October is the Cruelest Month for Stock and Financial Markets

Stock-Markets / Financial Crash Aug 24, 2009 - 09:10 AM GMTBy: Tarek_Saab

T.S. Eliot famously declared "April is the cruelest month" in his poem, The Wasteland. Apparently, Eliot was no stock investor. For those holding stocks, it is October which has been the cruelest month. October 1929. October 1987. October 2008 . . . Wasteland indeed.

T.S. Eliot famously declared "April is the cruelest month" in his poem, The Wasteland. Apparently, Eliot was no stock investor. For those holding stocks, it is October which has been the cruelest month. October 1929. October 1987. October 2008 . . . Wasteland indeed.

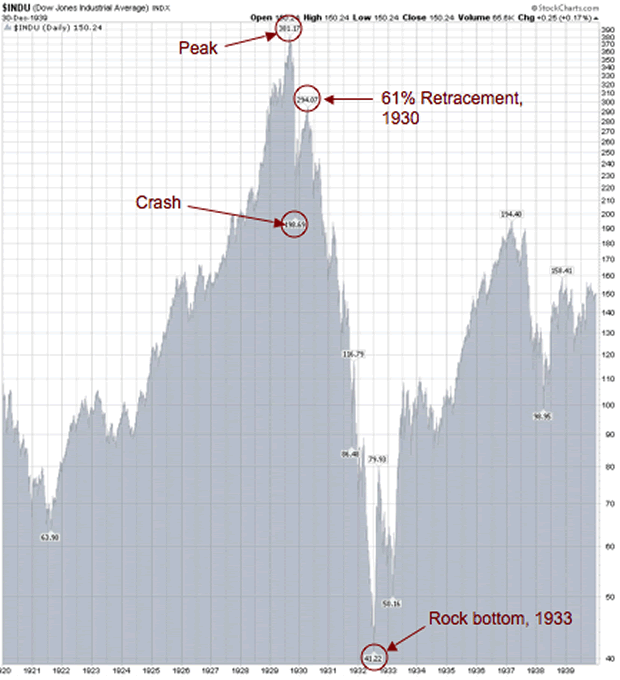

If analysts like Robert Prechter and the Elliott (not the poet) Wave theorists are correct, and the 2009 market recovery is similar to the 61% retracement in 1930 following the '29 crash, then we are on the verge of a frightening collapse. As Prechter notes in a recent interview: "What I have been saying publicly is that the Dow could go below 1,000 which is a radical enough statement."

Could it happen? If history repeats itself . . .

To put the above chart in perspective, consider that the Dow did not fully recover its 1929 peak until 1953! The growth was so moderate, in fact, that the Dow did not eclipse 1,000 until 1972 - and this occurred when the US economy was production-based.

Still, in October 2007 the Dow came within a hair of 14,000, representing 14x growth peak to peak in 35 years from 1972 to 2007; a symptom of credit-induced inflation and a bubble of unimaginable proportions. During this period, our economy transitioned from one of production to service, and through that process became entirely unsustainable. How far can you stretch a rubber band before it breaks?While the greatness of the United States has faded faster than Harrison Ford's career, Tom Clancy hero Jack Ryan lives on in cinema history, as does our notion of patriotism, though even Ryan never saw clear and present danger like what we are presently facing.

Does the nation sense it? Could a monumental crash be in the offing this fall? (more below . . )

The spectrum of national pessimism varies depending on one's political credo; from the communists, like our President, to the "Hannitized" and the Glenn Beck fans, who still feed into the party line shouting "mega-dittos!" and "You're Great American!" from Juneau to Tallahassee. Hannity implores his base, "let not your heart be troubled!" Easy for him to say. This once-great nation remains distracted with the prospect of national healthcare while the economy languishes in peril.

Those with little capital have no choice but to weather the storm with a combination of precious metals and US dollars. Those with money to invest are seeking offshore safe havens. Outside the far right and the far left moves a segment of investors looking beyond the pale of American politics to growing worldwide sanctuaries.

Many Americans ask, where is it any better than here? Truthfully, not too many places unless you are a socialist, but there are oases where freedom is a way of life and not a marketing slogan. Paraguay and Uruguay are two countries drawing international investors because of tax benefits (Paraguay's income tax is 0%), cheap land and labor, political stability, and a variety of other merits. As free marketers know, economic stability is never built on a mountain of credit. Also, it is difficult for a central bank to control the population when 90% of the people do not own bank accounts.

In the most recent issue of Without Borders, the Casey Research spin-off, authors Simon Black and Fitzroy McLean recommend holding 30% of one's investment portfolio in "foreign productive real estate." They define this real estate as "rental property or agricultural/forestry which can also be used as your escape destination if things get really bad at home."

Escape destination, indeed, not only physically, but fiscally. For what good does it do to flee the country if your money cannot make the trip? The existing threat of foreign exchange controls, as I wrote in my last article, is an ever present danger.

Foreign productive real estate is crash proof and protective for two main reasons: 1. A producing commodity will always generate income despite market fluctuations. 2. The United States government mafia simply cannot repatriate foreign land. (And if the real estate does not produce, it is exempt from US taxation as well).

It is time for another Jack Ryan-sequel to Patriot Games. Clancy could call it Repatriate Games, as in, protection from the government repatriating your assets, which is happening to banking customers in Switzerland. Or he could call it Expatriate Games, as in the six million Americans who presently live outside the United States.

Either way, now might be the time to begin thinking differently. For some, freedom never came so cheaply.

Till next time, that's my Saab Story.

P.S. I would be happy to assist anyone with foreign investment contacts if you send me an e-mail: tarek @ goldandsilvernow.com

By Tarek Saab

Tarek Saab is a former finalist on NBC's "The Apprentice" with Donald Trump. He is an international speaker, syndicated author, entrepreneur, and the President of Gold&SilverNow. His website is www.goldandsilvernow.com

© 2009 Copyright Tarek Saab is - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.