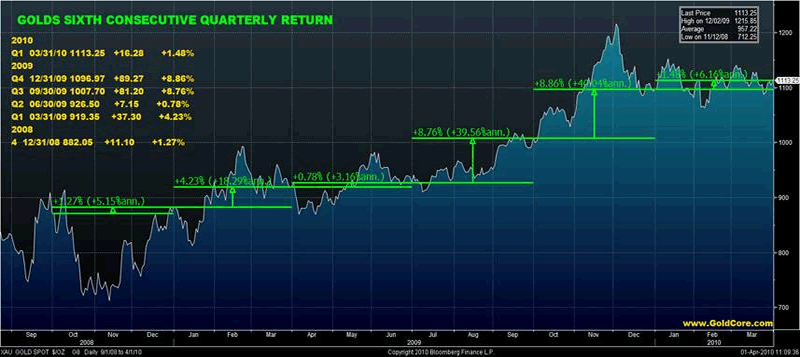

Q1 2010 - Gold +1.5% and Silver +3.5% - Gold's Sixth Consecutive Quarterly Advance

Commodities / Gold and Silver 2010 Apr 01, 2010 - 11:15 AM GMTBy: GoldCore

Gold jumped to as high as $1,118/oz in New York on the surprisingly poor jobs number before dropping slightly to close with a gain of 0.86%. It has since risen from $1,112/oz to $1,118/oz in Asian trading this morning. Gold is currently trading at $1,117/oz and in euro and GBP terms, gold is trading at €827/oz and £734/oz respectively.

Gold jumped to as high as $1,118/oz in New York on the surprisingly poor jobs number before dropping slightly to close with a gain of 0.86%. It has since risen from $1,112/oz to $1,118/oz in Asian trading this morning. Gold is currently trading at $1,117/oz and in euro and GBP terms, gold is trading at €827/oz and £734/oz respectively.

While the euro and dollar are relatively flat, the bond market (US) is under pressure again today and this and higher oil (nearing $85 a barrel) and commodity prices has contributed to gold's strength. Support is at $1,100/oz and gold's resistance is at $1,130/oz and a break above that level could see us quickly challenge the $1,145/oz level.

Gold rose on a poor jobs number yesterday. On a few occasions recently gold fell on a poor jobs number and this was blamed on risk aversion. But the poor jobs number led to risk aversion and a lower dollar and higher gold yesterday. Further negative economic data could see the dollar come under pressure again and lead to gold rising to challenge the recent nominal high.

Gold recorded its sixth consecutive higher quarterly close yesterday (see table) which is important from a technical perspective. Gold's medium and long trend remains up and gold remains in a bull market. The rise of gold has been quite gradual with periods of rising prices followed by lengthy periods of consolidation.

Unlike in the late 1970s when gold rose by more than 100% in three individual quarters. Gold's rise has been gradual and orderly and we have yet to see the speculative mania that was seen in the 1970s. Indeed gold is only marginally above the price that it was six months ago. The bull market in gold is likely to end with very high monthly and quarterly returns and with a parabolic spike and we are a long way from there today.

Those awaiting a much heralded pull back may be advised to dollar cost average and gradually assume a position (thereby ensuring an average price) rather than trying to "time the market" and pick the perfect buy point.

Silver

Silver rose sharply from $17.48/oz to $17.72/oz this morning in Asia. Silver rose 3.56% in the quarter and thus marginally outperformed gold. Silver is currently trading at $17.68/oz, €13.10/oz and £11.62/oz.

Platinum Group Metals

Platinum is trading at $1,648/oz and palladium is currently trading at $483/oz. While rhodium is at $2,600/oz. Palladium for immediate delivery climbed to the highest price since March 2008 in London. The metal gained as much as 2 percent to over $490.00 an ounce at 11:30 GMT.

Palladium and platinum ended the first quarter 17 percent and 12 percent higher respectively.

News

The UK's Royal Mint saw first-quarter gold coin production fall by half from the record levels seen a year earlier according to Bloomberg. The U.K. Mint used 104,007 ounces of silver in the quarter, compared with 102,586 ounces a year earlier. The Austrian Mint (Muenze Oesterreich AG), the maker of the best-selling gold coin in Europe - the Austrian Philharmonic (1 oz to 1 kilo), said last week that sales had fallen 80 percent in the first two months of 2010 after buyers began to regain confidence in the global economy. This shows that sentiment among retail investors remains lukewarm and far from a speculative frenzy and mania levels.

The respected commodities analyst Dennis Gartman has said how he feels the recent allegations of market manipulation in the gold and silver markets seem more substantial. Gartman said in a note "the markets are taking into consideration the reports of "confirmed" manipulation in the gold and silver market. These reports circulate in the precious metals markets from time to time, and we have, over the years, always taken exception to what the conspiratorialists and the GATA people have to say in this regard. However, this time the reports...in a series of e-mails from one gentleman to the CFTC...have a sense of responsibility to them, allowing us to be more concerned about such activities than we have been in the past. If nothing else, the CFTC's commissioners should investigate the allegations being made and do what they can to squelch them."

Bloomberg reports that the World Gold Council and the Industrial & Commercial Bank of China Ltd. plan to develop new gold investment products in China and promote domestic demand for the metal.

Initial claims for US unemployment insurance benefits fell last week to the lowest level this year, the government said Thursday in a report which may signal improvement in the troubled labour market.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.