Why Amazon, Google and Netflix Are Fighting Over this Rare Gas

Companies / Energy Resources Jul 12, 2021 - 12:06 PM GMTBy: Submissions

Big Tech may be in for a major crisis in the coming months, all because of a global shortage virtually nobody’s talking about.

And it has nothing to do with the shortages we’ve seen worldwide in everything from computer chips to lumber to chicken wings.

This supply squeeze runs far deeper and has the potential to crush major blue-chip companies if the situation doesn’t dramatically improve soon.

That’s because Big Tech companies like Amazon, Alphabet, Facebook, and Netflix all depend on this one gas to keep their servers up and running around the clock.

Helium - which is both abundant, yet extremely rare - has unique properties that make it the perfect fit for creating the technology that’s become a part of our daily life.

It’s responsible for helping create today’s cars, bringing you high-speed internet cables, and even building the device you’re reading this on right now.

The health sector is in desperate need of this gas too since it’s needed to cool the magnets inside of MRI machines.

In fact, it’s such a crucial piece of so many different industries that helium has even been identified as one of 35 minerals deemed critical to the United States’ national security.

That’s why it’s so devastating that supply has taken a complete nosedive recently.

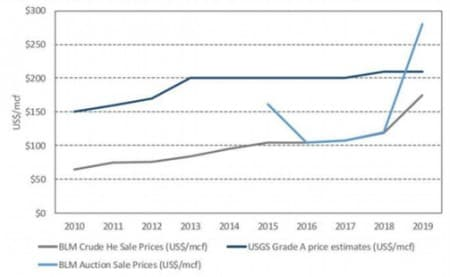

As a result, it’s caused the price of the rare gas to increase more than 3x in recent years… And it seems to be soaring higher by the day.

Source: Bureau of Land Management, USGS

The supply crunch has helped junior producers, like Avanti Energy Inc. (TSXV:AVN; OTCMKTS:ARGYF), to raise over $100 million across the industry over the last year.

It’s also sent share prices parabolic for an average of 500% gains across these producers.

And Avanti Energy could be the next fast-mover after their latest potential discovery in the center of the world’s biggest helium market.

High-Grade Discovery Found in the Heart of Helium Country?

With the demand for helium continuing to rise and the world’s biggest supplier in the industry moving out, it’s created the perfect recipe for a boom for small helium producers.

And Avanti Energy (TSXV:AVN; OTCMKTS:ARGYF) just made a major announcement that has the potential to make them a huge player in the United States market.

Their world-class team just announced that they’re working to acquire the helium rights to approximately 62,000 acres of land in Montana.

The land stands in an area where surrounding wells have shown incredible findings, which points to the potential for big discoveries in the region.

Experts generally consider anything from 0.3% to 1% Helium percentages to be commercially viable.

But their neighbors have shown grades of up to 2% Helium and 96% Nitrogen in multiple targets nearby.

And now, Avanti Energy has discovered several closed structural highs reaching up to 170m of relief on the property for which they’re set to acquire a license.

After doing a detailed analysis of both the property and the surrounding area, they were so confident in what they saw that they offered to buy licenses for roughly 50,000 acres of land.

That makes it nearly 5x the size of their entire land portfolio before the acquisition of the license. And it speaks volumes coming from this team given their track record of major discoveries.

Several key members of Avanti Energy’s management team were responsible for spotting and developing Encana/Ovintiv’s Montney production.

As that discovery has produced over 300,000 boe/d over the past decade and a half, it’s become one of the largest natural gas discoveries in North America.

And now, with insiders buying more shares in Avanti Energy (TSXV:AVN; OTCMKTS:ARGYF) throughout the last two months, it suggests a high level of confidence in their prospects as they continue to grow their land portfolio.

But while many aren’t yet aware of the looming helium crisis, potential discoveries like these could be crucial for Big Tech and other major blue-chip companies in the near future.

Supply Squeeze Putting Big Tech in a Pinch

Avanti Energy’s recent announcement could have tremendous implications as we’re in the middle of the biggest supply squeeze we’ve seen in years.

And it’s all surrounding a chemical that the entire world relies upon as more and more of our world goes digital.

Without sufficient helium for these companies, it could mean no internet, no computers or cell phones, no computer chips for the latest vehicles, and no MRIs for those who desperately need them.

But today, the gas is running out with no replacement in sight. And it’s all about to get much worse in September.

For over seven decades, the US Federal Helium Reserve (FHR) has provided roughly 40% of the world’s helium supply.

The supply has been slowly dwindling for years… And in September, the Bureau of Land Management (BLM) is set to auction off the rest of the helium to the private markets.

That could send helium prices sky-high as it will lift the price ceiling that’s in place today...

This is why with helium demand now set to outpace supply until at least 2025, the race is on for junior helium producers to make new discoveries to even the score.

Adding to a Fast-Growing Land Portfolio

Avanti Energy (TSXV:AVN; OTCMKTS:ARGYF) just broke the news that they’re planning to acquire a license for 50,000 acres of land prospective for high-grade helium in Montana.

This is coming just a few months after they added another 9,500 acres across the border in Alberta, Canada.

Like the newest addition, this Canadian property also has promising data behind it and brings their total land holdings to over a massive 75,000 acres today.

But they’ve also identified roughly 20 more properties they may target across Alberta, Saskatchewan, and Montana over the coming months.

Avanti Energy has been on a tear adding up properties lately, and that gives them the potential to build a long-term pipeline of opportunities and projects.

Beacon Securities Limited has already stated they believe “critical mass has been achieved” for Avanti Energy today though.

And they’ve called this new property in Montana a key asset for the world-class team to begin exploration.

The acquisition will not close until the team completes their due diligence on the land and ownership.

The potential for this junior producer is incredible given the size of their holdings, but at the moment, shares are trading at less than $3.

While it’s still early in the game for Avanti Energy (TSXV:AVN; OTCMKTS:ARGYF), the upside potential for this junior is remarkable.

And if results are positive for their upcoming exploration programs, they could play a key role in tackling the supply squeeze of the century as helium prices continue to rocket higher.

By: Jessica Thiel

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Avanti Energy Inc. (“Avanti” or “AVN”) to conduct investor awareness advertising and marketing. Avanti paid the Publisher to produce and disseminate four similar articles and additional banner ads at a rate of seventy thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Avanti) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries (including key technology sectors) and that helium will retain its value in future due to the demand increases and overall shortage of supply; that Avanti can pursue exploration of the recently acquired licenses of property in Alberta; that Avanti’s licenses in respect of the Alberta property can achieve drilling and mining success for helium; that Avanti will be able to acquire the rights to helium on the 12,000 acres of land in Montana pursuant to its recent letter of intent announced on April 16, 2021, and the helium rights to the ~50,000 acres of land in Montana pursuant to its recent letter of intent announced on June 14, 2021; that the Avanti team will be able to close on the aforementioned Montana helium license acquisitions; that the Avanti team will be able to develop and implement helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist in the Alberta and both Montana projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; that the Company may not fulfill the requirements under its Alberta licenses for various reasons or otherwise cannot pursue exploration on the project as planned or at all; that the Company may not be able to acquire the helium rights to the Montana lands as contemplated in the letter of intent or at all; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.