Bitcoin, Crypto's Controlled Demolition Panic Event, Worse to Come!

Currencies / cryptocurrency Oct 19, 2025 - 11:34 AM GMTBy: Nadeem_Walayat

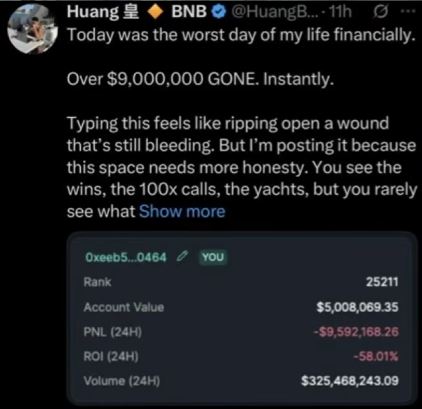

The anticipated controlled demolition by insiders was instigated Friday that largely misfired for stocks (for now) but the leveraged longs in the crypto markets got blasted with both barrels to the extent that the price lows differed across exchanges as each sought to maximise liquidation of leveraged longs on their exchange i.e. BTC $107k vs $101k, Solana $170 vs $130, liquidating longs whilst preventing buy orders from getting filled near the lows which illustrates the crypto markets are FRAUDULENT! They are not the future they are just the modern equivalents of bucket shops cons of 100 years ago!

If they can do it Friday they can do it any day! When you have a felon in the White house committing fraud by the rich and powerful is the norm, don't folk look here, looky there at the penniless migrants crossing the border.

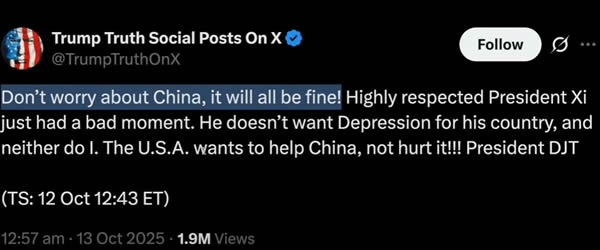

What you think Trump did not profit from the crypto controlled demolition? The market manipulator in chief spooked the markets Friday with a statement warning of 100% China tariffs incoming and then the Trump crime syndicate covered their shorts ahead of the following tweet before Mondays open, triggering a reversal so shorts get liquidated as well!

I keep telling folk not use leverage but do people listen?

The crypto casino continues onto it's next victims...

Imagine if these folk had been 65% in cash how different life would look today.

At the start of the week AI continued ripping stocks to the moon, AMD blasted off to a high of $244 on OpenAI hopium, with numero uno Nvidia also trading to a new all time high of $195 within a stones throw of $200. The AI bubble continued to inflate the indices such as the S&P touching 6765, this despite the fact that most of the rest of the stock market is stagnating with more than 90% nowhere near trading at a new all time high. The divergence is clear and dangerous. Nevertheless Paul Tulip Jones poster child of FOMO mania who right at the bull markets top spewed that a Nasdaq 2x blow off top was incoming...

Which was regurgitated right across fool tube and twatter, folk instead of selling where fomo buying into prospects for a 2x blow off top barely a day before the controlled demolition that took the S&P well below Octobers opening low and thus ending a 6 month bull trend.

Remember folks the top is always a 2x blow off away...

Investors perception right now is that YES stocks are over valued especially AI stocks, but what many fear is not risk of loss but the fear of missing out, FOMO!

What do I do? I SELL INTO FOMO which is why I am 65.5% cash, yes the nasdaq could go nuts and 2x, but unless you press the SELL button it's not going to mean anything other then a looking in the rear view mirror exercise. It's what folk do in the present that counts, not future fantasies or hindsight could haves. What does one do TODAY?

Are stocks going up?, are they expensive? Then SELL!

Are stocks going down? Are they cheap? Then BUY!

Yes expensive stocks can become more expensive, and cheap stocks can become cheaper but you will only know that with the benefit of HINDSIGHT!

