When the US Bond Market Bubble Blows Up!

Interest-Rates / US Bonds Aug 16, 2019 - 01:45 PM GMTBy: Gary_Tanashian

Amazing isn’t it? It was only back in H2 2018 when everybody but you (because you are as smart as I think you are or because you read NFTRH or nftrh.com) and me was unbelievably bearish about the TREASURY BOND BEAR MARKET!!!

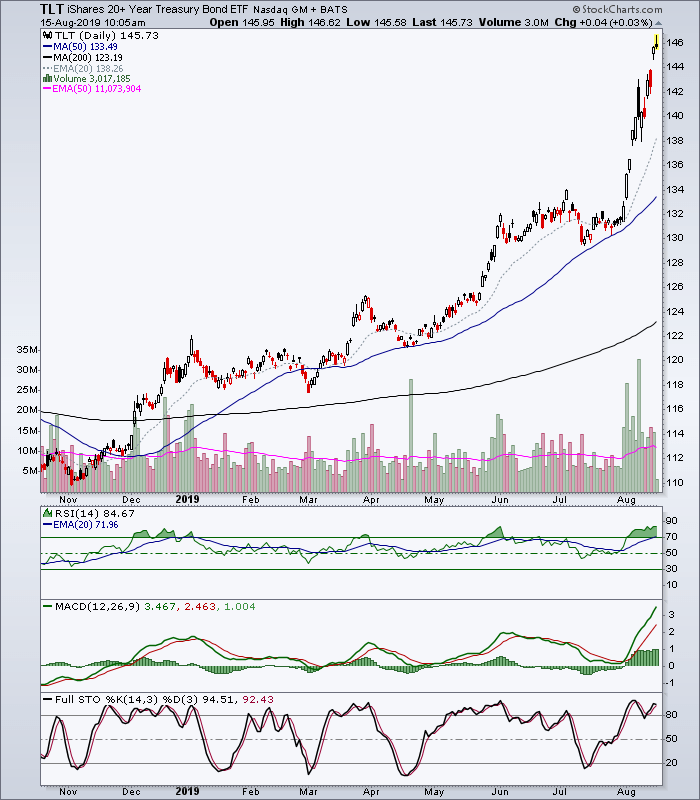

Today… not so much. The herd is absolutely pile driving bonds right now.

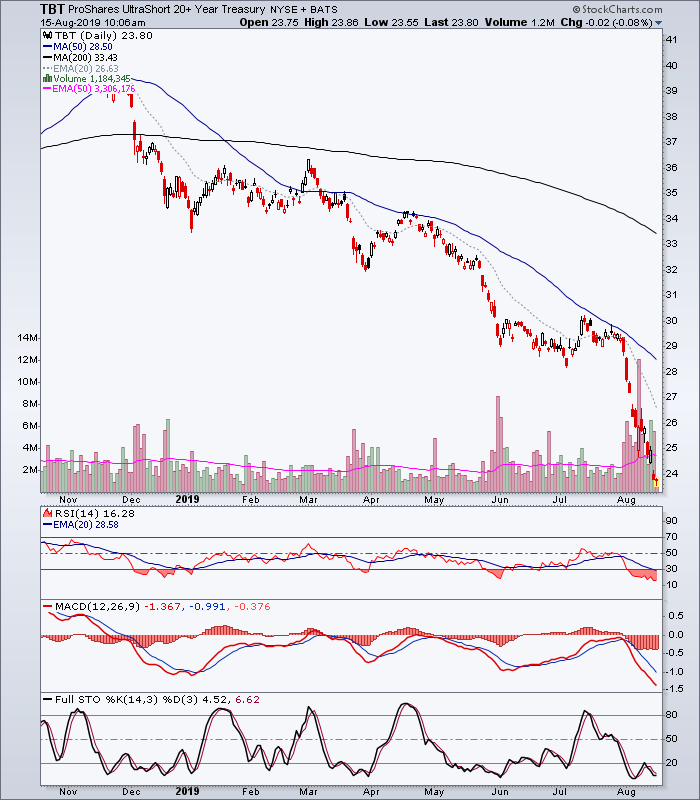

I know this all too well because while my SHY (cash equiv.) position is doing well it’s not anything like the above, and is basically – given relative position sizes – offsetting a position in this, which I am still holding with all the stubbornness of a pissed off contrarian.

