Gold Contrarians Will Get Killed

Commodities / Gold & Silver 2009 Nov 20, 2009 - 09:40 AM GMTBy: Jordan_Roy_Byrne

In the last ten years, the financial world has experienced quite a few bubbles. Ten years ago there was the tech bubble. Then the housing bubble. And then the credit bubble. There was an Oil bubble too. With all these bubbles popping up, so to has an increase in bubble calling and contrarian thinking. As a result, sentiment analysis has become more popular.

In the last ten years, the financial world has experienced quite a few bubbles. Ten years ago there was the tech bubble. Then the housing bubble. And then the credit bubble. There was an Oil bubble too. With all these bubbles popping up, so to has an increase in bubble calling and contrarian thinking. As a result, sentiment analysis has become more popular.

One has to look at three things: fundamentals, technicals and sentiment. For contrary thinking (in terms of sentiment) to be most powerful, either technicals or fundamentals need to agree. As an example, I anticipate a reversal when sentiment is overly bullish and that market is running into technical resistance. Just because sentiment is bullish, doesn’t mean a reversal is coming.

The reality however and this is very important to understand, is that sentiment follows the trend most of the time. A secular bull market evolves as more and more people become bullish and invest in that market. Over time, sentiment is going to be more bullish because there are more participants in that trend. That is what causes higher prices. It is the very nature of a major bull market for sentiment to be bullish.

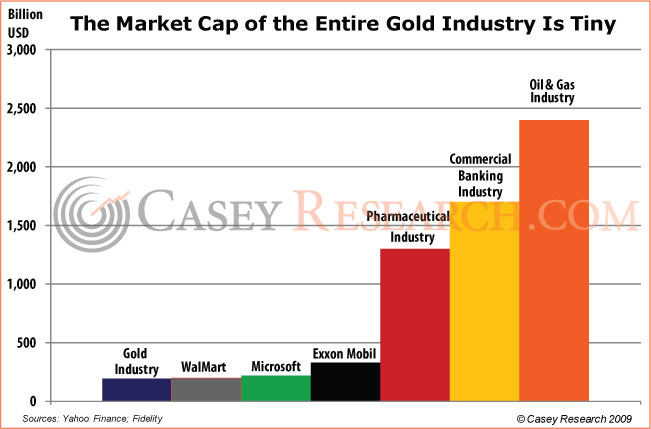

First, let me debunk the bubble callers and those who say Gold is a crowded trade. I’ve heard at least three different people say this. Google that and you’ll be amazed at the number of results. Here are some excellent charts.

The first chart I saw in an editorial from Puru Saxena, here: http://www.321gold.com/editorials/saxena/saxena111309.html

The second chart is c/o of Casey Research, which I saw in an editorial by Chris Puplava here: http://financialsense.com/Market/cpuplava/2009/1118.html

Does it look like the Gold market is anywhere remotely close to a bubble? Apparently, the bubble callers and crowded trade folks haven’t done their research. Doesn’t look crowded to me.

Even if a few more people own gold, my bet is that they don’t own enough of it. Gold is under-owned. John Paulson, the great hedge fund manager is pretty bullish on Gold, but he doesn’t own much more than 10% in his fund. (Perhaps that is why he’s starting a Gold fund). Dennis Gartman, I believe only owns around 5% (He’s said so on television). Months ago, Steve Leuthold was on Bloomberg and he was bullish on Gold but said he only owned 1-2%. A time ago, most folks would have 10% of their worth in Gold, whether it was in a bull market or not. Most people who own gold investments, don’t own enough.

Moving along, it is important to understand the technical ramifications of Gold’s move past $1000/oz. A market that breaks free from a multi-decade base is a market that shoots much much higher. There are numerous examples of this but we’ll discuss only two.

Oil had traded between $10 and $40 for nearly 25 years. It broke past $40 and we all know what happened in 2008. In just a few short years the market rose nearly 300% following the breakout.

Then there is the Dow Jones breakout in 1983. The market consolidated underneath 1000 from 1966-1982. It brokeout in 1983, retested the breakout and then ran to 2700. The markets 3-year run from mid 1984 to mid 1987 was probably the strongest three year run it had dating back to 1933. The market advanced 170% in four years.

Gold has followed a similar pattern, if you use $700-$730, the monthly resistance. Gold broke past that in 2007 and then retested it in 2008. The breakout past the 2008 high confirms that Gold is in new territory. Judging from history (and there are many examples), Gold is at the start of a major move higher. Our target for this move is $2,100-$2,300 in the next 12 months.

It is interesting how these major breakouts occur at a time when fundamentals are their strongest. How can anyone call Gold a bubble when gold production continues to decrease? How can anyone call Gold a bubble when monetization is rampant? How can anyone call Gold a bubble when the FHA and FDIC will need to be bailed out? How can anyone call Gold a bubble when the US deficit is in the trillions of dollars? The deflationary forces plaguing us are bullish for Gold. That is what the market is saying and that is how traders and investors are reacting.

There is a reason the recognition phase in a bull market comes after that major breakout. Humans are reactive and when it comes to the markets, they follow the herd. It is only after price breaks out do the fundamentals become so obvious. The views of the bubble callers and wanna be contrarians are baseless, misguided and ironically, coming at the worst possible time.

Good Luck and Good Trading!

For more information on our Gold/Silver stock newsletter and examples of accurate real time sentiment analysis, please visit: http://www.trendsman.com/Newsletter/GSletter.htm

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.