For instance Look at all those folk who failed to Sell Eth when it pumped to over $4800, I was having a discussion with a patron at the time that folk should take the profit rather than fantasise about a 2x to $10k because you can't sell with the benefit of hindsight at $4800 after it's fallen to $3800 which looked a lot more probable then $5800 and thus I sold over 90% of my Eth.

Alls the likes of Tulip Jones are doing is to convince folk to BUY INTO the HIGHs, I doubt Tulip Jones is buying, I'd guess he was SELLING into the rally that he was suggesting others should buy.

Do I think the stocks bull market is over?

No, I doubt it, so why have I been selling all the way to getting to 65.5% in cash?

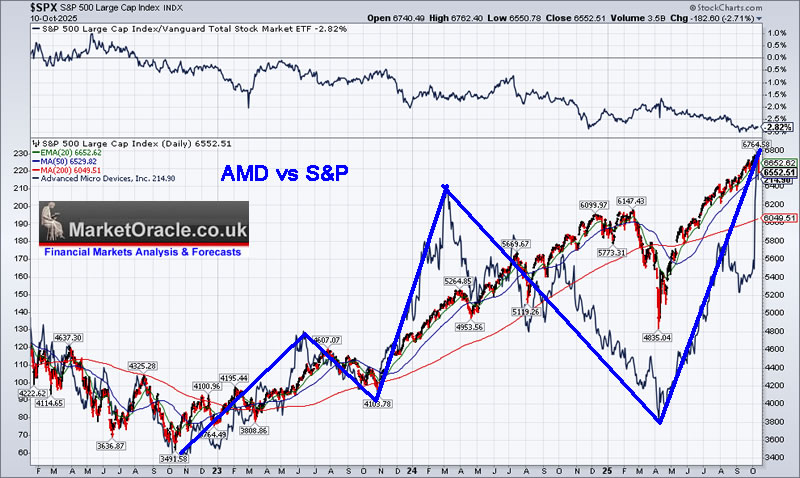

I am reacting to stocks becoming expensive and acting accordingly, just as a little over 6 months ago I was reacting to stocks becoming cheap thanks to Trump tariffs chaos and buying. The indices such as the S&P and Nasdaq really are nothing burgers as AMD illustrates why.

AMD pumped to a new all time high by trading to a high of $244 vs the previous weeks close of $164 on news that OpenAI has partnered with AMD to provide them with compute power as OpenAI seeks to diversify from being beholden to Nvidia AI processors such as Black Well that triggered a FOMO mania pump, Anyone that partners with OpenAI experiences FOMO mania, not so long ago it was Oracle that saw it's stock price soar by 30% in a day on news of an OpenAI partnership to a high of $346, vs $292 now.

OpenAI seeks 1gw of compute power from AMD during 2026, scaling up to 6GW over the coming years which implies AMD to the MOON, another 2x, or will it?

OpenAI a company that makes no profit is the poster child of the AI bubble as it commits hundreds of billions to orders for AI infrastructure so as to feed the frenzy towards being the first to AGI triggering capex spending frenzy amongst the hyperscalers, such as Amazon, Microsoft, Google, META, Alibaba, all in a race towards AGI.....

AMD pumped to $244, currently trades at $220 which is pretty good going considering the controlled demolition, as numbers are crunched as to what this will mean for forthcoming earnings.

How much is the deal worth? About $100 billion for 6GW of compute over the next 5 years, now compare that to AMD's 12 month revenue of $29 billion and you can see why the stock price took off like a rocket. Reality is that in a best case scenario AMD earns $15 billion during 2026, or about $4 billion per quarter which would be a 50% jump in revenue and likely a more in profit. Also part of the deal AMD hands over 160 million shares to OPENAI for a cent per share, so a 10% share share price dilution.

