HSBC Says "Get Your Gold the Hell Outta Here!”

Commodities / Gold and Silver 2010 Jan 08, 2010 - 02:02 PM GMTBy: Casey_Research

Doug Hornig writes: That’s the directive that came down from HSBC USA in late November.

Doug Hornig writes: That’s the directive that came down from HSBC USA in late November.

It seems that everyone these days wants gold. Real, physical gold coins that they can hold in their hands, or bars that they’re assured are resting safely in a well-guarded vault. HSBC’s New York vault, for example, buried deep below its 5th Avenue tower, where it has stored people’s gold since it inherited the facility from Republic Bank a decade ago.

But no more.

HSBC has served notice to its retail customers – many of whom are simply middle-men and custodial services which store gold with HSBC on behalf of hundreds of their own account holders – that all their gold must be out of its facility by July 2010. Otherwise, folks, prepare for an unwelcome knock at your door. HSBC’s letter says that, in the absence of directions to the contrary, clients’ metal “will be returned to the address of record... at your expense.”

Picture, if you will, what the Wall Street Journal reported: “fleets of armoured cars laden with gold ferrying the precious metal out of New York.”

Where to? That’s a good question. One destination is a pair of warehouses operated by FideliTrade, the parent company of Delaware Depository Service Co. Its vaults in Wilmington have been filling up quickly, leading Jonathan Potts, the managing director, to comment that, "I have never seen any relocation like this.” Other depositories have seen a similar run.

The logic behind HSBC’s decision, according to the Journal, is simple. The vaults are being cleared of smaller clients in order to make more room for institutional holdings, because “retail customers tend to be more expensive [to service] in part because of their diverse holdings. They usually buy American Eagle or Canadian Maple Leaf coins, and bars of various weights and sizes, all of which need to be categorized and stored separately. In contrast, institutions typically buy standardized bars of 100 or 400 ounces, making them easier to store. Institutions also tend to hold the metal for long periods.”

HSBC itself didn’t say why it’s doing this (in fact, its letter wasn’t intended for public release). So, predictably, the Internet exploded with rumors that its action had more sinister motives.

Chief among them has been the tungsten story. That one, in case you haven’t already heard it, maintains that a foreign gold buyer – some say Indian, some say Chinese – found to its dismay that bars it recently purchased were merely gold-plated tungsten. (Tungsten would be the metal of choice for a counterfeiter because it’s the closest metal to gold in specific gravity, and can fool the most basic test for purity.) Some go as far as to claim that Fort Knox is full of fakes, deliberately placed there to make our official stash appear bigger than it is. A suspicion that’s easily stoked since no outside auditor has inspected U.S. gold holdings in over 50 years.

Be that as it may, the latest rumor claims that the appearance of tungsten bars at this time is going to cause widespread chemical testing of gold bars, and HSBC doesn’t want to be caught with anything bogus. Thus they’re preemptively moving their gold out, protecting themselves and at the same time laying off the need to do any testing onto someone else.

This is a great tale, but it ignores the fact that it’s largely coins and small bars that are being moved, and those are not cost effective to counterfeit in tungsten. In addition, that the story is presently confined to the Net means it’s fiction until proven otherwise. As Ed Steer – GATA activist and author of Casey Research’s Gold and Silver Daily – points out, “If it were true, Bloomberg would be all over it in a heartbeat.”

Or someone would. And even if the mainstream media failed to do their job, there’s still the absence of a smoking gun. Who’s seen the tungsten bars? What are the names of officials who can confirm the fraud? Why aren’t the Indians who’ve been ripped off waving the phonies in front of a TV camera? These questions don’t yet have satisfactory answers. Thus the rumor will have to remain just that.

Rumor #2: HSBC has less gold on deposit than it promises, and it’s doling out what it does have to its best friends. This one might make some sense if HSBC were getting out of the gold business entirely. But it isn’t. And if it does have any physical shortages, it can cover them indefinitely with paper “equivalents.”

Rumor #3: HSBC is going under. Those storing large amounts of gold know it, and they’re protecting their assets from future claims by creditors. HSBC is hiding the mass exodus of gold by claiming to have ordered it. No way to confirm this, of course, but the volume of gold that’s leaving means an awful lot of people know what’s happening. Word of the bank’s fragility would surely have leaked out by now. That it hasn’t makes this one highly doubtful – not to mention that HSBC likely falls into the “too big to fail” category and would be propped up if it faced collapse.

Rumor #4: The most outlandish of all. Under this scenario, Washington suspects an attack in conjunction with the terrorist trials, and it’s ordered gold moved out of New York so it isn’t contaminated in the event of a dirty bomb. (Those with the deepest, darkest level of cynicism claim that this would also provide the government with a handy excuse to default on foreign claims to physical metal – as in, sorry, it’s gone, but here’s what you’re owed in dollars.)

All of these make for spicy Web chatter, but after checking with our own sources, we believe that the truth is far more mundane, yet quite exciting in its own right. In essence, we think the WSJ’s analysis is pretty close, with a twist.

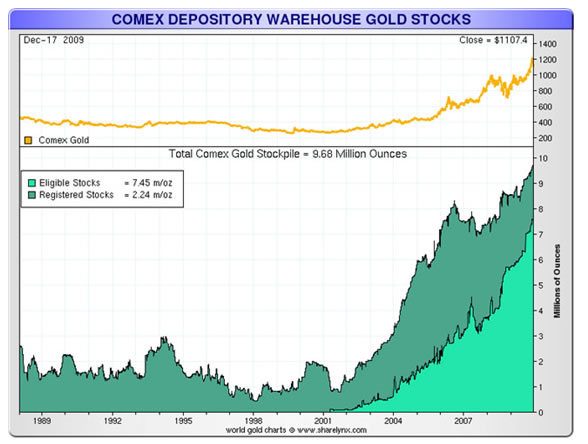

It all has to do with the COMEX. That exchange, which handles futures activity in gold, has to maintain a cache of metal with which to settle trades. As a courtesy, it will also arrange to store gold for buyers who don’t want to take physical delivery. But it has no vaults of its own. It contracts with four banks to do the actual storage, though only two maintain significant amounts: of the 9.73 million ounces of COMEX gold, Scotia Mocatta has the most, nearly 5.1 million; HSBC USA is next, with over 4.1 million.

The amount of gold warehoused by the COMEX has exploded since the metal’s bull run began in 2001, as you can see from the following chart (where “registered stocks” are sitting there with someone’s name already on them, and “eligible stocks” are awaiting either registration or delivery):

The trend is obvious, and what it means is that HSBC needs an ever-increasing amount of space for its COMEX gold. Provided, of course, that the trend remains in place. Or accelerates.

HSBC has cast its vote. It clearly believes that it’s going to be getting more gold from the COMEX, maybe a lot more, and it’s making room by giving the boot to other depositors. Perhaps the bank knows something we don’t know, or perhaps it’s just acting out of reasonable expectation.

Either way, it’s telling us that the demand for gold is going to continue rising. And coming from a major bullion bank, that’s about as bullish a signal as anyone could want. If you don’t own any physical gold, it’s time.

Right now, gold is a bit off its recent highs… so, as believers in sound money, the Casey folks are stocking up on their yellow metal before its price resumes its journey to the moon. This is the time to learn everything you can about how and from whom to buy gold, where to safely store it, gold proxies, and major gold stocks. Check out Casey’s Gold and Resource Report risk-free for 3 months – it’s only $39 per year, a mere pittance for what you’ll get out of it. Click here to learn more about gold and gold’s “slingshot effect.”

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.