Coronavirus Pandemic UK and US Second Waves, and the Influenza Doomsday Scenario

Politics / Pandemic Jul 08, 2020 - 07:34 PM GMTBy: Nadeem_Walayat

Three weeks ago I warned to expect an end to the trends of reducing number of deaths from covid 19 in the wake of black lives matters protests, lack of social instancing and winding down of lockdown's across the US and UK, where the only figure that actually counts in terms of the impact of the virus is in the number of deaths.

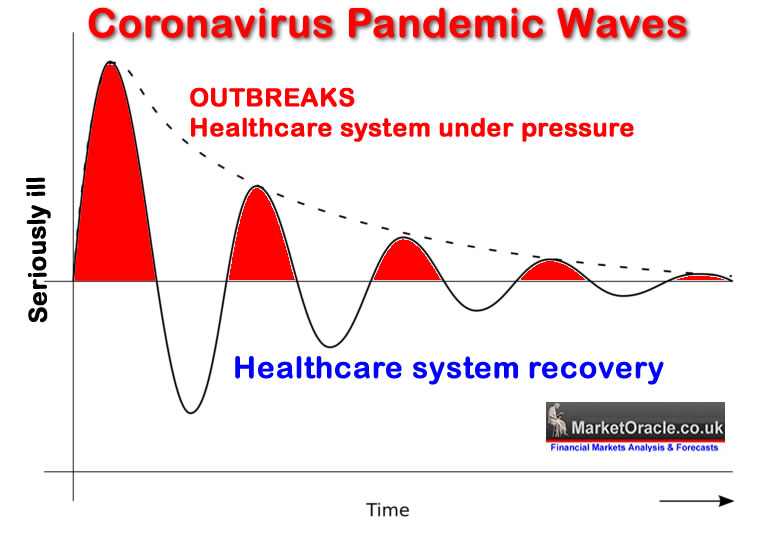

Whilst my analysis of Mid March warned to expect several pandemic waves where each subsequent wave 'should' be smaller than the one before due to increased institutional, governmental and individual intelligence on combating the virus..

So now 3 weeks on where do the trends towards a second peak stand. Have the UK and US blown all their hard work in containing the virus during the past few months or not?

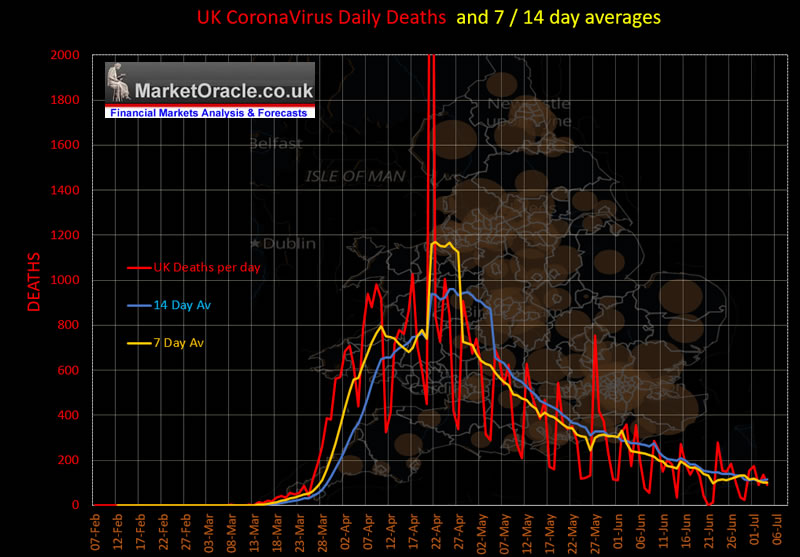

UK Covid-19 2nd Wave Status

Three weeks ago the 7 day average was 196, and the 14 day at 218. Current 7day av is 101, and 14 day at 113. So the UK so far has done well to sustain the downwards trend trajectory.

However, the UK celebrated it's 4th of July Independence from Covid 19 day when the people of Britain were free to congregate and get drunk in the pubs across the UK. Which will likely act like pouring rocket fuel onto the simmering covid-19 fire that I suspect will manifest in hospitalisations over the coming weeks and a sharp increase in the number of deaths about 3-4 weeks down the road.unless the Pandemic is now largely over and far more people have already contracted the virus and are now immune. So it will be illuminating to see where things stand a month down the road. If the 2nd peak in deaths materalises or not and if it does to what extent and to what degree treatments work.

