United States Sinking Economy as Deficits Soar

Stock-Markets / Financial Markets 2009 Feb 27, 2009 - 10:25 AM GMT

Are we rearranging the deck chairs on a sinking ship? - President Barack Obama forecast the biggest U.S. deficit since World War Two in a budget on Thursday that urges a costly overhaul of the healthcare system and would spend billions to arrest the economy's freefall. An eye-popping $1.75 trillion deficit for the 2009 fiscal year underlined the heavy blow the deep recession has dealt to the country's finances as Obama unveiled his first budget. That is the highest ever in dollar terms, and amounts to a 12.3 percent share of the economy -- the largest since 1945. In 2010, the deficit would dip to a still-huge $1.17 trillion, Obama predicted.

Are we rearranging the deck chairs on a sinking ship? - President Barack Obama forecast the biggest U.S. deficit since World War Two in a budget on Thursday that urges a costly overhaul of the healthcare system and would spend billions to arrest the economy's freefall. An eye-popping $1.75 trillion deficit for the 2009 fiscal year underlined the heavy blow the deep recession has dealt to the country's finances as Obama unveiled his first budget. That is the highest ever in dollar terms, and amounts to a 12.3 percent share of the economy -- the largest since 1945. In 2010, the deficit would dip to a still-huge $1.17 trillion, Obama predicted.

Our linear-thinking society assumes that the government us under control. That couldn't be further from the truth. Government can only rearrange the economic deck chairs. In other words, they will be the final arbiters of who will pay more taxes and who will receive their largesse. What Obama is proposing is that we borrow more money, taking liquidity out of the system, reducing what is left for business and personal use.

To the extent that we borrow more from China, we may buy some time, but if the economic slowdown continues to spread globally, we may not be able to count on foreign investors to stimulate our economy. Keep in mind that China has faced several natural disasters in the last year, the latest of which is a massive drought that is destroying their agricultural production. China may have to pay more attention to their own needs or face open rebellion by millions of laid-off and starving workers.

The idea that the Federal Reserve controls interest rates is also erroneous. The market controls interest rates and the Fed follows what the marketplace dictates. If China were to withdraw its financial support, then interest rates will explode upwards, due to a loss of confidence by the investor public. In the end, excessive borrowing will expose the Fed's lack of control and result in a massive loss of confidence in the government.

The November low isn't holding!

-- U.S. stocks have been seesawing since the Dow and S&P 500 ended Monday's session at nearly 12-year lows. That low followed several down weeks as investors have sifted through the economic stimulus plan, the foreclosure fix and the bank bailout plan. "The markets have been disappointed by what the government has been coming up with in terms of solutions for the housing collapse and bank crisis," said Robert M. Siewert, portfolio manager at Glenmede. "Until investors have some confidence in the end game, the downturn will continue."

-- U.S. stocks have been seesawing since the Dow and S&P 500 ended Monday's session at nearly 12-year lows. That low followed several down weeks as investors have sifted through the economic stimulus plan, the foreclosure fix and the bank bailout plan. "The markets have been disappointed by what the government has been coming up with in terms of solutions for the housing collapse and bank crisis," said Robert M. Siewert, portfolio manager at Glenmede. "Until investors have some confidence in the end game, the downturn will continue."

Treasuries see failure ahead?

-- The U.S. sold $22 billion of seven- year Treasury notes in the maturity's first appearance since 1993 as President Barack Obama's administration released a budget proposal that would yield a record deficit of $1.75 trillion. The auction was part of a record $94 billion in notes sold this week as the Treasury steps up the pace of borrowing amid an economy that shows few signs it will resume growing soon.

-- The U.S. sold $22 billion of seven- year Treasury notes in the maturity's first appearance since 1993 as President Barack Obama's administration released a budget proposal that would yield a record deficit of $1.75 trillion. The auction was part of a record $94 billion in notes sold this week as the Treasury steps up the pace of borrowing amid an economy that shows few signs it will resume growing soon.

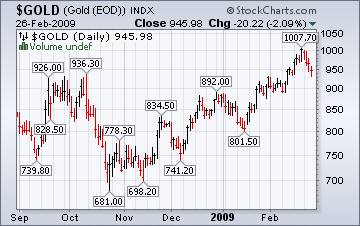

Could this be a top in Gold?

( Bloomberg ) -- Gold fell in New York for a fourth straight day, the longest slide in a month, on speculation equities will rebound, reducing the appeal of the precious metal as an alternative investment. Silver sank the most in 12 weeks. Could it be that after a four month rally, the price of gold could not be sustained by investors? Copy writers look for cause and effect. Maybe it's just time for a decline.

( Bloomberg ) -- Gold fell in New York for a fourth straight day, the longest slide in a month, on speculation equities will rebound, reducing the appeal of the precious metal as an alternative investment. Silver sank the most in 12 weeks. Could it be that after a four month rally, the price of gold could not be sustained by investors? Copy writers look for cause and effect. Maybe it's just time for a decline.

Japanese consumers slash spending, manufacturers cut production.

Japan headed for its worst postwar recession in January as manufacturers cut production by an unprecedented 10 percent and consumers slashed spending. Japan's consumer prices failed to rise in January for the first time in more than a year as households cut spending, the statistics bureau said today, indicating deflation may resurface in the world's second-largest economy.

