Harry Boxer's Top Stock Picks for 2009

Companies / Investing 2009 Jan 07, 2009 - 10:05 AM GMTBy: Harry_Boxer

Technical analyst Harry Boxer of TheTechTrader.com shares a few his Top 10 Stock Picks for 2009. For the complete list, and video chart analysis on each stock, please sign up for a free 15-day trial to Harry's Technical Trading Diary at www.thetechtrader.com. Once signed up, click on "Charts of the Week" and view the reports for Dec 29th (initial picks) and Jan 5th, which provides chart updates -- featured below -- on these picks.

Technical analyst Harry Boxer of TheTechTrader.com shares a few his Top 10 Stock Picks for 2009. For the complete list, and video chart analysis on each stock, please sign up for a free 15-day trial to Harry's Technical Trading Diary at www.thetechtrader.com. Once signed up, click on "Charts of the Week" and view the reports for Dec 29th (initial picks) and Jan 5th, which provides chart updates -- featured below -- on these picks.

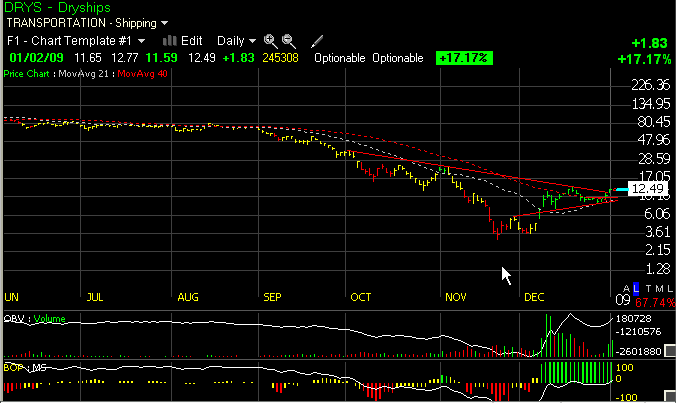

DryShips (DRYS): The stock has had a very powerful thrust off the lows. A nice bullish consolidation above the moving averages has taken place, particularly in the last 4 days when the volume was extremely low. The moving averages held, the stock then broke on Wednesday and followed up on Friday, when it gained another 1.83 on 24 1/2 million shares. That volume was the heaviest in 2 weeks. The mid-December level was around 13.30, so a very strong chance we may test or exceed that and head up to the 17-18 area, perhaps as high as the 22-23 zone, depending on market conditions.

Sequenom (SQNM): With tops in the 21-21 1/2 area continually being pressed and tested, and with a current flag pattern underway, I think it's very possible that a takeout may occur very quickly and a thrust to the 24 1/2-25 range could be imminent, not to mention a further test and a run-up to 28-29, the Sep-Oct highs. But what I’m really looking for is a move that takes this up to 38-40, the top of the channel, over the course of the next few weeks.

Cogent (COGT): The stock has moved out of a long base. Over the last few days it's edged up quietly on low volume. It's right around the 21-day moving average. If it can get a little burst here, it could make a run at the top of the channel and get up to the 16 3/4-17 range, which would be my next trading target.

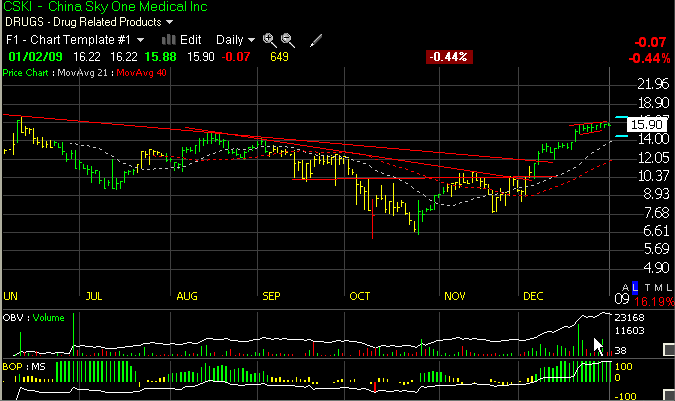

China Sky One Medical (CSKI): This is in a beautiful rising bull flag on low volume, with great technicals. There's no reason why it can't move higher. It's currently about to be testing the June all-time high up in the 16 range. I’m expecting that to break out and then move up towards the 20 area or thereabouts.

Harry Boxer is an award-winning, widely syndicated technical analyst and author of The Technical Trader (www.thetechtrader.com), which features a real-time diary of Harry's minute-by-minute trading ideas and market insights, plus annotated technical charts & stock picks (including his "Top 10 Picks for 2009"), based on Harry's 30 years experience as a Wall Street technical analyst. Plus NEW Member Chat Room!

Good trading!

Harry

For more of Harry Boxer, sign up for a FREE 15-Day Trial to his Real-Time Technical Trading Diary. Or sign up for a Free 30-Day Trial to his Top Charts of the Week service.

(c) 2008 AdviceTrade, Inc. All rights reserved. Distributed only by written permission of AdviceTrade and The Technical Trader at info@advicetrade.com . In using any portion of Harry Boxer's content, you agree to the terms and conditions governing the use of the service as described in our disclaimer at http://www.thetechtrader.com

Mr. Boxer's commentaries and index analysis represent his own opinions and should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret Mr. Boxer's opinions as constituting investment advice. Trades mentioned on the site are hypothetical, not actual, positions.

Harry Boxer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.