Is Salter Duck Water Power The Uranium Banana Skin?

Commodities / Uranium May 17, 2007 - 08:44 AM GMTBy: Bob_Kirtley

Recently, we wrote an article on the possible threats to the uranium bull market and nuclear power in general. In this article we will explore what we believe is the biggest single threat to the long term position of nuclear power with uranium as a fuel.

Recently, we wrote an article on the possible threats to the uranium bull market and nuclear power in general. In this article we will explore what we believe is the biggest single threat to the long term position of nuclear power with uranium as a fuel.

We ask you to look upon this technology with a open mind, no matter what prejudices or previous conclusion you may have arrived at. We were extremely sceptical when this was first brought to our attention, but as professionals we researched the topic thoroughly regardless of our opinions beforehand, and all that we ask is for you to put your sceptical views aside if you have any, until you have read this article in its entirety.

Taking the UK as an example, we are taking a careful interest in this power source, as the UK is one of the areas which could stand to benefit from this technology. Recently, a review from the UK government showed that there are now types of wave power that are capable of producing electricity at a cost lower than USD 0.10/kWh. This is the point at which electricity consumption becomes economically viable.

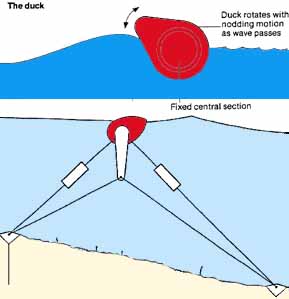

Out of all the wave power devices, the “Salter” Duck is the most efficient, generating electricity at under USD 0.05/kWh. The Duck was invented and developed in the 1970's, by Professor Stephen Salter at the University of Edinburgh and the device generates electricity by bobbing up and down with the waves on the sea surface. Despite its ability to produce energy extremely efficiently the idea was killed off mid way through the 1980's when a report from the EU “miscalculated” the cost of electricity produced by a factor of ten! They hugely overestimated capital cost, underestimating the reliability of underwater cables and ridiculously claiming that each Duck would cost the about the same as the prototype had cost. Recently, the “error” has been uncovered and the Salter Duck is getting more coverage and consideration.

Many view this “error” or “miscalculation” as a deliberate attempt to destroy the Salter Duck's future as a source of electricity. Some believe that pressure from the Nuclear Industry may have influenced the EU in its decision to report that the Salter Duck was not economically viable as it would have seriously threatened the existence of nuclear power, which at the time was an extremely prominent emerging energy source. What does this tell us? Well it suggests that people in the nuclear industry felt threatened by the possibilities of wave power and that in itself adds credibility to the wave power idea. It also adds to the argument that marine renewables are the biggest single threat to nuclear power and the uranium bull market as the nuclear industry may have been forced to act this way.

Let us explain in a bit more detail how the Salter Duck actually works. The Salter Duck works by absorbing 90% of the energy from incoming waves and leaving a calmer sea behind the cam. The nodding motion of cam operated pistons then compress hydraulic oil and once this pressure has built up, the pressurised oil is released through a hydraulic motor that in turn converts 90% of the captured power to electricity.

After campaigning long and hard to save their project, Professor Salter and his team had to break up in early 1987. Salter wrote to the House of Lords committee on renewable energy; “We must stop using grossly different assessment methods in a rat race between technologies at widely differing stages of their development. We must find a way of reporting accurate results to decision makers and have decision makers with enough technical knowledge to spot data massage if it occurs. I believe that this will be possible only if the control of renewable energy projects is completely removed from nuclear influences .” Once the programme manager of Salter's team started predicting that they could get costs down to 3.3p/kWh, an economically viable level, he was excluded from the next important meeting of the key committee. He also claimed that ‘ They [the government] basically killed the project because it was going to threaten the expansion of the nuclear industry,'

Salter admits that the project was perhaps a bit ahead of its time. ‘It's a bit like somebody saying in 1905 that they had a really good idea for a huge aircraft like the Airbus A380 when people didn't believe that biplanes would fly.” Regardless of the sentiment towards his project, Salter still remains convinced of the potential from wave power, claiming that “you could run continents with this sort of power”. Salter says, “The long-term dream for the Duck stream is that you run a long line of them from the Hebrides down to the west coast of Ireland, with a break to allow shipping through, then you build out from Cape Wrath [the most westerly point on the northern coast of Scotland], past the Faroes and all the way to Iceland. You can use hydroelectrics and the Icelandic geothermal to back that up when there aren't any waves. So you get a very high-capacity factor of wave power coming into Scotland and Norway and feeding on down into the rest of Europe . That's a really enormous resource.'

However another renewable marine resource is tidal power and this also has a lot of potential. The Pentland Firth , which is the channel between Scotland and Orkney is estimated to hold 50% of Europe 's tidal power . Using tidal steam turbines, many, including Salter himself think that we could get 10-20GW of power out of the system. I realize that this figure does not mean a lot to a lot of people so let us put this enormous amount of power into perspective.

This project could produce more energy than all the nuclear power stations in the UK combined.

Does that sound like a threat to nuclear power? Could marine renewables be the Uranium Banana Skin?

Personally we think that these two power sources do not have to smash into each other head first, there should not be confrontation between them, but co-operation. By working with each other, rather than against each other they can both offer an extremely good solution to not only the UK 's energy needs, but global energy needs in general. A lot of the research in the article has been focused on the UK and Europe , but that is simply because that is where the studies have taken place and where the research has been carried out. We are confident that with more research in different parts of world, similar possibilities can be discovered.

We see nuclear energy as a “temporary” solution to the worlds energy needs. When we say “temporary” we are talking perhaps up to 50 maybe even to 100 years. Over this period we see nuclear energy surpassing fossil fuels and then renewable energy sources taking over from there. Nuclear energy is not going to be a long term solution for energy, if all the worlds electricity was produced by nuclear power, then we would run out of uranium in five years! Whilst that would be very beneficial to the uranium price and our uranium stocks it is not helpful to humanity's energy needs.

Nuclear should be the transition energy, that takes us from fossil fuels to the renewable energy sources. After all, living on nuclear energy is like living on a set amount of capital, but living using renewable energy sources is like living from an everlasting income. This of course would all change if someone cracked either breeder reactors or nuclear fusion which will be discussed in a future article.

So in conclusion, what it the uranium banana skin? The answer is that eventually renewable energy, in particular marine renewables such as wave and tidal power will be the banana skin that causes the nuclear industry to come to its knees. The good news as far as uranium investors are concerned is that this will not begin to happen for at least another decade and nuclear energy is at the very least, the immediate future whilst renewable energy is still being developed and most importantly, put into action.

For ideas on which uranium stocks to invest in, subscribe to the uranium stocks newsletter at www.uranium-stocks.net completely free of charge.

By Sam Kirtley

www.gold-prices.biz

Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England.

He has been working for a number of years on a full time basis representing a group of investors in England.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.