U.S. CPI Deflation for 7th Consecutive Month

Economics / Deflation Oct 15, 2009 - 01:12 PM GMTBy: Mike_Shedlock

Bloomberg is reporting Consumer Prices in U.S. Increased at Slower Pace

Bloomberg is reporting Consumer Prices in U.S. Increased at Slower Pace

The cost of living in the U.S. rose at a slower pace in September, showing inflation will not be a threat as the economy emerges from the worst recession since the Great Depression.

The 0.2 percent gain in the consumer-price index followed a 0.4 percent increase in August, as forecast, figures from the Labor Department showed today in Washington. Excluding food and energy costs, the so-called core index also climbed 0.2 percent, more than anticipated and pushed up by health care and a rebound in auto prices. Rents dropped for the first time in 17 years.

The number of Americans filing first-time claims for unemployment benefits dropped last week to the lowest level in nine months, indicating the improving economy is leading to a slowdown in firings, another Labor Department report also showed.

Applications fell by 10,000 to 514,000 in the week ended Oct. 10, lower than forecast, from a revised 524,000 the week before. The total number of people collecting unemployment insurance also decreased.

Compared with a year earlier, consumer prices were down 1.3 percent. For the core index, prices climbed 1.5 percent from September 2008 after a 1.4 percent increase in the 12 months ended in August.

Food prices, which account for about a seventh of the CPI, decreased 0.1 percent in September, reflecting cheaper meats and produce.

Lower food prices are dragging down revenue at some businesses. Spartan Stores Inc., which distributes groceries and runs supermarkets, said lower prices are hurting sales.

Dennis Eidson, the Grand Rapids, Michigan-based company’s chief executive officer, said yesterday in a statement that he expects weakness for the remainder of its fiscal year due to “product price deflation” as consumers “behave cautiously given the challenging economic environment.”

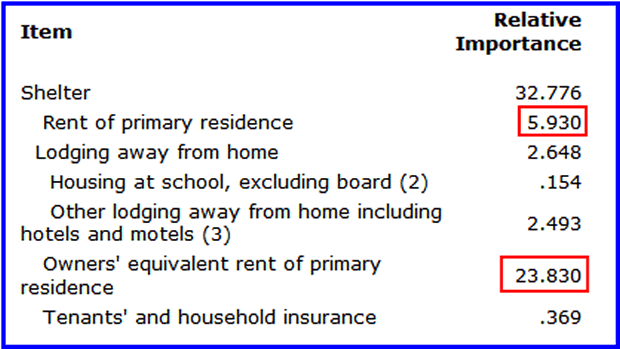

Rents, which make up almost 40 percent of the core CPI, fell. Owners-equivalent rent, one of the categories used to track rental prices, decreased 0.1 percent, the first drop since 1992.

Although new claims are falling, they are still above 500,000 and businesses are still reluctant to hire. The combination certainly suggests higher unemployment numbers coming up.

I do expect food prices to continue to decline; However, the most interesting thing in the report is that rents fell for the first time in 17 years. Let's take a look at just how realistic that is.

OER From Twilight Zone

Please consider a few snips from Bill Gross Bets On Deflation written September 29, 2009.

Rents Falling Everywhere

Given that the official measure of CPI is based on rents not housing prices, please consider the following collection of links courtesy of Lanser on Real Estate: Really? Rents fall almost everywhere.

- Manhattan:Apartment Rents Drop as Employers Cut Jobs

- Houston: Renters are snagging deals in a slowing local market

- Tuscon: On your mark, get set, go! Apartment firm makes game of it.

- Nashville: Apartment rates squeezed by lower demand

- Nationwide: Renters look for thirfty comfort, not style

- Tokyo: Apartment rents under pressure

- Middle East: 17% fall in rents seen in Qatar this year

- Orange County: O.C. renters get twice the freebies

New York City Landlord Chimes In

On August 27, I received an email from a landlord in New York City about falling rents and concessions. Please consider a snip from Landlord From NYC Chimes In On Falling Rents.

Hi Mish,

I'm a landlord here in NYC (as well as an avid reader of your blog) and I actually feel the 7-10% drop mentioned in the article understates the case somewhat. Based on what I'm experiencing, I'd say that rents are down 10 to perhaps as high as 20% from their peaks.

With that backdrop let's take a closer look at the reported numbers.