The problem is how much of the deals will actually get delivered as OpenAI is handing out multi billion dollar contracts left right and centre, there is NO limit! How long before we hear about a $1 trillion 10 year contract? Where is the money coming from because OPenAI has LESS revenue than what it is offering AMD for 2026, let alone the necessary cash flow, in fact OPENAI's burn rate is greater than it's revenue so has negative cash flow. Thus the money to pay AMD is coming from NEW INVESTORS! That's right! Not from earnings but from NEW INVESTORS, OPENAI is basically a PONZI SCHEME! Announcing contracts that will be paid for by future investors, which is fine as long as the bubble keeps INFLATING! Because Investors will some day STOP throwing money at the cash burning machine and when that day comes the bubble pops and all of these companies with multi billion dollar contracts are left holding a bag of nothing! Producing hardware and data centre capacity that they can't sell because the investors are no longer willing to finance the black hole in it's quest for AGI.

AMD wasn't cheap BEFORE the news, and now it's even more expensive, lets crunch the numbers with say a 50% jump in earnings for 2026 which at $220 would put AMD at 80% of it's PE range vs 94% pre announcement which whilst not cheap is sustainable for a bull market. Whilst the upside to say 100% of it's PE range by the end of 2026 implies $250 is doable, thus we could see AMD trade to over $250 as long as the OPENAI bubble does not burst!If it bursts then and the deal vanishes then it's back below $140 for AMD.

But as things stand the OPENAI deal means $250+ is doable even if it proves temporary, so at $220 one is holding for perhaps $255,vs the risks of seeing sub $140, hence why I halved my exposure to AMD on it's pump to $244 and will continue to scale out as it trades higher.

Meanwhile Folk obsesses over what the S&P will do, would knowing what the S&P will do allow one to bank 30% profit in a day in AMD?

Focus on the pump, These are the prices folk were investing to see sub $130, that's where to invest for the long-run not at $230! Instead folk have got it the other way round, at $120 eager to exit, at $230 eager to hold on for AI fantasies.

Folk who sold all earlier in the 180's did well, it's the best one could have done given the circumstances, i mean BEFORE the OPENAI announcement AMD was trading at $164 enroute to sub $130, so the only way someone could have foreseen this pump is if they had inside knowledge OR a time machine!

(Charts courtesy of stockcharts.com)

As I keep iterating and as AMD illustrates the S&P really is a nothing burger but still folk hitch their investing wagon to what the S&P does and then get confused when the stocks they are invested in do something different without realising that the S&P is just an AVERAGE of 500 stocks by market cap, it's pretty much useless when it comes to investing as the chart of AMD vs the S&P illustrates. Folk took the under performance of AMD vs the S&P as signal to bailout at the earliest opportunity, which meant they a. missed the doable pump to $187 and b. they definitely had nothing left for the unexpected pump to $244

What's the objective?

a. to MAINTAIN Exposure through mechanisms such as the percent invested of target column C where when negative one has scope to let positions run until the get to extreme overvaluations due to no hard cash being at risk..

b. To Buy when CHEAP, forget what the S&P is doing, alls an investor can know is if a stock is cheap or expensive and act accordingly, instead folk obsess over the fact that the AMD isn't doing what the S&P is doing, instead I took the ridiculous FOMO to the March 2024 high as a warning that what follows on the downside will be pretty severe i.e. I commented at the time that AMD falling to as low as $110 would not sup rise me, and it did that and more, entered into a severe bear market whilst the S&P trended higher where by THE LOW folk had had enough of AMD, many wanted to sell at a loss and buy something that more closely matched the S&P, my response was I never sell at a loss, and then came the break evens which for most were in the 120's, and my response was I'll start trimming AT a decent PROFIT at $160+ and that $180 was doable and given March 2024 there was a chance of FOMO mania to something daft like $250.

