Financial Markets Heading for Less Volatility During 2009

Stock-Markets / Volatility Dec 09, 2008 - 09:09 AM GMTBy: Clif_Droke

If you had to choose one word to describe this year, it would probably be “volatile.” That 2008 was characterized by volatility is an understatement. Such volatility hasn’t been seen in decades.

If you had to choose one word to describe this year, it would probably be “volatile.” That 2008 was characterized by volatility is an understatement. Such volatility hasn’t been seen in decades.

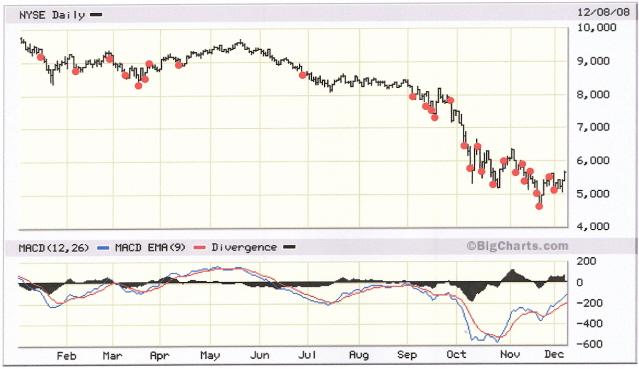

Not only was price volatility at an extreme this year but so was share turnover. Take a look at the following chart of the NYSE Composite Index for 2008. The red dots indicate the number of times the upside/downside or downside/upside trading volume ratio was beyond the boundary that has historically characterized “overbought” or “oversold.” Needless to say 2008 was a record year in terms of volume turnover.

We hear much discussion over volatility but few know how to define it. “Volatility is an external manifestation of underlying internal economic instability.” That’s how my colleague Bud Kress defines the dominant market environment we’ve all been subjected to these past three months. That’s certainly one way of putting it, although there’s also a more practical way of explaining it. Indeed, Mr. Kress’ cycles probably provide an even better answer as to why super volatility has beleaguered the financial market in recent months.

Extreme volatility is itself a form of change. It’s a state of flux wherein nothing remains constant and little or no progress is made. This year’s motif in the political realm, in fact, has been that of change. “Change now!” has been the rallying cry for millions seeking salvation from this year’s financial turmoil. Change has definitely characterized the economic realm, which in turn is the progenitor of political sentiment. The year 2008 has been one of great change in the monetary and economic realms with the result that millions have demanded change in the political realm. But as someone has said, if people are kept in a constant state of change they never arrive at anything. Thus we see that hyper volatility is the very antithesis of progress.

What was responsible for the extreme volatility of 2008? Many pundits pinned the blame on speculators, short sellers, hedge funds, and a host of other culprits. Most of them fell short of the mark in discovering the underlying cause for the volatility. The answer, as usual, is to be found in forces beyond our immediate sight.

It was the combination of the opposing Kress cycles with the confidence crisis that forced much of this year’s volatility onto the market. The confidence crisis was in turn a creation of the Fed’s tight money policy since 2004. The market was able to shrug off this tightness to a large extent from 2004 until 2007. But when the Kress 2-year cycle peaked in October 2007 it began the turmoil that would be seen in 2008 when the Kress 6-year cycle bottomed simultaneous with the 12-year cycle peak. Adding to this volatility was the fact that the Kress composite interim cycle is bottoming in December. Thus we had three major cyclical occurrences in the same year, a rare event to be sure.

The volatility in recent months has indeed been extremely rough but with the bottoming of the Kress interim weekly cycle this month, we should finally witness a declining in market volatility and along with it the advent of a kinder, gentler trading environment. This seismic volatility has been mainly a function of the cyclical cross-currents since September as discussed. In September-October the 6-year cycle was bottoming while the 12-year cycle was peaking, producing a ramp up in the Volatility Index (VIX) to all-time highs. Then, after the 6-year cycle bottomed in October, the duel in November-December has been between the newly formed 6-year up cycle versus the major composite weekly cycle bottom scheduled for around Dec. 18-21. Dueling cycles always produce major increases in volatility.

Now that the 12-year cycle peak has done its damage, however, the 6-year up cycle is starting to assert itself. It’s probable that this important major cycle will overpower the composite weekly cycle scheduled to bottom in a few days and produce a higher low at the upcoming cycle bottom. The bear market price low could therefore be (and is probably) already in for the SPX and the recent improvement in the NYSE hi-lo differential is a strong case in point. Once the Kress interim cycle bottoms later this month the market will be free of all intermediate term cyclical constraints and should be able to commence a new cyclical bull market heading into 2009.

Moreover, the important 10-year cycle is peaking in 2009 and should also support a recovery in the first half of the new year. This time, unlike 2008, the three nearest major Kress cycles (including the 6-year and 10-year cycles) will be in harmony on the upside instead of at odds. And the key 6-year cycle bias in 2009 will be up instead of down.

Technical traders will have confirmation that the bear market’s back has been broken once the VIX breaks the 60-day moving average uptrend (see chart below). We should also see improved trading conditions entering 2009, with fewer whipsaws and sudden reversals that have characterized the past few months since the volatility explosion.

The past year was a challenging one fraught with peril in the face of frozen credit and cyclical cross-currents. Yet for every crisis there is a corresponding opportunity. This year’s crisis has brought equity values to opportunity levels as we enter what promises to be a kinder market environment, thanks in part to the Kress cycle configuration going forward. The fact that the Fed has finally (if belatedly) reversed its tight money stance is also a key factor in the months ahead.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.