Japan headed for its worst postwar recession in January as manufacturers cut production by an unprecedented 10 percent and consumers slashed spending. Japan's consumer prices failed to rise in January for the first time in more than a year as households cut spending, the statistics bureau said today, indicating deflation may resurface in the world's second-largest economy.

The Shanghai Index may not be sustainable in a global slowdown.

-- China's stocks declined, driving the benchmark index to the lowest level in three weeks, on speculation regulators will restrict financial companies' investments in equities. Today's decline trimmed the index's advance to 17 percent this year, still the best among the 90 benchmarks globally tracked by Bloomberg. Stocks have rallied as investors bet government spending plans will help the economy weather the global recession.

-- China's stocks declined, driving the benchmark index to the lowest level in three weeks, on speculation regulators will restrict financial companies' investments in equities. Today's decline trimmed the index's advance to 17 percent this year, still the best among the 90 benchmarks globally tracked by Bloomberg. Stocks have rallied as investors bet government spending plans will help the economy weather the global recession.

The dollar is still the world's primary currency,

-- The demand for dollars and the relative scarcity of them has taken the U.S. Dollar to new highs. The truth is, the dollar is the currency everyone loves to hate. Investors remain worried that one or more of the major U.S. banks face nationalization in the near future. The lack of clarity in the government's bailout of the financial sector has many investors concerned. However, if the dollar breaks out over 88, investors will pile on as it moves higher, forgetting their worries.

-- The demand for dollars and the relative scarcity of them has taken the U.S. Dollar to new highs. The truth is, the dollar is the currency everyone loves to hate. Investors remain worried that one or more of the major U.S. banks face nationalization in the near future. The lack of clarity in the government's bailout of the financial sector has many investors concerned. However, if the dollar breaks out over 88, investors will pile on as it moves higher, forgetting their worries.

How to survive a property crash.

It's amazing that few so-called experts have learned much from these centuries of painful cycles. Most of us who are interested in property wrung our hands in the late Nineties wondering why it was that so few lessons had been gleaned from the crash of the late Eighties and early Nineties. But once again, lending institutions, having previously declared themselves chastened by what they'd done only a few years before, were lending irresponsibly, leading us into the current situation like property-addicted lemmings. We also fell for the bait. It's time to review the lessons again.

It's amazing that few so-called experts have learned much from these centuries of painful cycles. Most of us who are interested in property wrung our hands in the late Nineties wondering why it was that so few lessons had been gleaned from the crash of the late Eighties and early Nineties. But once again, lending institutions, having previously declared themselves chastened by what they'd done only a few years before, were lending irresponsibly, leading us into the current situation like property-addicted lemmings. We also fell for the bait. It's time to review the lessons again.

Cost discrepancies explained.

The Energy Information Administration explains why the price of gasoline has diverged from the price of a barrel of oil. The most commonly traded type of oil is called “West Texas Intermediate (WTI),” WTI is light, sweet crude, with low sulfur content and relatively high yields of high-value products such as gasoline, diesel fuel, heating oil, and jet fuel. Currently there is a glut of WTI in the market. However, there are other types of crude oil that is imported and is more costly that is also used by refiners. This is one of the reasons why the price of oil is lower while the cost of gasoline is not.

The Energy Information Administration explains why the price of gasoline has diverged from the price of a barrel of oil. The most commonly traded type of oil is called “West Texas Intermediate (WTI),” WTI is light, sweet crude, with low sulfur content and relatively high yields of high-value products such as gasoline, diesel fuel, heating oil, and jet fuel. Currently there is a glut of WTI in the market. However, there are other types of crude oil that is imported and is more costly that is also used by refiners. This is one of the reasons why the price of oil is lower while the cost of gasoline is not.

A lack of industrial and commercial demand keeps prices down.

The Energy Information Agency's Natural Gas Weekly Update reports, “ The impact of the current recession outweighed the space-heating demand, as the lack of industrial and commercial demand continues to depress natural gas spot prices. The decreases in spot prices appear not to be weather driven, as some areas of the country are experiencing relatively cold weather, but still failed to register any price increases. ”

The Energy Information Agency's Natural Gas Weekly Update reports, “ The impact of the current recession outweighed the space-heating demand, as the lack of industrial and commercial demand continues to depress natural gas spot prices. The decreases in spot prices appear not to be weather driven, as some areas of the country are experiencing relatively cold weather, but still failed to register any price increases. ”

Will the government win the War on Recession?

One of the great lessons of liberal theory concerns the extraordinary capacity of free exchange to create wealth. Trading makes both parties better off. Saving makes resources available for investment. Investment creates jobs that yield more products for people to purchase. Through this mechanism the West grew rich.

The economics of stimulus are not as complicated. They amount to taking from some and giving to others. There is no wealth creation at all. There is no magic "multiplier" to turn stones into bread. The economics of stimulus is value-destroying, because property is pried loose from owners who are putting it to socially useful purposes, and given to government so it can pass it out to friends.

This process is costly to overall wealth production – and most of those costs are unseen. We will never know what kind of real stimulus could have taken place had the property been left in private hands. What jobs might have been created, what investments might have been made, what kind of business expansions might have taken place? We will never know .

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.