Likewise today, yes AMD could fomo to something daft life $300, BUT whatever high it trades to, AMD WILL SEE sub $140 again! And once more sub $110 would not surprise me. So I would be a bloody fool not to cash in most of my AMD chips given expectations, to the upside there is $300 of potential FOMO, and to the downside there is the likelihood of revisiting sub $110, and in between is the strategy for maintaining exposure no matter what the price does because without exposure AND cash one can do nothing hence why AMD is still about 1% of my portfolio even though I think sub $140 is on the cards where Column C enables me to maintain exposure even though the PE ranges are screaming at me to SELL.

And one can do the same with every stock and in large part one will see that the S&P where investing is concerned is a red herring!

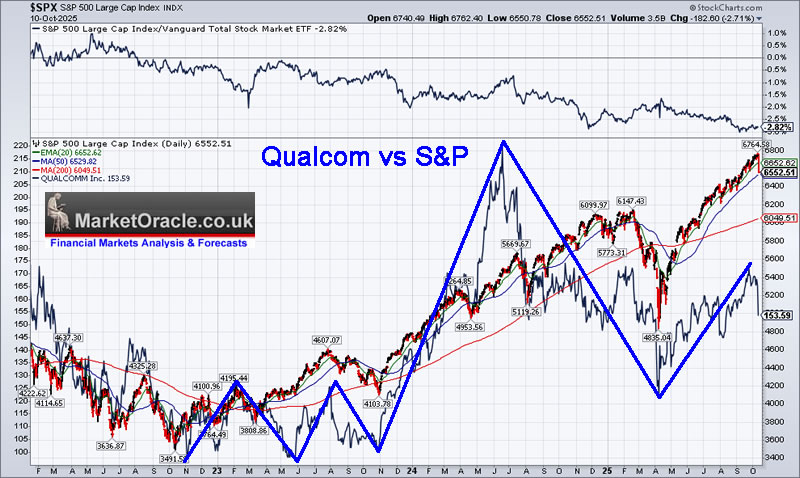

Now alls we need is for OPEANAI to announce a deal with Qualcom and we can see this AI laggard also FOMO to a new all time high.

The bottom line is that this is a stock pickers market as AI stocks such as Nvidia, Broadcom and AMD illustrate.

CONTENTS

The AGI Bubble That WON'T BURST!

Buy for Where You will SELL Not where it Could Trade to

Gold and Silver Canaries in the Coal mine

Fed Three Rate Cuts 2025

US Economy is Booming! 3.8% GDP! Or is it?

Dancing with Stock Market Seasonal's

Stock Market Volatility

Retail FOMO

Stock Market Breadth Divergence

Stock Market Base Case vs Best Case

Market Probabilities

Stock Market Trend Conclusion

LLM's are a Stepping Stone to the Chat GPT of Robotics!

20 Million Homes!

The FOMO Pandemic!

US Stocks Long-term Outlook and What to do About it

The FOMO Indicator

AI Stocks 2025 Cheap vs Expensive

ASML Earnings Wed 15th Oct - $985, EGF's -9%, 18%, Dir 28%, PE ranges 92%, 64%, FOMO 28%

TSMC Earnings Thurs 16th Oct - $303, EGF's 15%, 19%, Dir 0%, PE ranges 128%, 96%, FOMO 32%

Where to Stash the Cash?

Crypto Crash - Binance Controlled Demolition Event

Bitcoin Seasonal Trend

BItcoin Bull Market Target

Bitcoin Distribution or Consolidation?

CIRCLE

Nations in Terminal Decline - Blame the Immigrants!

The rest of this extensive analysis was first made available to patrons who support my work on 15th October.

The OpenAI Stock Market AI Ponzi Bubble Mania into 2026 IPO

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Recent analysis -

Stock Market Fomo Mania Into US Rate Cut Controlled Demolition Event

Jackson's Black Hole, Will Nvidia Earnings Spark Panic Event in Correction Window?

Stock Market Smells like 2021, US Housing Market Analysis

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series.

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $9 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buy the dips and sell the rips analyst.

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.