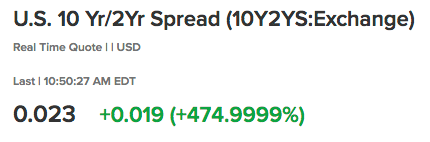

The two positions are part of my at least temporarily interrupted yield curve steepener. Hilariously the spread is up almost 500% today and just barely not inverted.

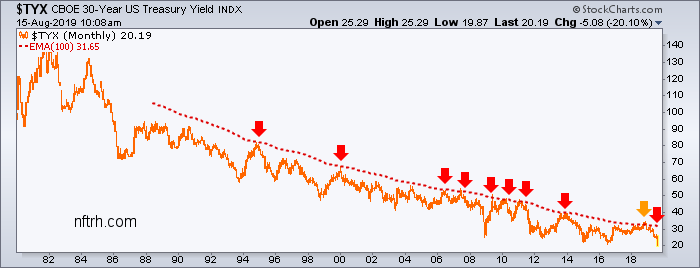

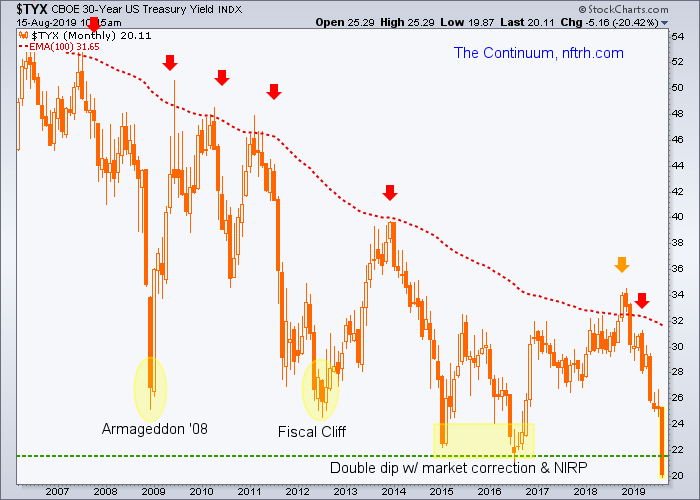

And so the Continuum continues downward.

Here, let’s magnify it so see what it actually looks like with respect to recent history.

While I am not a bond expert I do know that the 30yr US Treasury bond is the debt riddled Uncle Sam’s promise to pay and in mass herding into the long bond investors are seeking the safety of Unc’s good faith and promises. No seriously, this is the last time they are going to conspire to break the bank and spend well beyond their means.

Spend spend spend, Bush, Obama, Trump, Congress always… The chart above mentions the Fiscal Cliff, and I distinctly remember laughing at the hissy fit the markets were having with all the hand wringing about ‘will they or won’t they?’ continue to spend off the charts. Oh yes, right. They. Always. Spend.

Anyway, you’re buying bonds right now? You’re funding a spend-o-holic that just keeps adding layers of excess, talks some talk about fiscal restraint and then adds more layers… routinely and forever, until the thing rolls over, wheezes and exhausts itself… or until bond yields rebel.

Speaking of which, when – and it could still be a wait – the bond revulsion materializes, the herds clustering in bonds will be the food, the dupes funding the system yet again. A knock-on effect for me personally is that while the stock market is fairly bearish at the moment and could get more so (did you see FOX and CNN last night babbling on and on about the inverted yield curve as the cause of the market correction and its predictive powers about recessions?) this bond bubble makes me suspect of a hardened bear view on stocks.

If this is finally the great deflation, that’ll be one thing. But if it’s yet another inflationary operation in the making the gun is loading for yet another cycle. The Continuum has broken below all-time lows. Ooh, that’s scary. So is it real (deflationary crash) or Memorex (a shakeout of the inflationists before yields tear ass in the other direction with the force of a thundering herd breaking out of the slaughterhouse pen)?

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.