Consumer Price Index For September 2009

Inquiring minds are investigating the Consumer Price Index For September 2009

On a seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in September, the Bureau of Labor Statistics reported today. The increase was less than the 0.4 percent rise in August. The index has decreased 1.3 percent over the last 12 months on a not seasonally adjusted basis.

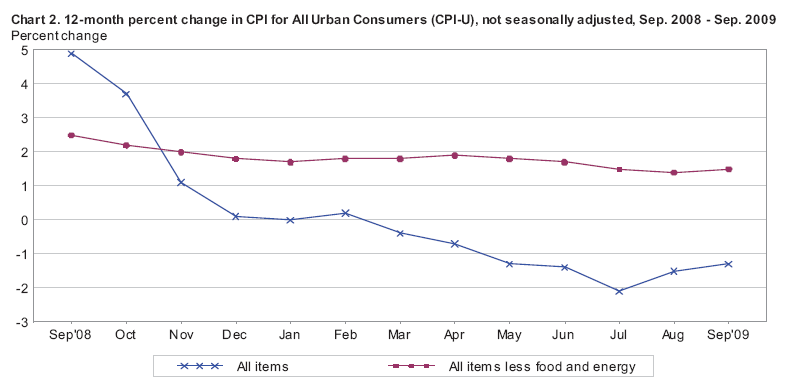

CPI-U 12 Month Percent Change

CPI has been negative for 7 consecutive months at right above 0% for another 3 months. Moreover, those numbers are overstated because rents have been dropping for quite some time but the BLS has somehow missed it.

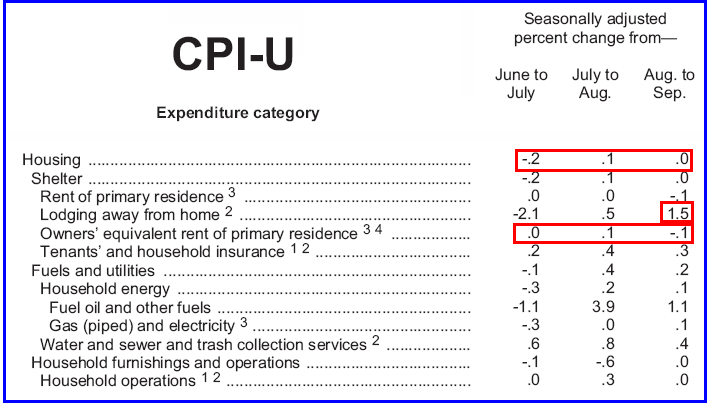

Housing Components of CPI

Relative Importance Of Shelter Components In The CPI

One quick look at the the above data should be enough to convince anyone that the CPI is as much overstated now as it was understated in previous years.

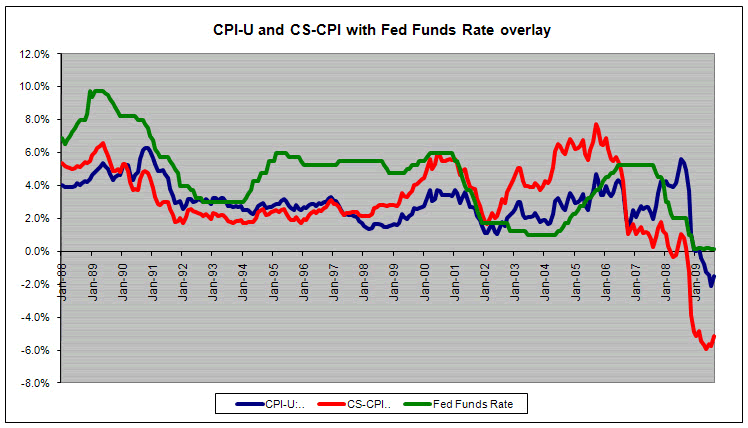

Case-Shiller CPI

Moreover, given that housing is realistically a consumable item I have the year over year Case-Shiller CPI at negative 5.1% (prior to this release).

Since the Case Shiller housing market peak in June 2006, OER is up +7.7%, while the Case-Shiller index is down -30.9% - an amazing 3860 basis point divergence!

CS-CPI YOY has now fallen for 11 consecutive months and 14 of the past 18. Meanwhile the government's CPI-U YOY has fallen for 6 consecutive months.

The Case-Shiller CPI is formulated by substituting Case-Shiller housing prices for Owners' Equivalent Rent in the official release. See above link for details.

Whether purposeful of not, the effect of all these distortions is an unrealistically high CPI now (even by the BLS' preferred OER method) vs. an unrealistically low CPI in prior years.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.