Bitcoin Halvings Price Forecast and Stock to Flow Analysis

Currencies / Bitcoin Jul 18, 2021 - 05:16 PM GMTBy: Nadeem_Walayat

This is part 2 (part 1 Investing in the Tulip Crypto Mania 2021) of my extensive full spectrum analysis of the crypto markets, of what I expect to happen over the next 6 months in terms of a Bitcoin price trend forecast, and the strategy I am deploying to capitalise on as well as 5 potential black swans that could collapse the crypto markets where Stable Coins such as USDT are what could be imminent catalysts for.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

Topics covered in this analysis:

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

The whole this extensive analysis has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

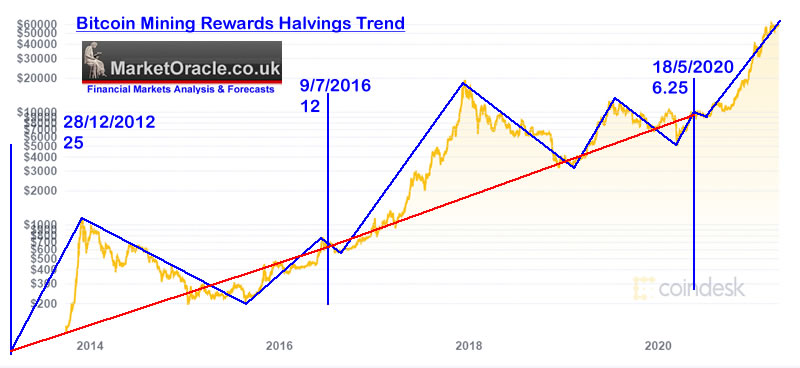

BITCOIN HALVINGS TREND TRAJECTORY

The supply of bitcoin is capped at 21 million coins. Imagine what would happen to the price of Gold if no more Gold could be mined, that's the trend trajectory that Bitcoin appears to be on i.e. there will come a time when NO MORE bitcoin can be mined!

So the simplest thing to do would be to to buy bitcoin when cheap and forget about it for a decade or so and then likely see a return of X10 that which one paid for it.

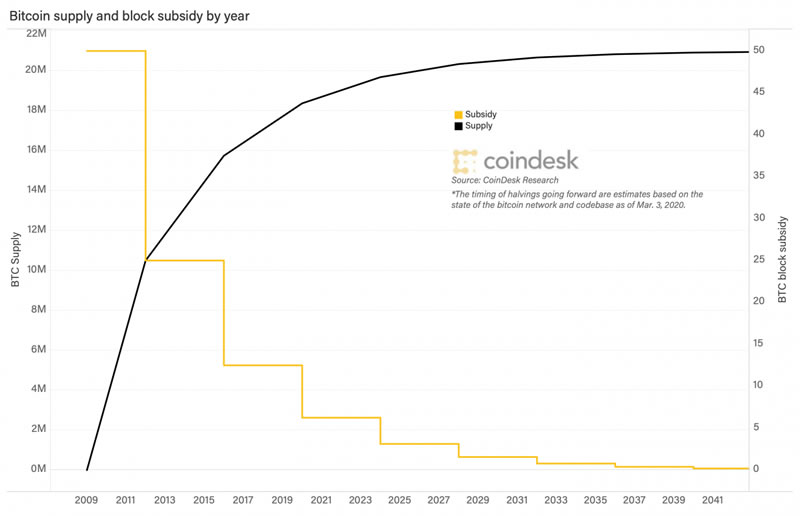

Total bitcoins mined to date number 18,700,000, 210,000 blocks will be mined from May 2020 to roughly March 2024, totaling 1.3 million bitcoins, which implies a total of 20 million bitcoins by the time of the next halving of rewards for miners to 3.125 bitcoin rewards per block mined (block rewards to miners is how the block chain works).

Which implies by 2028 to expect the bitcoin supply to increase by only 656,000 to roughly 20.65 million, then what? the next 4 years to 2032 will see only 328,000 new bitcoins produced that will take the supply to very close to the 21 million limit.

