Post-Covid Stimulus Payouts & The US Fed Push Global Investors Deeper Into US Value Bubble

Stock-Markets / Financial Markets 2021 Jul 21, 2021 - 06:04 PM GMTBy: Chris_Vermeulen

In this second part of our research into how capital is being deployed across the globe and why traders/investors continue to pour capital into the US equities markets, we’ll explore how the US major indexes have reacted to the continued investments by the US and foreign investors compared to foreign market trends.

Using methods like this to determine where capital is being allocated and why traders/investors decide to move capital into and out of various global indexes, suggests one of the most important aspects of swing trading is to stay keenly aware of how capital is moving and deploying across the globe.

In October of 2019, we attempted to highlight how capital is shifting and how trends are setting up in currencies, global major indexes, and other global sectors.

October 17, 2019: CURRENCIES SHOW A SHIFT TO SAFETY AND MATURITY – WHAT DOES IT MEAN?

While reviewing our past research posts, we found this one particularly interesting because it was posted only 4 months before the COVID-19 peak and indicated our long-term predictive modeling system suggested a volatility surge may take place in late 2019 or early 2020.

October 29, 2019: LONG-TERM PREDICTIVE SOFTWARE SUGGESTS VOLATILITY MAY SURGE

Even though our predictive modeling system can’t attempt to predict unknown outside global events, like COVID or wars, it can make some really uncanny and accurate predictions related to price activity and volatility in the markets that come true.

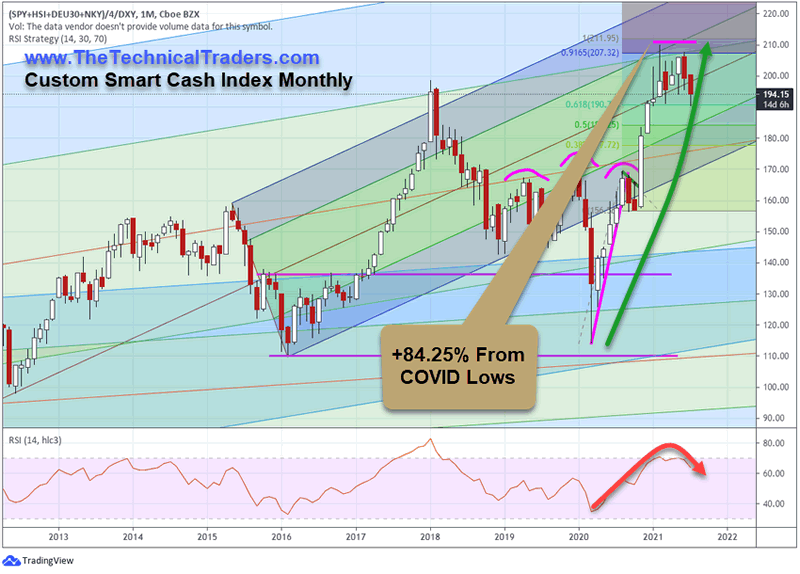

Global Custom Smart Cash Index Continues To Flatten

This first chart shows our Custom Global Smart Cash Index Monthly Chart. The point we want you to focus on with this chart is the sideways and weaker price action over the past 6+ months as well as the +84.25% rally from the COVID lows.

This chart reflects a fairly even and global response by traders after the March 2020 COVID lows to expect a global reflation rally bringing global indexes back up to the pre-COVID-19 peaks. In this case, that rally phase completed by September/October 2020. After the November 2020 US elections, a second rally phase was initiated that pushed the Custom Global Smart Cash Index to recent highs (near $210). These current highs represent a new high price valuation level, even higher than the 2018 peak levels, which suggests that large amounts of capital shifted back into the global markets after the November 2020 election.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Currently, though, this chart shows a broad sideways weakening price trend that may suggest an early stage peak has setup – similar to the peak in 2018. As capital seems to be fleeing the global market indexes and sectors, it is likely to move away from risks related to this inflated secondary rally phase and into assets that provide better safety and security.

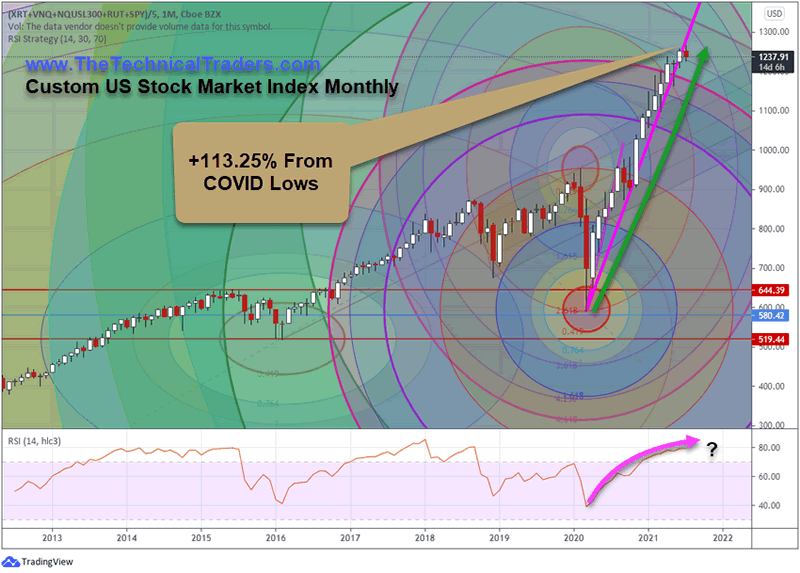

Custom US Stock Market Index Chart Shows A +34.42% Greater Rally Than Global Index

