Gold Stocks Continue To Disappoint

Commodities / Gold and Silver Stocks 2020 Nov 01, 2020 - 12:24 PM GMTBy: Kelsey_Williams

Apparently investors don’t tire of hearing the same old thing; and their advisors willingly provide the same questionable advice: “The best way to play this new bull market in gold is to buy gold stocks” or something to that effect. Are gold stocks a better choice than golditself? Let’s find out…

Four years ago, in 2016, I wrote the following:

“This year’s turnaround in gold mining shares had helped to buoy the hopes and dreams of investors who were ‘betting’ that their long, agonizing wait for euphoric, exponential gains is over. They continue to believe that the future for the Gold Mining Industry is quite rosy. Unfortunately, they are probably wrong.” (see Gold Mining Shares Are A Lousy Investment)

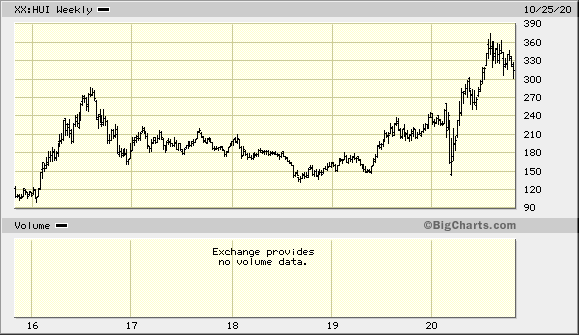

Just prior to that article being published, the HUI gold stock index had peaked at almost the 300 mark after tripling in price from the 100 level earlier that year in January.

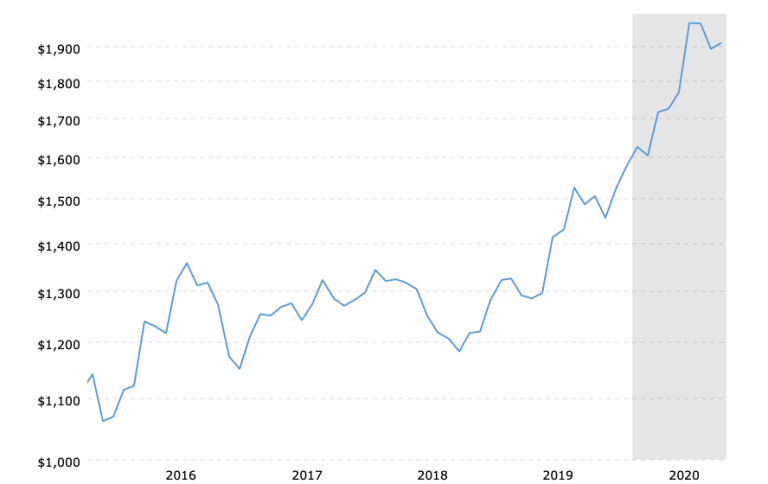

The rise in share prices of gold stocks outstripped the increase in physical gold prices quite handily. Gold, itself, rose from $1070 to $1370 for a gain of twenty-eight percent. That’s nice, but not nearly so nice as the two-hundred percent gain in gold stocks.

Below are two charts in succession. The first (source) is a five-year history of HUI prices; the second (source) is a five-year history of physical gold prices…

The gains for both gold stocks and physical gold from January – August in 2016 are apparent on the charts. However, the action from August 2016 forward tells us something significantly different from that which might have been expected.

Rather than any outsized gains for gold stocks, the mining shares have underperformed the yellow metal by a very wide margin. In fact, whereas gold over the past four years is up forty percent ($1370 to $1915), gold stocks re: HUI are up only about thirteen percent (290 to 328).

