Gold Price $4000 – Insurance, A Hedge, An Investment

Commodities / Gold and Silver 2021 Jun 11, 2021 - 07:33 PM GMTBy: Kelsey_Williams

After decades of concerted effort by governments and central banks, the focus away from gold as money has led to its characterization as an investment, a hedge, insurance, etc. Some still refer to it as a barbarous relic. Are any of these descriptions valid?

GOLD AS INSURANCE

There is a seemingly plausible argument for calling gold a hedge or insurance given volatile conditions in our society today. But the logic leading to those classifications ignores the single factor that affects the price of gold. That single factor is the actual loss in purchasing power of the paper money substitute in which gold is priced.

Historic instances of extreme civil unrest, political instability and insurrection are most times associated with amplified concerns regarding the local fiat currency. A higher price for gold is a reflection of the cumulative deterioration of the currency in which it is priced.

It is especially important to remember this today. If you wake up some morning this fall and find that gold is priced at $4000 oz., it can only happen after the US dollar has lost additional purchasing power of fifty percent.

In other words, by the time gold is at $4000 oz., it will cost you twice as much for everything you need. You will need $100,000 per year to pay for what costs you $50,000 per year now.

This does not mean that further increases in the supply of money and credit are guarantees that the dollar will collapse or that its purchasing power will disappear overnight. (see Gold Price Is Not Correlated To Money Supply)

GOLD AS A HEDGE

As far as being a “hedge against inflation”, some clarification is in order.

- Inflation is the debasement of money by government.

- All governments (and central banks) inflate and destroy their own currencies.

What most people mean by the term ‘inflation’ are really the effects of inflation. Those effects are volatile and unpredictable. (People expected hyperinflation in the late 1970s and early 1980s. It didn’t happen. They expected it again after 2011. It didn’t happen. Similar expectations are voiced daily about the prospects for hyperinflation now. It is less likely now than before.)

Some say inflation is back and that it has returned with a vengeance; but inflation never went away. It is ongoing, continuous, and deliberate. (see Inflation – What It Is, What It Isn’t, And Who’s Responsible For It)

Gold acts as a restraint on government’s propensity to inflate its way to prosperity; or a central bank’s desire to create money in perpetuity that it can lend to all comers.

Gold is not immune to inflation, though. (See Mansa Musa, Gold, And Inflation)

GOLD AS AN INVESTMENT

When gold is characterized as an investment, the incorrect assumption leads to unexpected results regardless of the logic. If the basic premise is incorrect, even the best, most technically perfect logic will not lead to results that are consistent.

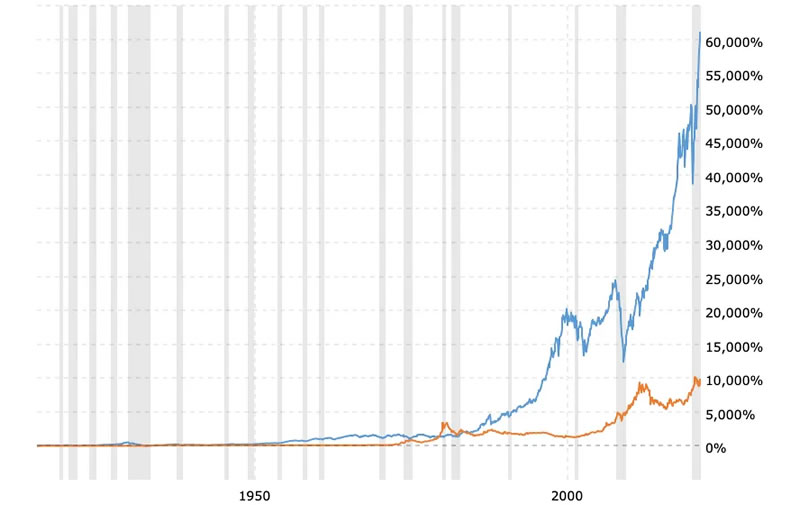

If we think of gold as an investment, then it’s not too hard to see why some might refer to it as a barbarous relic. As indicated in the chart (source) below, gold’s price performance when viewed as an investment is not strong enough to merit the consideration of most investors and financial advisors…

Gold Price vs Stock Market – 100 Year Chart

It is hard to argue favorably about gold’s merit as an investment when stocks have outperformed it by a margin of 6 to 1. That gap continues to widen dramatically in favor of stocks.