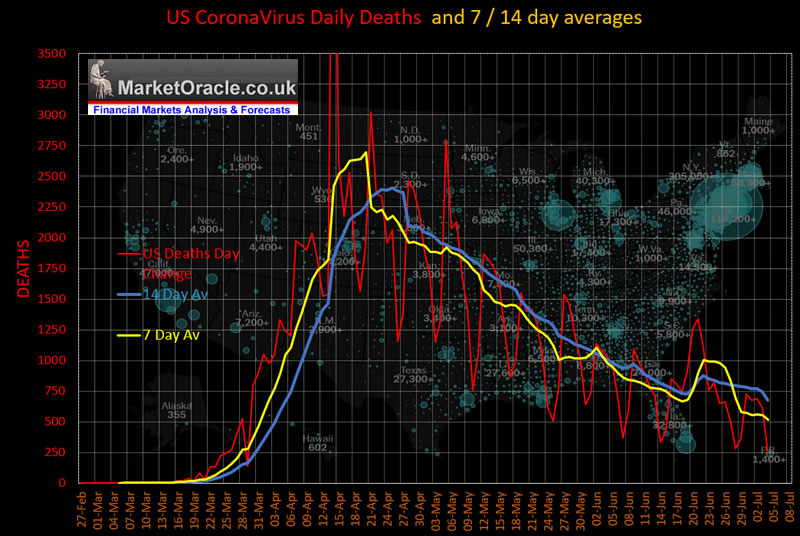

US Covid-19 2nd Peak Status

Apparently the Blue states have decided to hell with the virus and so the warned of spike is fast gathering pace in those states whilst the Red states continue to battle to fight the war against the pandemic and thus acting to average down the pandemic waves.

Three weeks ago the 7 day average was 835, and the 14 day at 970. Current 7day av is 516, and 14 day at 675. So the US deaths are still trending in the right direction after a blip Mid June.

However this could be the calm before the coronavirus storm as the US has seen a acceleration in the number of new cases over the past 3 weeks that now exceeds the number of new cases at the height of the pandemic. So suggests to expect a spike in the number of deaths towards the end of July. However which should be moderated to some degree due treatments that have been shown to work to reduce duration of illness and the mortality rate.

Doomsday Scenario

As the world combats coronavirus that most nations despite decades of warnings of a pandemic being inevitable still failed to prepare for. However, lost on most is that the Pandemic that we were all supposed to be preparing for was not of Coronavirus but a deadly of INFLUENZA! The risks of which have NOT gone away!

So the Doomsday scenario is that come Autumn / Winter 2020, the dreaded long expected Influenza pandemic materialises which once more sends the world's economies into a tails spin of death spikes, lockdown's led by a stock market deep discounting crash, though be forewarned that IF it happens, such a market crash would prove JUST AS TEMPORARY as that of the Corona Crash of March 2020! Especially as we have many more pieces of the jigsaw puzzle as to how governments would react i.e. print money on an epic scale! That populations are better trained to follow social distancing, face coverings and other r0 reduction strategies than was the case in March.

Cue again our Chinese friends - 29th June 2020 - Swine flu strain with human pandemic potential increasingly found in pigs in China

What the world doesn’t need now is a pandemic on top of a pandemic. So a new finding that pigs in China are more and more frequently becoming infected with a strain of influenza that has the potential to jump to humans has infectious disease researchers worldwide taking serious notice. Robert Webster, an influenza investigator who recently retired from St. Jude Children’s Research Hospital, says it’s a “guessing game” as to whether this strain will mutate to readily transmit between humans, which it has not done yet. “We just do not know a pandemic is going to occur until the damn thing occurs,” Webster says, noting that China has the largest pig population in the world. “Will this one do it? God knows.”

This article is an excerpt from most recent in-depth analysis How to Get Rich Investing in Stocks by Riding the Electron Wave that has been exclusively made available to Patrons who support my work.

- From a stocks bull market far far away

- THIS TIME IT'S DIFFERENT!

- Moores Law and the Inflation Mega-trend

- The Electron Mega-trend

- Investing in Stocks on an Exponential Trend Trajectory

- Eight Rules for Investing Stocks

- Machine Lifelong Learning

- Coronavirus Pandemic UK and US Second Spikes Plus the Doomsday Scenario

- Dow 30k before End of 2020?

- Black Lives Matter Protests To trigger 2nd Covid-19 Wave?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.