What this means is that price for transacting in Bitcoins is going to continuously become more prohibitive in terms of transaction fees in response to which bitcoin developers are developing layers on top such as the Lightening Network by doing transactions OFF the block chain, much as exchanges such as Coinbase seek to do i.e. transactions between other exchanges incur block chain transaction fees.

What this implies is that Bitcoin is going to gradually start to seize up both in terms of supply and demand, i.e. miners won't be able to generate rewards and fees to cover their hardware costs and those who transact in bitcoins won't be able to afford the transaction fees.

So how will the Bitcoin developers square this round peg?

By Wrapping Bitcoins into other crypto's namely Ethereum as one solution currently being implemented so most of the transactions will take place off the block chain which then risks the creation of fiat Bitcoins! Which is probably already happening to limited degree. FIAT BITCOIN!

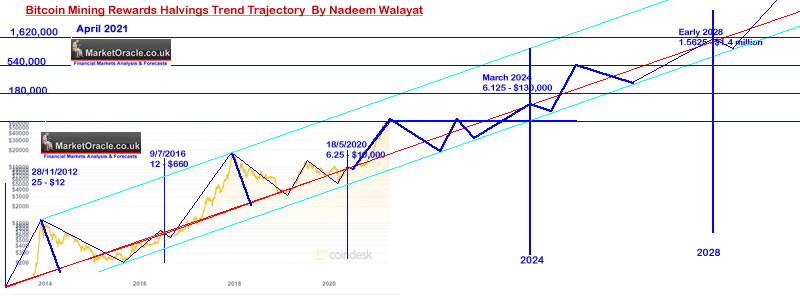

Clearly I am going to have to do a lot more pondering to try and divine what happens as Bitcoin approaches that 21 million limit. Perhaps developers decide to break all the rules and increase the supply of bitcoins, after all it is just code that can be reprogrammed if enough bitcoin holders agree to the change to implement it. Still in the meantime it appears that Bitcoin is on an inevitable long-terms upwards curve that gets accelerated around each halving of miner rewards, hence why so many are bullish about bitcoin in the long-run as the fundamental pattern for the bitcoin price is to surge higher following each halving in miner rewards at each 210k blocks mined with roughly the next halving due around March 2024 and then Mid 2028 that resolves in the following pattern.

Key points

- Bull market in advance of the halving of about 1 year.

- Bull market after halving's of about 1 year, as we experienced Since the May 2020 halving.

- Bear markets to the previous halving's bull market high so targets $20k

- Next halving at approx $130k

- Next Bull market could peak at between $500k and $600k

- 2028 Halving at approx $1.4 million.

Jeepers creepers! Can this pattern really continue as is ? Usually the more often a pattern repeats the more likely it is to fail next time as too many people will be expecting it to repeat.

What I expect to eventually happen is that Bitcoin hits a ceiling where it could remain stuck below for decades. Now the big question mark is where will that ceiling price be? Let's hope it's not already happened at $65k! Remember folks, in 1980 when Silver hit $50, where do you think precious metals investors thought Silver would trade to in future bull markets? I'd imagine a lot higher than $50!

Anyway before we all rush out and buy bitcoin, there is still the bear market to contend with which on face value implies $20k is probable.