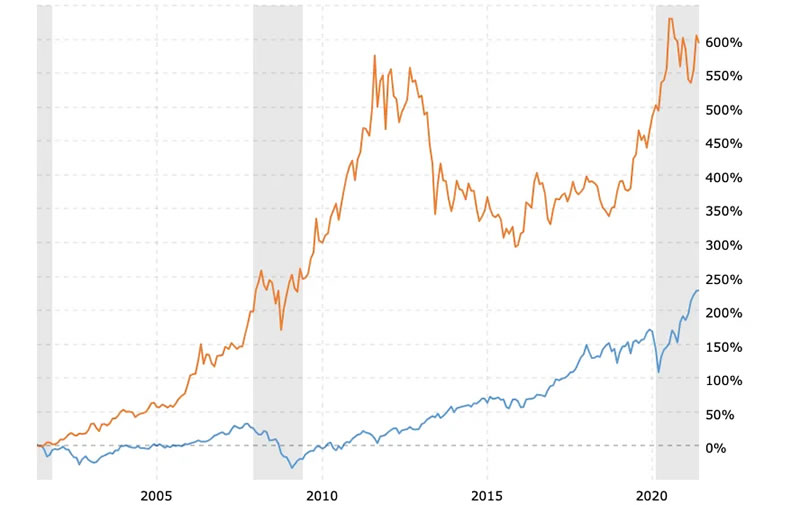

There is potential, however, for a more favorable view of gold as an investment when we look at the following chart…

Gold Price vs Stock Market – 20 Year Chart

As can be seen, it has been more profitable to hold gold rather than stocks for the duration of the 21st century. But that is somewhat misleading since the ratio turned in favor of stocks again after gold peaked in 2011. See the chart below…

Gold Price vs Stock Market – 10 Year Chart

Quite plainly, stocks have reasserted their deserved role as a preferred long-term, buy and hold investment. Over the past decade, stocks have outperformed gold by a 9 to 1 margin.

That really is as it should be; at least insofar as gold is concerned. That is because gold is not an investment. It is real money; original money.

Holding gold rather than stocks is similar in theory to selling stocks and holding cash. Cash is preferable for shorter periods. Gold is a better option for longer periods because its rising price will compensate for the continuous decline in the US dollar.

Don’t impute any value to holding gold other than its use as real money. If you want the potential investment returns of stocks, then buy stocks.

The use of strategy and timing involving gold does not change its characteristics. And a profitable trade in gold is not indicative of any special considerations regarding gold’s investment value. There are none. (see Gold’s Not An Investment – You Won’t Get Rich).

SUMMARY AND CONCLUSION

- Gold is real money – original money. Gold’s higher price over time reflects the cumulative loss in purchasing power of the US dollar.

- Gold is not an investment and it is not forward-looking. Higher gold prices at this point in time will come only after a further, significant loss in US dollar purchasing power is evident in fact; not in theory. Sometimes that takes several years, maybe decades. (think 1980 -2008; and 2011-2020)

- Gold is not a hedge against inflation. Inflation is the intentional debasement of fiat currencies by governments and central banks to suit their own purposes. Owning gold helps to compensate for the loss of purchasing power which occurs as a result of that inflation.

- If a complete breakdown in the US dollar occurs, the price of gold in dollars will skyrocket. So will the price of everything else we buy and sell. If you own gold before a dollar collapse, then your gold will maintain its purchasing power. The higher dollar price per ounce will offset the higher prices you pay for everything else – just to survive.

(The Exness review is here.)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.