Commodities are Ripping Higher— Here’s my Top Way to Cash in

Commodities / Uranium Mar 31, 2022 - 10:21 PM GMTBy: Submissions

Commodities are on fire.

Commodities are on fire.

The price of oil has soared 43% since the start of the year.

Palladium—a metal most often used in catalytic converters—has increased 28% over the same period, while wheat has spiked 39%...

These are major moves. But I see commodity prices headed even higher this year.

Specifically, a huge opportunity is setting up in one of the most overlooked corners of the commodity market.

I’ll show you how to position yourself for this in a minute. But first, let’s look at why commodity stocks have been on such a tear lately.

- The Russia-Ukraine war has lit a fire under commodity prices…

You see, Russia is the world’s second-biggest producer of oil, and the second-biggest producer of natural gas.

It’s the world’s sixth-biggest coal producer. And it ranks third in potash and nickel production.

The problem is that Russia has effectively cut itself off from the global economy by invading Ukraine.

Countries all around the world have hit Russia with a tidal wave of economic sanctions…

And two weeks ago, the US announced it will no longer buy Russian oil.

This is a huge deal. When you take Russia out of the picture, there’s a lot less oil, natural gas, coal, and wheat to go around. In other words, we’re looking at a global supply crunch for many crucial commodities.

- Ukraine is also a major player in the resource market…

It accounts for 13% of the world’s corn production, and 8% of the planet’s wheat. And it’s the largest producer of sunflower oil.

With Russia and Ukraine effectively out of the picture, the global commodity supply chain shrank overnight.

That’s why we’ve seen such explosive price hikes across the commodity market.

Unfortunately, these massive shifts will take months, if not years, to correct.

This makes energy, metals, and agricultural stocks good bets right now.

- But I’m even more bullish on uranium.

Uranium stocks have been out of favor for years.

But that’s about to change…

As you can see, uranium stocks are waking up in a major way. This chart shows the performance of the Global X Uranium ETF (URA), which invests in a basket of uranium stocks. It’s rallied 37% over the past year. That’s more than double the S&P 500’s return over the same period.

Source: StockCharts

I see uranium stocks headed much higher in the coming months.

You see, the US power industry gets roughly half of its uranium from Russia and its allies, Kazakhstan and Uzbekistan. This model is no longer sustainable in light of what’s happening between Russia and Ukraine.

Two weeks ago, Republican senators introduced a bill to ban Russian uranium imports. It was also reported yesterday that Russia is considering banning uranium exports to the US.

At this stage, it’s practically certain that domestic uranium production will become a major political issue in the coming years, likely much sooner. US politicians will likely view domestic uranium production as a way to achieve “energy independence.”

This is a recipe for much higher uranium prices…

That’s clearly good for shares of uranium miners.

And I expect the coming bull market in uranium stocks to blow away what we’ve seen from other commodities recently.

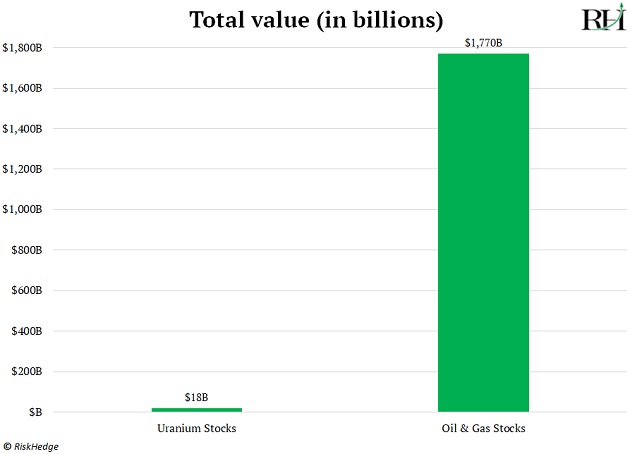

To understand why, look at this chart. It compares the market values of publicly traded uranium stocks with oil and gas stocks. You can see the uranium market is a tiny fraction of the oil market…

In other words, it won’t take much money to send uranium stocks soaring.

But don’t just take my word for it…

During the last uranium boom, Cameco (CCJ)—the largest publicly traded uranium company—saw its stock price go from $1.70 in 2002 to $56 in 2007. That’s a +3,200% rise in just seven years!

Smaller uranium stocks like Paladin Energy handed out even bigger returns.

Of course, volatility cuts both ways with uranium stocks. So, I don’t suggest speculating on small uranium stocks without doing your research. And as always, never bet more money than you can afford to lose.

However, URA is a great, one-click way to cash in during a uranium bull market.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.