FOR - Forestar Group - US Housing Market Stocks Analysis

Companies / US Housing Mar 21, 2023 - 02:42 AM GMTBy: Nadeem_Walayat

US House Prices Current State

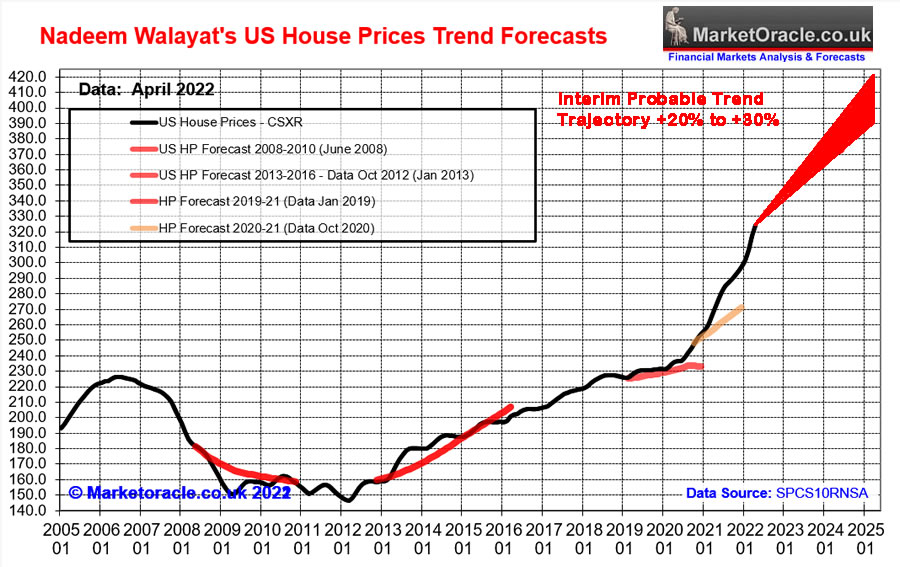

My interim view as of early July 2022 based mainly on my stock market, economy and UK housing market analysis at the time (Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range) concluded in an rough expectation for US house prices to target a gain of between 20% and 30% over the next 3 years that would be punctuated by a correction during 2023.

The latest Case Shiller 10 city index for November 2022 is 313, down form a peak of 330 in June 2022 (remember there is a 2 month lag in reporting of data). Thus US house prices have corrected by 5% from their highs though still positive on an 12 month basis at +6.3% which isn't anywhere near the shrill cries of the doom merchants such as Michael Burry of Mid 2022.

And given the background of soaring mortgage interest rates and contracting corporate earnings coupled with the inflationary cost of living crisis then +6.4% over the past 12 months is a sign of relative strength that suggests that yes US house prices whilst weak during 2023 are not going to fall off a cliff as many prospective buyers hope they will, after all the so called recession saw the US economy add 517,000 jobs last month, more than double market expectations! Thus the correction looks set to mild and prove temporary with prices set to resume their bull and likely to trade at new all time highs during 2024.

US Housing Stocks Mini Portfolio

Where housing stocks are concerned the more bad news the better which is the mistake most investors make when seeking good news to buy, countless times I get asked why am I buying x,y,z, stock when the news is so bad! We'll how else do you think you are going to get the stocks to trade down to a cheap prices? Not when the news is GOOD! You want the news to be BAD, DIRE, disastrous even because that is when one gets the greatest buying opps! It's why during October I looked like a porcupine given all the falling knives that I had tried to catch, which included a few US housing stocks though to very limited extent, pinprick exposures so as to get give me some skin in the game towards focusing on the US housing market.

FOR - Forestar Group

Missed the boat with DR Horton well in steps Forestar a majority owned subsidiary of DR Horton. Why buy DR Horton near it's highs when one can buy Forestar near its lows! In fact the stocks fundamentals are marginally better than that for DR Horton. So whilst a downturn in the US housing market will hurt both stocks, Forestar trades on a PE of 4.8 vs DR Horton on 6.1.

The stock trades in a easily defined range of $23 to $10. So accumulate below $11 with a view to selling above $22 for X2, whilst leaving a little on the table in case it blasts off, given it's low market cap of $765mln and low PE .Going into the low this was an easy stock to accumulate into which was followed by a 70% advance currently parking the stock at 38% of it's range. Forestar is now correcting which should see it trade down to at least $14.5, below that would be a lower probability trend towards $13.5, and I don't think we have much of a chance of seeing the stock go below that, not in this cycle. I aim to accumulate in the $14.8 to $13.5 range as the stock has put in it's bear market bottom and is now consolidating it's 70% advance in preparations for the next leg higher. So it's a case of asking oneself does one want to hitch a ride from about $14.5 to $23 for a potential 70% or not?

So those are the four US housing market stocks that I am accumulating and I am on the hunt for a UK property fund trading at an opportune level so watch this space!

This article is an excerpt from Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- SVB Collapse Buying Opportunity Counting Down to Resumption of Stocks Bull Market

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 75%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim FOMO rally buy the DIP analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.