Gold Rises on Increased Monetary Risk

Commodities / Gold and Silver 2010 Feb 15, 2010 - 06:18 AM GMTBy: GoldCore

Gold rose 3.4% last week closing at $1,088.20/oz on Friday and gold also rose in other major currencies. The higher weekly close in all currencies may embolden traders and investors to buy gold again after gold’s most recent sharp selloff. Those holding large short positions will also be nervous and could cause a short covering rally. Gold has risen in Asian trading before giving up early gains and then surged again in early European trade. Gold is currently trading at $1,100.20/oz and in euro and GBP terms €807.47/oz and £701.73/oz respectively.

Gold rose 3.4% last week closing at $1,088.20/oz on Friday and gold also rose in other major currencies. The higher weekly close in all currencies may embolden traders and investors to buy gold again after gold’s most recent sharp selloff. Those holding large short positions will also be nervous and could cause a short covering rally. Gold has risen in Asian trading before giving up early gains and then surged again in early European trade. Gold is currently trading at $1,100.20/oz and in euro and GBP terms €807.47/oz and £701.73/oz respectively.

U.S. markets are closed for Presidents' Day and many Asian markets, including Hong Kong, Shanghai, Singapore and Seoul are closed for the New Year Lunar holiday.

Fiscal problems in the Eurozone continue to dominate and have seen the Euro remain under pressure, especially versus gold. Gold closed last week above the important psychological level of €800/oz which is bullish from a technical point of view. Given the degree of the fiscal problems in the Eurozone the likelihood that it will take months (if not years) to recover from these problems, gold should challenge its record nominal high of €813/oz and then the next psychological level of €850/oz.

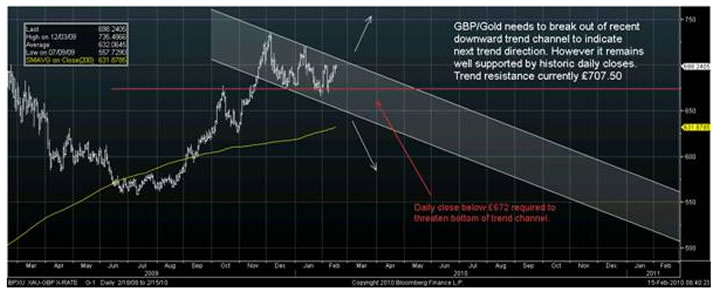

Sterling too has come under pressure and sterling gold has surged to over £700/oz. Worries over Greece, Spain, Portugal, Italy and Ireland are outweighing the increased concerns about the UK economy.

Gold’s record high in sterling terms was in December 2009 when it reached £735/oz. Trend resistance is currently around £707/oz and a closing price above this level could see gold rechallenge the recent record nominal sterling gold high. Especially as the UK’s fiscal position is also very poor and the coming political uncertainty of a general election will likely see sterling come under pressure.

Silver

Silver rose 4% last week (in its usual leveraged to gold manner) and is currently trading at $15.60/oz, €11.42/oz and 9.92/oz.

Platinum Group Metals

Platinum is currently trading at $1,519/oz, palladium at $414/oz and rhodium at $2,350/oz.

News

· EU finance ministers are to discuss a financial rescue package for Greece when they meet in Brussels later today. There are concerns that further pressure could be put on the euro, which fell to a nine-month low against the dollar on Friday. ECB President Jean-Claude Trichet said debt-ridden Greece must strengthen its auditing procedures and said that using unverified figures 'should not have been tolerated'.

· Oil slipped to near $74 on Monday after stronger-than-expected Japanese growth data was overshadowed by concerns rising energy demand could be curbed by China's moves to tighten monetary policy.

· Iran is "becoming a military dictatorship", US Secretary of State Hillary Clinton has said, during a tour of the region. She said Iran's elite army corps, the Revolutionary Guard had gained so much power they had effectively supplanted the government.

· Japan's economy grew by 1.1% in the final three months of last year takes in large part to government stimulus measures to prevent deflation. Despite the growth in October to December, the economy contracted by 5% over the whole of 2009. The figures mean Japan remains the world's second biggest economy, although China is drawing level and is expected to overtake soon.

Data Today

· There is no significant economic data scheduled for release today, although investors will be keeping an eye on Tuesday's UK inflation data and Wednesday's unemployment report.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.