What Happened to the Stock Market Crash?

Stock-Markets / Financial Markets 2009 Nov 07, 2009 - 01:10 AM GMTBy: Nadeem_Walayat

Dear Reader

Dear Reader

The big news of the week was the U.S. unemployment rate breaking above 10% to the highest rate in 26 years with all the expectations of the jobless recovery continuing well into 2010. Other news out of the U.S. came from the Fed confirming the view that U.S. Interest rates would be kept low for sometime.

Meanwhile in Britain the Bank of England announced that it will print a further extra £25 billion to keep the mild economic recovery chugging along into a May 2010 General Election, bringing the total now to £200 billion. Back in July 2009 the consensus was that the Bank had halted its Quantitative Easing programme at £125 billion.

i.e.

Telegraph - 10th July 2009 - Bank of England indicates an end to quantitative easing

Daily Mail - 9th July 2009 - Bank of England turns off printing presses on 'quantitative easing' …

Independent - 10th July 09 - City is caught by surprise as Bank stops 'printing money'

QE now at £200 billion illustrates the lemming like behaviour of the mainstream press that tend to act like sheep baahing in the same direction, though if they actually took the time to analyse the situation then maybe they would come up with a more accurate conclusion ?

At the time in the analysis - Irrelevant UK Base Interest Rate on Hold as Real Rates have Already Begun to Rise, I concluded that it was not possible for the Bank of England to halt money printing at the then current level of £125 billion and most likely the total would hit £250 billion by year end.

Financial Market Trends and Forecasts Update

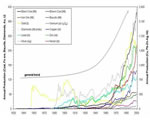

Last weekends in depth analysis (Stocks, Dollar and Gold Bull Markets Inter-market Analysis) gave updated projections for key markets into the end of 2009 and early 2010 as summarised below:

Gold Targeting $1200 by March 2010 : $1,096 ($1,046) + 4.8%

Gold is performing strongly as a consequence of the breakout from a near 30 year trading range. The Bull scenario remains in tact as long as $1020 holds.

Dow Targeting 10,350 to 10,500 During December 2009 :10,023 (9,712) + 3.2%

The price action remains for the Dow to exhibit a volatile trend into year the end target. The risk of 9430 breaking has diminished a little, but remains a possibility until the Dow breaks above 10120 which would effectively set the floor in the range 9700 to 9430.

What happened to the Crash ? Octobers over bearing bearish calls emanating right from the top of the analyst food chain as my recent article on Nouriel Roubini illustrated, the bears must be eyeing hibernation if 10120 breaks? Next week should prove interesting, though I suspect a Dow new 2009 high may be accompanied by the game of stock index musical chairs i.e. Forget the Dow and pick an index that has NOT gone to a new 2009 high to cling on for a while longer.

In Summary - 10,120 break is required to confirm this weeks apparent strength, though not far, only 100 points.

USD Targeting 84 during December 2009 : 75.90 (76.36) - 0.6%

In one word, WEAK, Whilst the previous low holds the bullish scenario manages to remain in tact.

Question from DPM - On dollar - Your prediction related to dollar multi-month up cycle is not sync with long upcycle run on Dow. They are inversely related. Your article on 'Aug 24, 2009' told about 10K level on DJIA and bull run for dollar( dollar index was around 77.5). Dow went higher and dollar went down(75).

I respect your views but hope to get more clarity regarding Dow when dollar reaches 90.Similar question was also asked on 'Aug 24, 2009' by another reader.

Answer - USD has shown weakness, it is not rallying, last weeks analysis revised this years target to 84. The focus of analysis is on the actual market rather than any suggestive inverse relationship. I would NOT be surprised that in a time when virtually everyone believes and alludes to the Dow / USD inverse relationship that it is at THIS TIME that it breaks down, which is why one needs to primarily keep focus on the actual market being traded.

Want more forecasts to help make your mind up ?

Robert Prechter of Elliott Wave International has given access to all of our readers to no less than EIGHT reports, including their current monthly issues of the Elliott Wave Theorist and Financial Forecasts as well as the short-term updates. Access is only available for a short period of time so ensure to download at your earliest!

Source: http://www.marketoracle.co.uk/Article14855.html

Your analyst.

Nadeem Walayat

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. The Government Will Default on Its Debts |

By: Gary_North

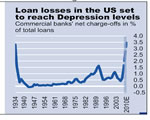

The governments of every major nation are going to default on their debts. There are two relevant questions: (1) How? (2) When?

Establishments around the world all deny this. They have gained power and wealth by means of the expansion of government. They have justified their success by insisting that the government-business alliance is the only way to establish economic growth and economic security for the masses. This claim rests on a more fundamental claim, namely, that an unhampered free market is destructive of economic stability and will inevitably lead to economic depression.

| 2. How and Why China Will Flood the Gold Market |

By: DailyWealth

Jeff Clark of Casey Research writes: As you read this, the Chinese government is doing an extraordinary thing... something nearly unheard of in the modern world.

It is encouraging citizens to put at least 5% of their savings into precious metals.

| 3. Telegraph UK House Price 55% Crash Forecast Revisited |

By: Nadeem_Walayat

Back in March if this year the Telegraph and other mainstream media ran with a scare story that UK house prices could crash by a FURTHER 55%, this was after UK house prices had already fallen by 22% and whilst house prices had yet to bottom the Telegraph story at the time seemed to be a completely ridiculous scare mongering purely for the purpose of sensational headline grabbing rather than presenting something that their readership could utilise to their advantage.

| 4. Nouriel Roubini's 2009 Stock Market Calls Track Record |

By: Nadeem_Walayat

Nouriel Roubini, Dr Doom the academic economist who has repeatedly peddled the stocks bear market case to a captured audience of naive investors has again come out with another in a series of Doom stories to scare investors away from the market.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Is Debt-Deflation Economic Depression Just Beginning? |

By: Mike_Shedlock

Last Thursday I received an email from David Meier, Associate Advisor at the MotleyFool concerning Debt-Deflation.

David asked if I had any comments on his article Debt-deflation: Just the beginning? Here is a partial listing:

| 6. Stocks, Dollar and Gold Bull Markets Inter-market Analysis |

By: Nadeem_Walayat

This analysis seeks to update the trend prospects for all three major markets into at least the end of this year by taking into account their inter-market relationships which should resolve in a more accurate projection for each individual market.

| 7. United States Catching the Argentinian Economic Disease of Hyperinflation? |

By: John_Mauldin

I have been in South America this week, speaking nine times in five days, interspersed with lots of meetings. The conversation kept coming back to the prospects for the dollar, but I was just as interested in talking with money managers and business people who had experienced the hyperinflation of Argentina and Brazil. How could such a thing happen? As it turned out, I was reading a rather remarkable book that addressed that question. There are those who believe that the United States is headed for hyperinflation because of our large and growing government fiscal deficit and massive future liabilities (as much as $56 trillion) for Medicare and Social Security.

| Subscription |

How to Subscribe

Click here to register and get our FREE Newsletter

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.