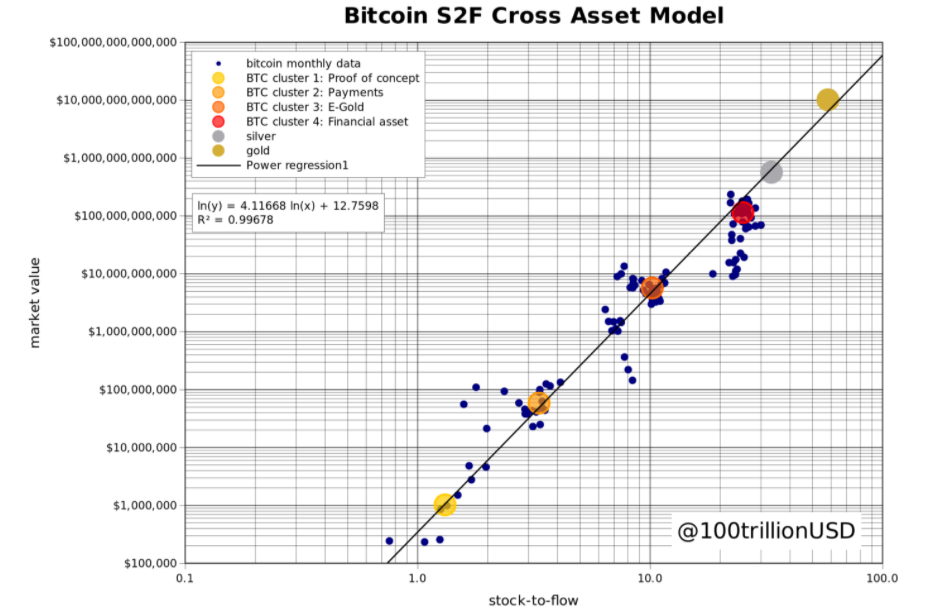

Stock to Flow Infinity and Beyond!

Once you venture into the realm of bitcoins future prospects then you are pretty soon going to be presented with Stock to Flow model projections. Which is basically how many years will it take for new annual supply of bitcoins to cover total available supply of bitcoins and what it suggests for future pricing given that Bitcoins future supply is reducing with each halving.

The stock to flow model suggests Bitcoin hitting $1.3 million during late 2025, sounds possible given what we have already seen happen but continue along this curve and we get to Bitcoin valued at $325 billion PER coin by 2045! Seriously, $325 billion per coin! In that case buy 1 Bitcoin at $40,000 today and then in 20 years time be richer than Jeff Bezos is today! This is what happens when people swallow their own hype. Clearly the stock to flow model is a load of crypto BS, not worth wasting any more time on.

Bitcoin, Crypto's and the Inflation Mega-trend

Where's the link? I don't see it. Which to me suggests that right now and maybe well into the future bitcoin and the rest of the crypto's are basically play money, outside of that which is leveraged to the Inflation Mega-trend. Akin to pyramid schemes where those who create and invest in the coins at start and hoard a large percentage of the coins basically can reap huge rewards the converse is that someone's got to lose and that's the Johnny come lately crypto traders and investors who have been convinced by hype that crypto's are the best thing since sliced bread.

I am not seeing a link between the real world i.e. the Inflationary mega-trend and Crypto's, so I treat crypto's as play money, yes I am mining which is giving me FREE crypto's, which at the current rate of exchange is FREE money. As long as I get a decent amount of free money for the inconvenience of the cooling fans running a little louder than normal then I will continue mining, and spending what the mining yields. But I am wary of investing in crypto's, because they are pyramid schemes.

You see the thing about stocks such as Google, Microsoft and Amazon is that I am pretty confident that any drop in stock price will be temporary because these corporations are growing their revenues and profits. With the likes bitcoin there is NOTHING there! Other than being charged GAS fees whenever one transacts in the crypto which for bitcoin is about $60 and $160 for Ethereum. and they call this a currency? Imagine going to buy a $5 cup of coffee and getting charged an extra fee of $xx, that's what it's like trying to transaction in Ethereum right now.

Today's get rich craze are crypto currencies, what will it be tomorrow? Probably something linked to climate change.

BITCOIN BLACK SWAN EVENTs

1. Will Crypto's Get Banned?

The rest of this extensive analysis has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

Including access to most recent extensive analysis evaluating the prospects for a Financial Crisis 2.0 - Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH!

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

My analysis schedule includes:

- AI Predicts Valuations for AI Stocks 3 Years Aheads.

- More X10 Biotech Tech Stocks - 60% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.\

And lastly a probable Black Swan Worse than the Pandemic!

Your biotech stocks investing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.