Gold Price Breakout - Trend Forecast 2019 July Update

Commodities / Gold & Silver 2019 Jul 28, 2019 - 03:41 PM GMTBy: Nadeem_Walayat

Houston we have lift off! So the gold price took off like a rocket in commemoration of the 50th anniversary of the Apollo 11 Launch and Lunar landings. One small step for precious metals one giant leap for gold bugs as the gold price barely paused at a series of resistance levels, $1300, $1350, $1370, $1400, none managed to hold gold in check for more than a couple of days as the price gravitated towards a rendezvous with $1450, which the gold price hit a week ago before retreating to currently stand at $1419.

My analysis just prior to the Gold price taking off first made available to Patrons who support my work (Gold Price Trend Forecast Summer 2019) concluded in bullish expectations for the summer trend to see the Gold price target a series of resistance levels all the way towards $1400.

Therefore my forecast conclusion for the Gold price is to trend higher towards a target of $1350-$1370 by late September 2019. This trend can be further broken down to expect a minor correction during July off of a June peak with the rally resuming during August and September.

(Charts courtesy of stockcharts.com)

Peering into the Mists of Time

Yes, my long term target for Gold is $1800. But I doubt it's going to happen this year as there are far too many hurdles to overcome. We will have to wait to see what the nature of Gold's forecast Summer bull run is before we start fantasising about a breakout above $1400 to $1500 and beyond.

I am sure there are many gold bugs out there who will be crowing loudly about the breakout in the Gold price, loudly banging out gold bug mantra, as they will likely have been doing since the Gold price was trading as high as $1900. However, for a rational analyst with the Gold price trading at $1280 towards the end of May, it was just not possible to conclude that THIS time the Gold price would break above a 5 year old trading range resistance at $1370, the best one can do is to state that the Gold price is targeting an assault on $1370 that would set the scene for Gold's next bullish phase with targets of $1400, $1500 and $1800 beyond.

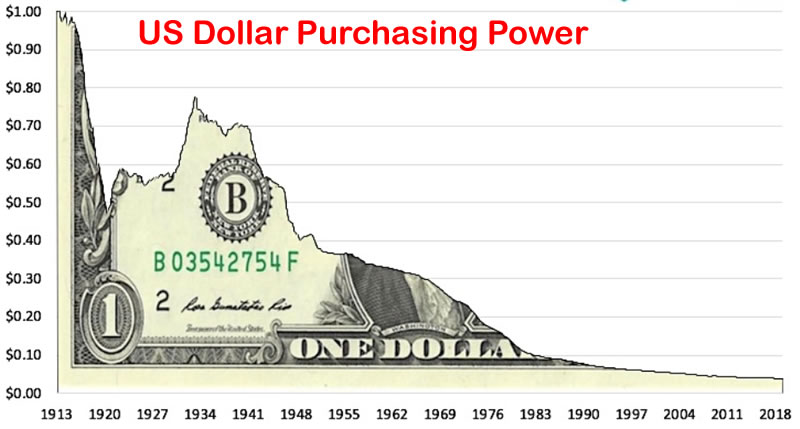

In attempts to explain the jump in Gold price, It looks like most have jumped on board the imminent cut in US interest rates wagon with likely the first cut next week. Is that really the reason for the jump in the Gold price? An expected 25 basis point cut in US interest rates? Gold is a limited supply commodity, an alternative for money, a hard currency so to speak because unlike fiat currencies it cannot be printed. And a reminder that the worlds central banks for the past 100 years have been busy printing money like there is no tomorrow. Resulting in all currencies being in a perpetual state of free fall against one another where exchange rate movements are just variations in the rates of free fall.

And THAT is the primary long-term driver for gold price, perpetual fiat currency money printing aka the Inflation Mega-trend.

Which is why my message for the past decade has been to leverage oneself to the inflation mega-trend by investing in assets that cannot be printed such as housing and yes certain stocks i.e. Google! (The Inflation Mega-trend Ebook - Jan 2010).

And THAT is the primary long-term driver for gold price, perpetual fiat currency money printing aka the Inflation Mega-trend.

Which is why my message for the past decade has been to leverage oneself to the inflation mega-trend by investing in assets that cannot be printed such as housing and yes certain stocks i.e. Google! (The Inflation Mega-trend Ebook - Jan 2010).

So should we surprised by the Gold price breakout ? No, it was inevitable, sooner or later, same for Silver, sooner or later we are going to see Silver take off on an even more parabolic trend trajectory than Gold (Silver Investing Trend Analysis and Price Forecast 2019).

GOLD BULL RUN TREND ANALYSIS

The rest of this analysis has first been made available to Patrons who support my work. Gold Price Breakout - Trend Forecast 2019 July Update

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis :

- Silver Forecast Update

- China Stock Market SSEC

- NASDAQ

- EuroDollar Futures

- Bitcoin Update

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- EUR/RUB

- Dow Stock Market Trend Forecast July 2019 Update

- Investing to Profit and Benefit from Human Life Extension AI Stocks and Technologies

And ensure you are subscribed to my FREE Newsletter to get my public analysis in your email in box (only requirement is an email address).

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.