According to estimates, the oil stockpile is equivalent to 40-50 days of production. It means that our oil-dependent civilization could survive without the oil production one quarter at most (assuming a reduction in consumption level).

OK, and now the most important part. Imagine that all gold mines cease their activities. What do you think would happen? Yes, you are right, don’t be afraid of the implications. Nothing. Of course, we exaggerate, because many people will lose their jobs and so on. But the truth is that the lack of fresh supply of gold will not significantly affect the global markets. We do not mean that gold is less important than oil for our modern economy, although it probably is.

The key thing is that there are massive above-ground holdings of gold. The above ground stocks are estimated to be around 190,040 tons. It means that the annual supply of gold adds only about 2.3 percent of the above-ground holdings of gold (and mining production even less – about 1.7 percent). Or in other words, the above-ground stocks of gold are almost 60 times larger than the annual flow of new gold from gold mining. It’s quite a difference between 50 days and 60 years!

Given such a high stock-to-flow ratio, and the fact that an amount equal to the annual mine supply changes hands in less than a week in the London market alone, the gold production costs do not provide a floor for gold prices. Actually, the opposite is true. When the price of gold drops, the least efficient miners exit the market, which lowers the average gold production cost. It means that gold prices are a determinant of producers’ costs, which is exactly what professor Brian Lucey of Trinity College Dublin et al. found in their article in Alchemist.

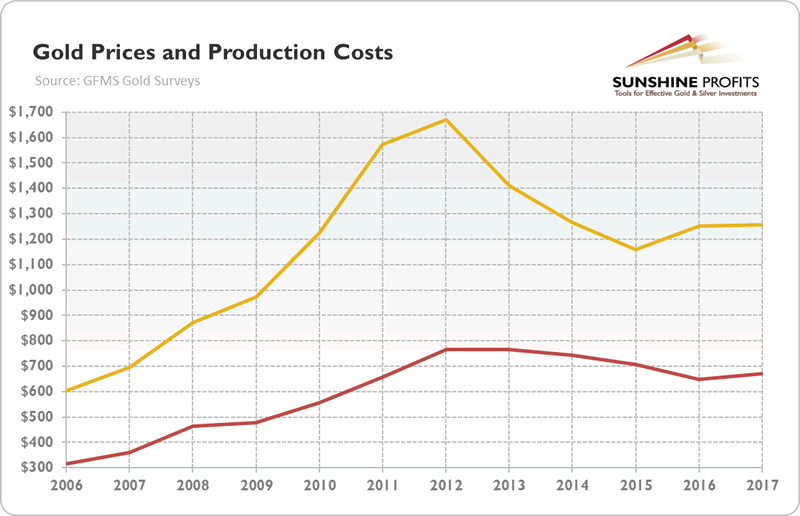

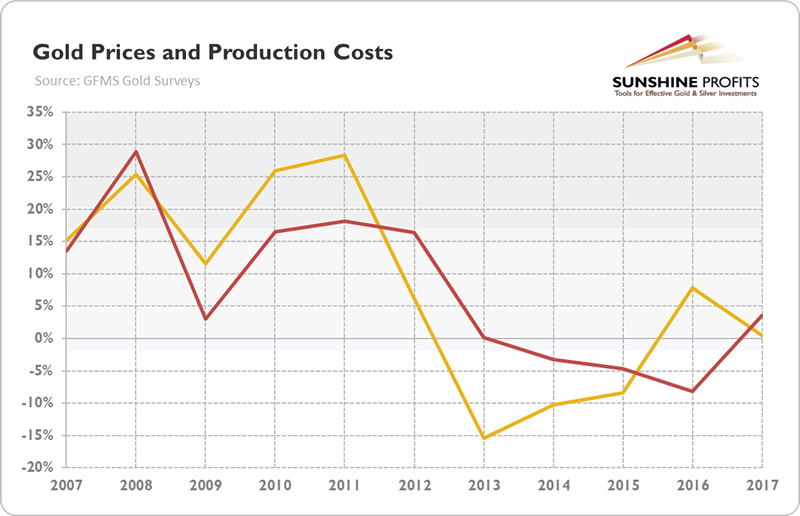

Just look at the charts below (the first one presents the level, while the second – percentage changes). There is visible co-movement between gold prices and production costs. In 2013, the price of the yellow metal plunged, but the costs remained steady. They started to fall one year later, declining until 2016, although the gold prices rebounded in 2015. It strongly suggests that the production costs lag behind the price of the shiny metal. Hence, they cannot drive the prices or create a floor, as they are determined variable, not determinant.

Chart 1: Gold prices (yellow line, London PM Fix, in $) and the average global cash costs (red line, in $) from 2006 to 2017.

Chart 2: Percentage change in gold prices (yellow line) and in the average global cash costs (red line) from 2007 to 2017.

If you still are skeptical, imagine that all gold mines go bankrupt. Even in such an extreme case there would still be 190,000 tons of gold left on the market, instead of 193,000 tons we would have with a fresh mining production. Maybe we are incorrigible optimists, but it does not look like a disaster. Does it?

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.