The Bank of Canada Ends QE, Plunging Gold Prices in CAD

Commodities / Gold and Silver 2021 Oct 31, 2021 - 04:24 PM GMTBy: Arkadiusz_Sieron

So, QE ended (so far in Canada, but the Fed will follow suit) and the termination plunged gold prices in Canadian dollars. Will this repeat globally?

Finally! Yesterday (October 27, 2021), one central bank ended its quantitative easing program after gradually reducing the pace of asset purchases earlier this year. Don’t panic though - it wasn’t the Fed, nor the ECB, nor the Bank of Japan. It was the Bank of Canada. As we can read in the monetary policy statement:

In light of the progress made in the economic recovery, the Governing Council has decided to end quantitative easing and keep its overall holdings of Government of Canada bonds roughly constant.

Of course, the central bank didn’t say a word about a reduction of the size of its balance sheet. This is how the dovish bias works: central banks never return to the pre-crisis levels of interest rates or balance sheet. Anyway, I would like to focus on the fact that the central bank of Canada admitted that it underestimated the persistence of inflation, which could remain elevated next year:

The recent increase in CPI inflation was anticipated in July, but the main forces pushing up prices – higher energy prices and pandemic-related supply bottlenecks – now appear to be stronger and more persistent than expected.

More persistent and higher inflation implies sooner monetary policy tightening. The BoC signaled that it could hike its main policy interest rate in mid-2022:

We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In the Bank’s projection, this happens sometime in the middle quarters of 2022.

The direct consequences of the Bank of Canada ending QE should be limited, as the BoC’s actions are not too meaningful for the global financial markets. However, yesterday’s decision is emblematic of the current shift among central banks from monetary easing into monetary tightening. Investors should be thus prepared for more persistent inflation and for a hawkish response of central banks.

Interestingly, while the BoC has just completed its asset purchases program, the Fed is only going to start tapering its own quantitative easing program. It means that the US central bank is tardy and behind the curve (especially that inflation in Canada is lower than across the border). So, its reaction will have to be stronger in the future. The market expects the first hike in the federal funds rate to happen in June 2022, so also in the middle quarters of 2022, despite the Fed’s one-year lag behind the Bank of Canada.

Gold may struggle until the Fed’s tightening cycle starts. You have been warned!

Implications for Gold

What does the end of Canadian quantitative easing imply for the gold market? Well, the direct impact on gold prices denominated in greenbacks should be minimal. However, the decision to stop QE exerted a huge impact on the price of gold denominated in the Canadian dollar. As the chart below shows, the price plunged yesterday from about 2228 CAD to C$2204 CAD within minutes.

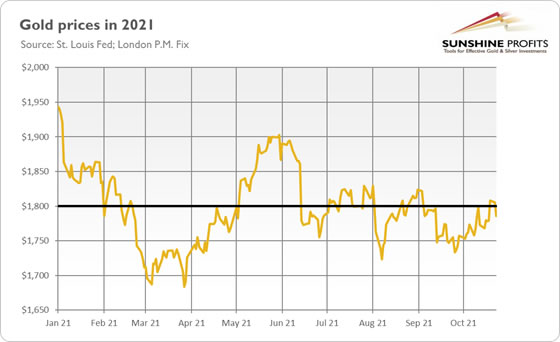

This drop may be a harbinger of what may happen in the international gold market when the Fed tightens its own monetary policy. Of course, the announcement of tapering at the November FOMC meeting is widely expected. However, please remember that the message of tapering could be accompanied by other hawkish signals as well. So, although gold has been moving upward recently (see the chart below), its struggles could continue for a while.

The silver lining is that the drop in the gold price in CAD – although abrupt – wasn’t too deep overall and reversed quickly. To be clear, a 1% drop is relatively large, but it’s not a total disaster, especially given the prominence of the event. It seems that inflation worries currently provide support for gold prices.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.