The Dubai Hainan Connection: The Millionaire Speculators of Wenzhou, China

Housing-Market / China Economy Mar 17, 2010 - 07:22 AM GMTBy: Mario_Cavolo

What does Dubai have in common with Hainan Island, China?

What does Dubai have in common with Hainan Island, China?

Answer: China's infamous millionaire real estate speculators of Wenzhou. I was recently pointed to a juicy background story at India Times of global property speculation leading from Wenzhou across the globe to Dubai and then back to Hainan Island where just one month earlier, the Wenzhou gang descended upon this tropical island paradise in a well-timed frenzy of property speculation, even by fast-rising Chinese property market standards.

From the India Times Article:

Millionaires from the isolated coastal city of Wenzhou, a centre of Chinese private enterprise, have fanned out across China and overseas over the last decade in search of property that they buy, and often quickly resell at a profit.

They may collectively face about 1 billion yuan ($146.5 million) in losses as the Dubai real estate market contracts, the head of the Wenzhou SME Business Development and Promotion Association said on Wednesday.

This story broke back in December revealing that in fact it was Wenzhou native Hu Bin, chairman of Shanghai Zhong Zhou Group, who laid out $28 million to purchase one island of the World Islands project set for luxury development and now looking more like a desert mirage. Post Dubai crash, Wenzhou investors are looking for the bargains there once again. "Since the recession on real estate in Dubai, I've led three groups of investors to Dubai to investigate properties," said Chen Zhiyuan, the president of Wenzhou Chamber of Commerce in the United Arab Emirates. According to a February report in China Daily, "Wenzhou, China's private capital powerhouse in the southern province of Zhejiang, is among the richest areas in the country and the birthplace of self-made billionaires who are manufacturing clothes, shoes, and other small commodities like lighters."

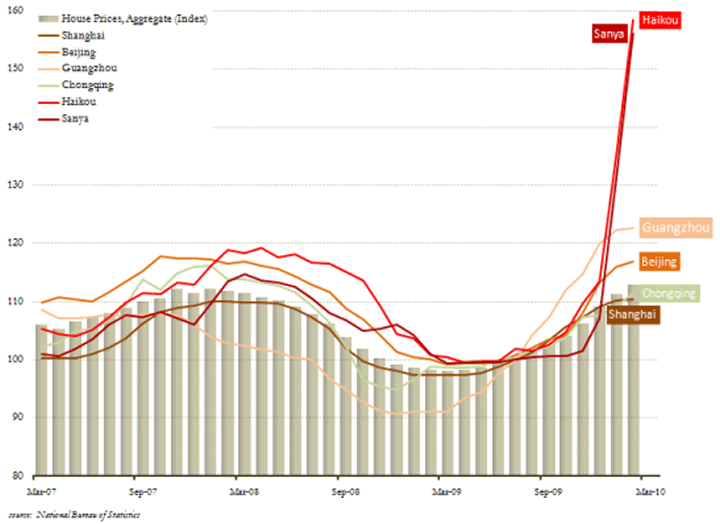

Chart from a related article at Business Insider

In an effort to identify where else the Wenzhou investment groups may be targeting for their investment hoards, we dig deeper to find a recent yet poorly translated article at www.kinablog.com , where we find the following:

Follow up:

Wenzhou hot money fled to the top of the boom in house prices in Hainan, Wenzhou, real estate speculators group is the initiator of the short-term speculation, but also the main force. However, according to investigation by the reporter, short-term access to huge profits, they chose the fast retreat.

And from Global Times - "Wenzhou...makes up half the housing sales"

"Buyers are mostly outsiders, including from Beijing, Shanxi, Jiangsu and Zhejiang, according to the Jintai Real Estate sales manager. And group purchases, especially those made by people from Wenzhou, a booming city in Zhejiang, could make up half of the housing sales, he said."

So there you have it folks; more rich people, in this case the Wenzhou real estate speculators making their speculative moves, swooping down Dubai-style on Hainan Island to suddenly raid, goose and disrupt market values to grab their profits and head home.

More so, this kind of real estate action only further reminds us of the bubbly real estate expansion taking place in China. A report from New York based broker Cushman & Wakefield indicates China overtook the US as the world’s top property investment market last year and did so with the expectation the market will remain strong even with lower reliance on debt for property financing. They say real estate investment in China more than doubled to $156.2 billion last year, while the total for the US slumped 64% to $38.3 billion. No question which side the bread is buttered on.

So do the innocent folks who got excited and hopped on a plane to Hainan Island to line up behind the wizards of Wenzhou find themselves left holding the bag? It seems so as prices have already begun cooling back down 20% according to several nice oceanfront property listings I am aware of locally along with real estate sales centers sans customers. The annual Chinese New Year season of joy, family harmony and propaganda winds down once again.

Silly me, back in my Sanya 3rd Quarter Real Estate Review I called the market top in property when prices were already a ridiculous 25-35,000rmb per square meter for the prime luxury properties in the area. Well I obviously got my head handed to me on that one courtesy of the wizards of Wenzhou creating this bizarre Macau style sucker's frenzy. That's good for innocent folks who were already holding property and find their values higher but bad for the folks who bought from the Wenzhou landlords who were buying and selling before the ink was dry and hopping the plane back to Wenzhou all the richer for their infamous exploits.

What more does Dubai have in common with Hainan Island? Due to the still relatively low levels of financing required for most of China's property purchases, hopefully not the bust that followed. If you're loaded up with credit card debt and having trouble getting by on $50,000 per year, just come to China and then you'll really feel poor.

By Mario Cavolo

Biography: Mario Cavolo has been based in China for over 10 years. He is a professional speaker, writer and media event personality providing multinational and media industry clients with training, coaching, communication, market research and advisory services. Take advantage of 7Mario’s “on the ground” China insights by visiting www.mariocavolo.com, where you will find insightful articles and commentary on business challenges, communication, and global market advisory with a special focus on China business and culture.

© 2010 Copyright Mario Cavolo - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.