Risks to Global Economy is Balanced: Stock Market upside limited short term

Stock-Markets / Stock Markets 2020 Jan 20, 2020 - 05:50 PM GMTBy: Submissions

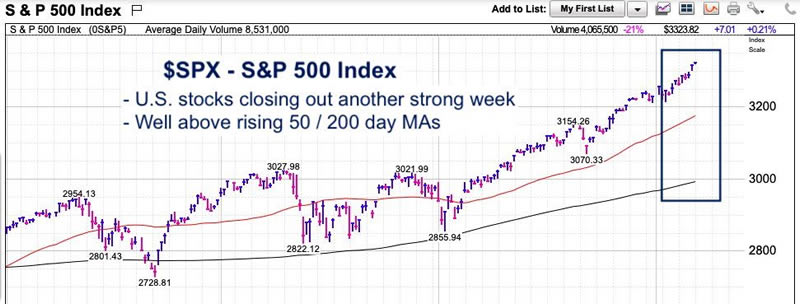

The US equity market has now risen more than 10% since the index broke the ascending triangle at 3025.

The short term sentiment is bullish thus we advise clients to exercise caution and move into cash by Jan end.

Markets Climb

S&P 500 closes a strong week higher. Many have argued that this is the blow off top. The lack of selling activity suggests that there is more to come as low volatility climb continues. Unless there is a correction 3% single day, we will not be interested in any selling yet.

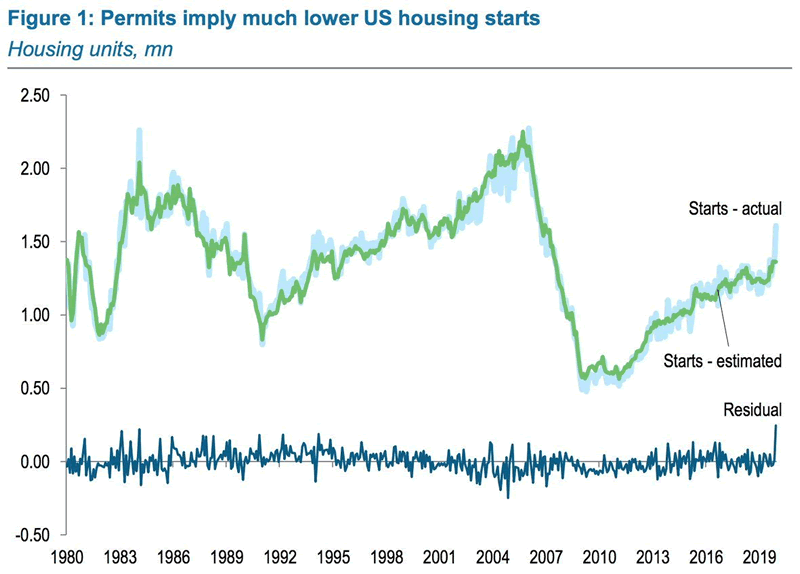

There was some good news on the real estate sector. New ground breaking surged, thus giving much needed momentum to the housing sector.

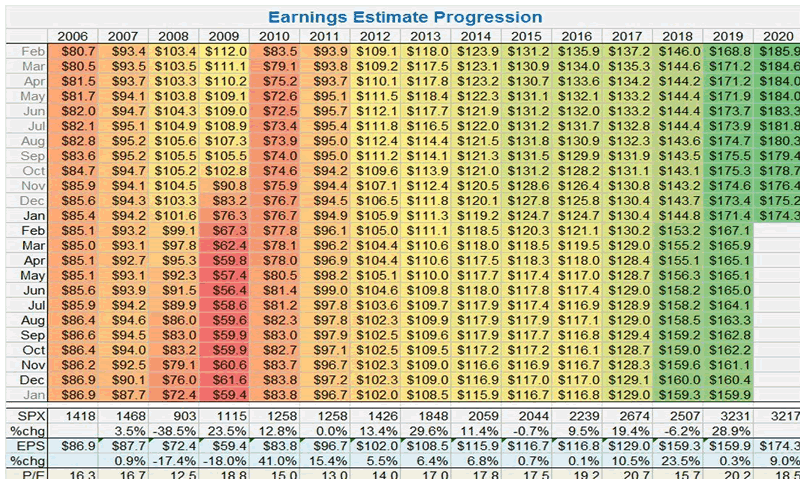

Earning Estimates

Earnings estimates have been higher and higher over the last 3 years thus feeding the global equity rush. The underlying economy though has started to slip as shown below.

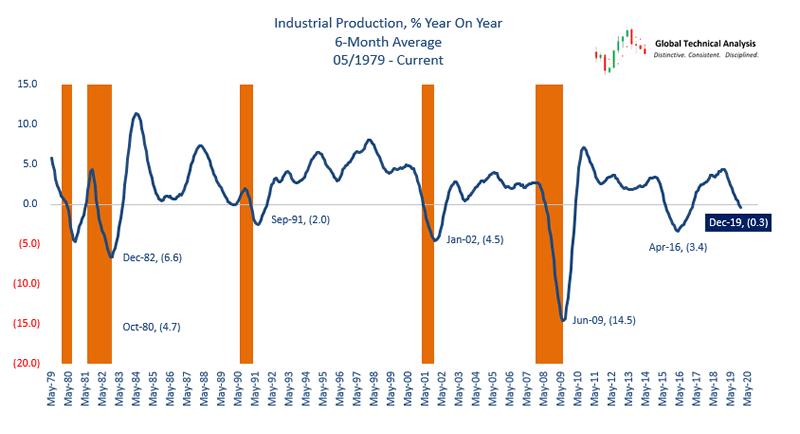

Industrial Production

The industrial production numbers were absolutely rotten to say the least. New orders plunged clearly suggesting the economy has entered into the winter. The stocks investors fed by crowding, ignores the ground reality. We suspect there is a reality check coming for equity investors world wide.