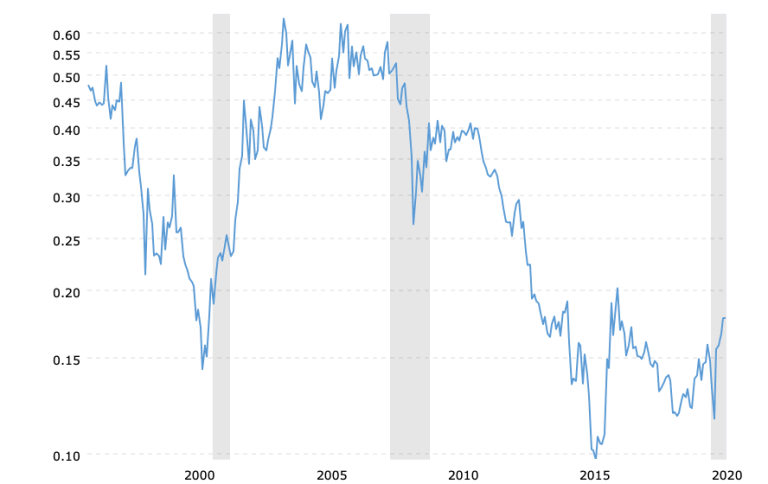

Gold stocks underperformance to gold should not be unexpected. It has been happening for decades and can be seen on the charts below. The first chart (source) is the HUI to Gold Ratio and dates back to 1996…

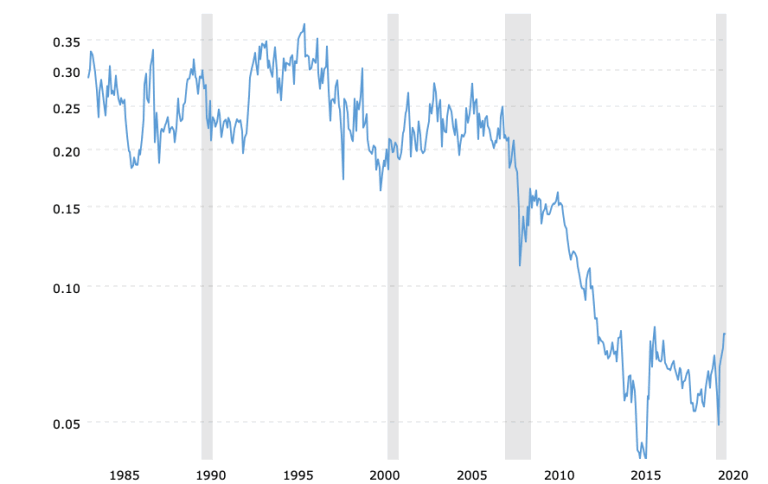

The second chart (source) is the XAU to Gold Ratio and dates back to 1983…

Most investors in gold stocks are not betting on the mining industry as much as they are betting on gold itself. They have invested in gold mining stocks because it is more convenient than owning the physical metal. They also think that owning mining stocks will lead to bigger gains as the price of gold continues to go up.

The logic goes something like this: Since mining costs are presumed to be relatively fixed and since the mining output is reasonably stable, a higher than expected gold price will bring higher profits even if production remains at the same level. The expectation of higher profits for the mine leads to the presumption of higher stock prices.

And, of course, if the price of gold continues to rise, then the profits can continue to rise, theoretically, in perpetuity. Unfortunately, it doesn’t happen that way; regardless of how logical it sounds.

Most of the biggest gains in gold stocks relative to gold bullion have come in a short period of time at the early stages of gold bull markets. You can see this on the HUI to Gold Ratio chart above for the period 1999-2003.

Other than that, the gold stocks to gold ratio has been in declining mode for most of the past four decades, ever since gold peaked in 1980. You can see this on the XAU to Gold Ratio chart above.

Even with the short-term gains in gold stocks relative to gold bullion between March and August this year, both gold stock ratios above failed to reach their previous high from August 2016 and remain today at near 40 -year lows.

At today’s prices, gold stocks are about fifty percent cheaper than they were in August 2011, while physical gold is at or near its peak from August 2011.

The price performance for gold stocks is antithetical to the purported advantages of owning them.

Gold continues to outperform gold stocks and does so with less risk. (also see: Gold Stocks vs. Gold – Not A Good Bet)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.