This second Custom US Stock Market Index chart shows an incredible rally phase after November 2020 that includes an additional +34.42% extended rally to the current $1266.42 highs. Comparatively, the Custom US Stock market index, which includes the NASDAQ, Russell 2000, SPY, Real Estate, and Retail Sales, highlights the incredible strength and resilience of the US economy and consumer over the past 12+ months. While the Global Custom Index has stalled over the past 6+ months, the US Custom Index has rallied an additional 13.5% higher.

At this stage of the rally, though, we need to see the Custom US Stock Market Index find support above the May 2021 lows, near 1164.38, and attempt to setup a new momentum base for any further upside price trending. The fact that the Global Custom Index is weakening while we’ve seen a fairly broad breakdown in commodities and the Russell 2000 recently suggests this extended rally may be pausing.

Normally, price moves in a rotational manner setting up new peaks and troughs as it trends. Recently though, the continued stimulus and global central bank actions have prompted a type of rally that we’ve not seen in many years – a hyper speculative rally based on expectations of very strong economic and recovery trends. As this phase of the post-COVID rally phase completes, the next phase may be much more difficult for traders to navigate going forward.

Post-COVID Recovery Cycles Will Change How Capital Seeks Opportunities In The Future

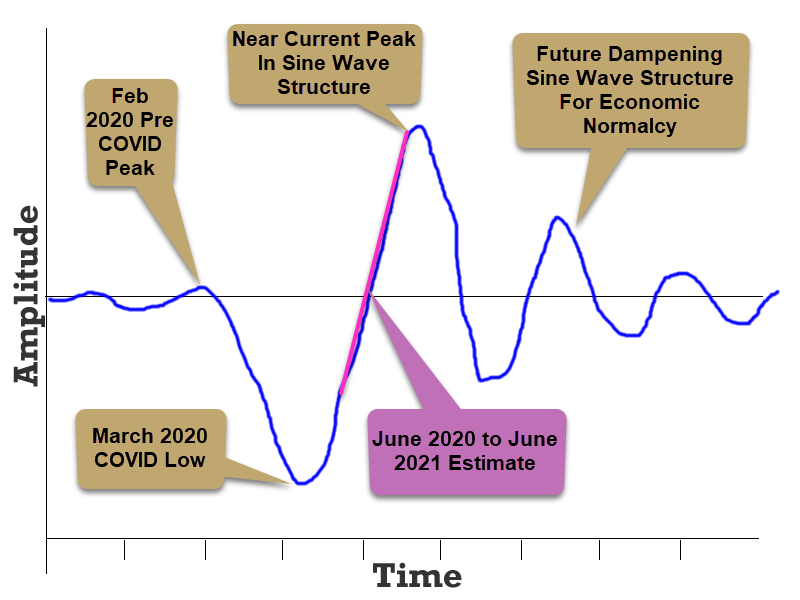

Recently, I shared a new research article related to the “Transitory Inflation” expectations that have been stated by Jerome Powell, and others, and how traders need to prepare for fairly broad rotations in the recovery data over the next 12 to 24+ months.

I strongly believe the global markets are going to contract into a sideways, slightly downward trend before the end of 2021 in alignment with the post-COVID cycle phases. Over the next 8+ months, my analysis of these phases suggests we will start to see weaker economic data, weaker consumer engagement, and eventually, the potential for another round of moderately negative economic data as the Month-over-Month and Year-over-Year data transitions into lower/weaker representation of the cycle phase (see the chart above).

Given the amount of capital deployed throughout the globe and within the US equities markets, this may prompt a series of fairly large price rotations over the next 18 to 24 months (or longer) and may not settle until after 2024. What the global central banks do, or don’t do, over the next 24+ months could compound these cycle phases and trends.

More than ever, right now, traders need to move away from risk functions and start using common sense. There will still be endless opportunities for profits from these extended price rotations, but the volatility and leverage factors will increase risk levels for traders that are not prepared or don’t have solid strategies. Don’t let yourself get caught in these next cycle phases unprepared.

Want to know how our BAN strategy is identifying and ranking various sectors and ETFs for the best possible opportunities for future profits? Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

From all my decades of experience, I can tell you that unless you have a solid foundation related to knowing when and where opportunities exist in market trends, you are likely churning your money in and out of failed trades. I will be presenting my two favorite strategies at the July Wealth365 Summit on July 13th at 4 pm and July 16th at 12 pm. The Summit is free to attend and offers unparalleled opportunities for learning…plus a potential prize or two!

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.