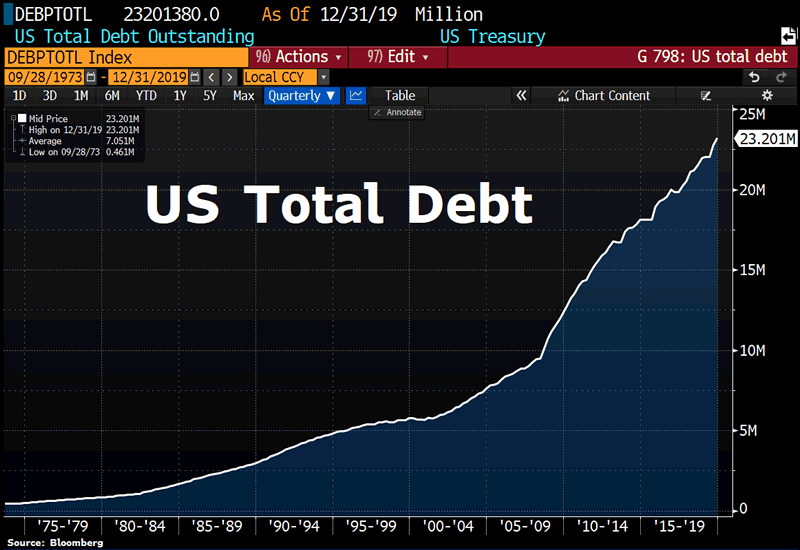

US Debt

The US total debt has now hit a all time high at 23.1 Trillion. This comes even as US treasury plans to issue new 20 year bonds.

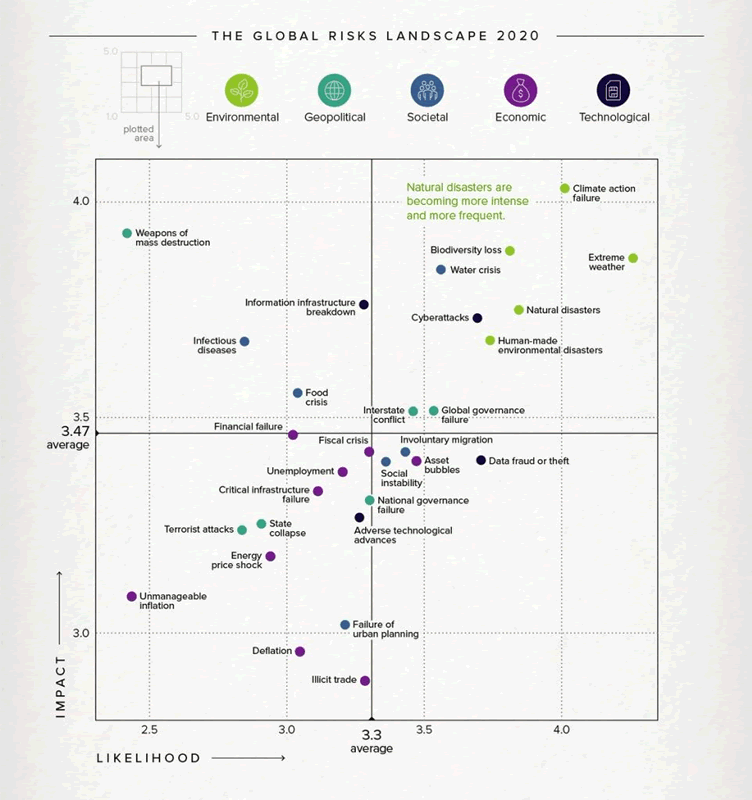

Global Risks

A scatter of global risks show concentration of inflation and deflation risks in the low likelihood and low impact category. However the asset bubble has now crossed into the higher likelihood segment. We note the emergence of a global governance failure as a high likelihood and high impact event which has emerged increasingly in Asian and middle eastern countries. Investors are advised to be aware of the risks going forward.

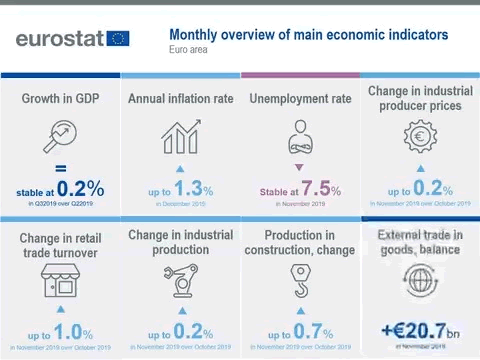

EUR area snapshot

EU area has been picture of mild stability going into the new year.

Managed Account

The Mehabe team runs the internet finest artificial intelligence trading system based on the Echo State Network. The system is high performance and our performance for current month is noted below.

The system is offered at a nominal cost. Read more of the Mehabe Guarantee.

All fees is backended that is at end of the month. LOW DD SYSTEM.

By Mehabe

About us:

https://Mehabe.om is a Artificial Intelligence driven quantitative investing firm offering managed account, tradecopier and custom tailored investing solutions for global clients. We have a history of industry leading performance.

Website: https://mehabe.com

Email : fundsupport@mehabe.com

Copyright 2020 © Mehabe.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.