Gold Technically Damaged But Fundamentals Remain Sound

Commodities / Gold and Silver 2010 Feb 08, 2010 - 05:48 AM GMTBy: GoldCore

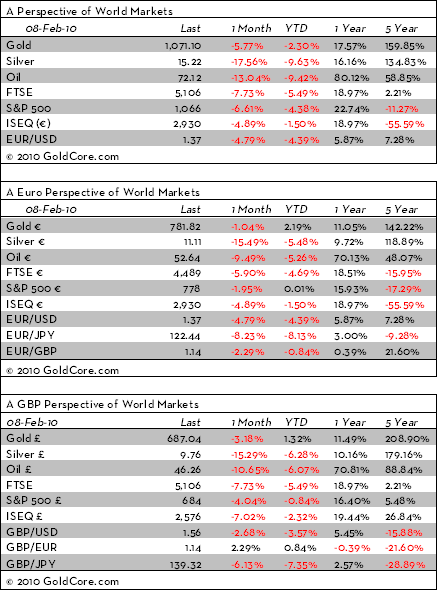

Gold closed lower in US trading on Friday at $1,057/oz. It traded sideways in Asian trading prior to jumping from $1,066/oz to $1,073.50/oz in early trade in Europe. Gold is currently trading at $1,070.20/oz and in euro and GBP terms, gold is trading at €783/oz and £688/oz respectively. Gold's 2.7% fall (in US dollars) last week led to further technical damage and may embolden some traders to short the market.

Gold closed lower in US trading on Friday at $1,057/oz. It traded sideways in Asian trading prior to jumping from $1,066/oz to $1,073.50/oz in early trade in Europe. Gold is currently trading at $1,070.20/oz and in euro and GBP terms, gold is trading at €783/oz and £688/oz respectively. Gold's 2.7% fall (in US dollars) last week led to further technical damage and may embolden some traders to short the market.

However, the supply demand fundamentals remain sound and could see gold supported above previous resistance at $1,030/oz. Especially as interest rates remain near zero and macroeconomic and systemic risk remains elevated. Safe haven investment demand may be boosted by sovereign contagion risk.

While European stock markets have eked out gains this morning, concerns of financial contagion due to the risk of a large sovereign default linger. This may lead to continuing risk aversion until these concerns are allayed. While all of the focus has been on European sovereign debt issues, it should be remembered that the US faces similar challenges (both at national and state level as in California) and Treasury Secretary Geithner yesterday sought to dispel concerns regarding the US budget deficits and federal deficit by saying that the US would "never" lose its AAA credit rating (see news below).

Gold may also be supported by renewed tensions over Iran's nuclear programme. Iran has announced immediate plans to step up its nuclear programme, which some Western nations fear could be used to make a nuclear bomb. Iran's nuclear chief said that they would start enriching uranium to 20% from Tuesday, and that 10 new uranium enrichment plants would be built in the next year.

Silver

Silver began at $15.10/oz in Asia and has moved upwards since. Silver is currently trading at $15.25/oz, €11.12/oz and £9.78/oz.

Platinum Group Metals

Platinum is trading at $1,488/oz and palladium is currently trading at $404/oz. Rhodium is at $2,400/oz.

News:

The euro hovered above an eight-month low in late Asian trade after eurozone finance chiefs reassured their Group of Seven counterparts over Greece's deepening debt troubles. Some dealers said the European currency received a modest boost from remarks by eurozone finance officials at the G7 talks in Canada on Greece's efforts to rein in its public debt of more than €294 billion.

Sterling tumbled to an 8 1/2-month low against the dollar on Monday as the pound bore the brunt of risk-aversion selling triggered by jitters about the fiscal health of some euro zone countries and the UK itself. Worries about how European states will service their debts have prompted investors to cut their exposure to risky assets, including those denominated in sterling, which has been battered in recent weeks. Analysts said sterling may come under more selling pressure as broad concerns about sovereign debt highlight Britain's own grim fiscal position and lead to further risk aversion.

The US and UK are proposing imposing forward-looking levies on banks to help insure the global economy against financial crises, officials said after a Group of Seven (G7) meeting in Canada.

US Treasury Secretary Timothy Geithner said the U.S. government "will never" lose its sterling credit rating despite big budget deficits and a newly increased debt limit that now tops $14 trillion. Geithner said that in times of economic crisis, international investors will continue to buy U.S. Treasury bonds because the bonds are a safe investment.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.