Will Coins and Bars Save Gold 2019?

Commodities / Gold and Silver 2018 Dec 30, 2018 - 04:02 PM GMTBy: Arkadiusz_Sieron

There is a disconnection between paper and physical gold prices and the former has to catch up with the latter eventually. Myth or fact? We invite you to read our today’s article about demand for gold coins and bars and find out whether it will save the yellow metal.

There is a disconnection between paper and physical gold prices and the former has to catch up with the latter eventually. Myth or fact? We invite you to read our today’s article about demand for gold coins and bars and find out whether it will save the yellow metal.

The best stories are about the conflict between good and evil, or light and dark. In the precious metals market, we also have such a narrative, or actually several variations on the theme. But one of the most popular thread is the ‘disconnection’ between paper and physical gold. The characters are clearly identified: paper market is the powerful Empire while the physical gold is Rebellion, which heroically fights a stronger and more vicious opponent.

The battle is about gold and silver. The paper market suppresses their prices by malicious use of derivatives, mainly futures, and other techniques of manipulation. Luckily for the Rebellion, these actions are doomed to failure. When the fraud is exposed and the paper gold market collapses under its own weight, ‘real’ market forces come to the fore, pushing the gold prices eventually back to the fundamental level which would be reflected in the pure physical price market. In other words, after being manipulated for years, the ‘true’ price of gold will surface.

According to this narrative, the declines in the gold prices are practically always seen as something suspicious or even fake. Hence, many investors do not react adequately to market changes, but wait for the “imminent” rebound, missing many opportunities to gain.

The fact that the prices of bullion coins or bars typically lag behind the spot price only reinforces the belief in the disconnection between paper and physical markets. It’s true that prices of gold bars and coins are above the spot price, but this is due to premium for refining or minting and selling to retail investors. Bullion dealers quote prices higher than London fix, since they bear higher costs than wholesale players and add some markup to make a profit.

Another thing is that there is a limited capacity to produce them, which lifts prices. For example, only the US Mint (surprise, surprise) can mint US Mint coins. When strong demand meets limited supply we have higher prices. However, it proves neither a shortage of gold, nor the disconnection between physical and paper market. It rather demonstrates the lack of enough equipment for coining.

Moreover, the fact that bullion dealers slowly cut the prices of coins and bars should not be very surprising. You should know the mechanism from the gas stations: the price of gas rises much faster than it falls in a response to changes in the crude oil prices. One reason for this is limited competitive pressure. But it’s also true that gas stations wait with cuts to cover the costs of the higher-priced gas still in their tanks. The same applies to bullion dealers. They reduce retail prices with some delay, as they wait to cover the costs of the higher-priced coins and bars still in their inventory.

The best example of the permabull mindset is the immediate reaction to the plunge in gold prices in 2013. After a decade-long bull market, the sudden dive was a bitter pill to swallow. Therefore, people deluded themselves that the decline was an anomaly. The quote from Doug Casey is very telling:

My first reaction is to suggest that this is only an aberration, and that the fundamentals of the depreciating value of paper currencies will eventually take the price of gold much higher, making it a buying opportunity.

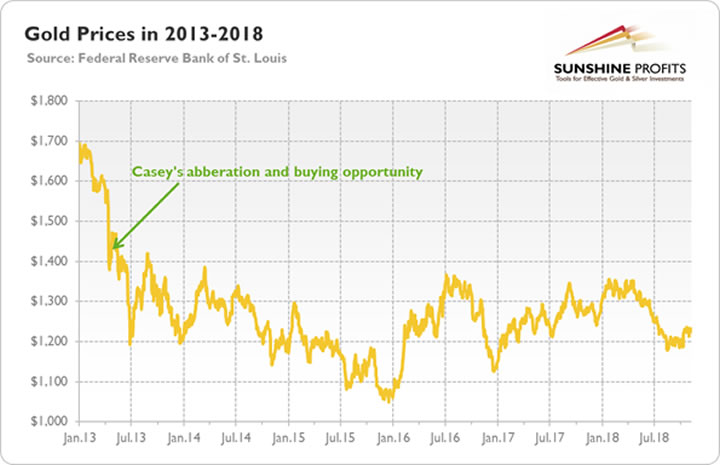

He wrote these words in April, 2013, after the price of gold slid to $1,400 level. Five years later, it is lower, not higher, at the level of about $1,200, as one can see in the chart below. Of course, the price of gold may eventually go higher. But a term “eventually” is not very useful in trading and investments. If the price is going to decline and provide an ultimate buying opportunity at much lower price levels, it simply makes sense to close the positions and reopen them much lower (perhaps profiting from the decline). And you know: Didi and Gogo waited for Godot for a long time, but he never arrived.

Chart 1: Gold prices (London PM Fix) from January 2013 to November 2018.

To be clear, we are not admirers of our monetary system based on paper currencies. We acknowledge that it is more inflationary than the gold standard and may collapse one day. We like gold, but we like objectivity and truth much more. And we care about our clients’ portfolio’s returns much more than we do about the profits of gold sellers and producers that would prefer one to believe that gold is going to always go up and never decline. Still, we are sympathetic to part of gold bulls’ arguments. At first glance, it makes sense: the supply of money increases, the currencies systematically depreciate, so the price of gold should only rise.

However, such reasoning does not take into account market sentiment and investors’ psychology. People react differently to low and high inflation. If we have hyperinflation, or just high and accelerating inflation, gold will shine, without a doubt. But we have modest inflation. Moreover, the US dollar is not the only currency which depreciates – all currencies depreciate in a similar pace. Actually, thanks to strong demand for greenback (due to its status of international reserve), and contained inflation, the dollar looks quite attractive. Especially given that gold does not bear any yield.

The bottom line is that the gold price discovery might indeed not be perfectly honest. Perfect honesty is very rare on Earth, perhaps even rarer than gold. But it does not mean that there is a disconnection between paper and physical gold prices. It’s a perfect… nonsense, as any price differential would create enormous arbitrage opportunities. There might be a disconnection between the paper and physical prices in the future if there is a shortage of a given precious metal (it’s unlikely that we’ll see shortage of gold, but silver is a different story), which has already happened in the palladium markets about two decades ago, but this is unlikely to happen anytime soon and very unlikely without a powerful parabolic upswing in prices beforehand. We have definitely not seen one recently.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.