Euro Gold Near Record Highs Due to PIIGS Contagion Risk

Commodities / Gold and Silver 2010 Apr 23, 2010 - 08:43 AM GMTBy: GoldCore

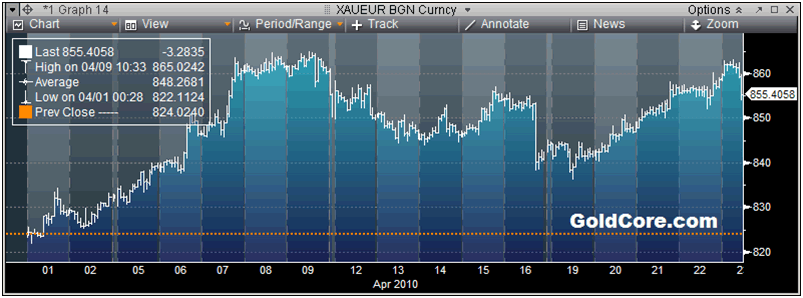

Gold dipped to $1,132/oz in New York before recovering to close with a loss of 0.49%. It has range traded from $1,137.50/oz to $1,143/oz in Asian and European trading this morning. Gold is currently trading at $1,140/oz and in euro and GBP terms, at €859/oz and £741/oz respectively.

Gold dipped to $1,132/oz in New York before recovering to close with a loss of 0.49%. It has range traded from $1,137.50/oz to $1,143/oz in Asian and European trading this morning. Gold is currently trading at $1,140/oz and in euro and GBP terms, at €859/oz and £741/oz respectively.

Gold is being supported as the slow motion train wreck that is the Greek debt crisis rumbles on. The increasing likelihood of a Greek default with wider ramifications for the eurozone and the euro saw gold rise to close to its recent record (nominal) high at €865 per ounce. Greece's deficit crisis is pushing its bond yields close to those of a junk-rated nation such as Pakistan - a country beset with geopolitical instability. Two-year Greek note yields soared to more than 11 percent this morning after Moody's Investors Service cut the nation's credit rating yesterday and the European Union said the country's budget deficit was worse than previously forecast.

The risk of the Greek crisis spreading to other at risk European economies and creating contagion in the debt markets is real and significant. Indeed, a sovereign debt crisis and potential currency crisis would likely have as serious affects as the Bear Stearns and Lehman Brothers collapse. The same complacency that was prevalent prior to the Bear and Lehman collapse is prevalent today as seen in equity markets remaining near multi year highs.

The US Producer Price Index (PPI) for March jumped 0.7% and US wholesale food prices are up 6.8% in the past year. Food prices for the month rose by 2.4%, the sixth consecutive monthly increase and the largest jump in over 26 years. The numbers were worrying as they come at a time of dollar strength. The Reuters/ Jefferies CRB Index (see chart below) shows commodity prices remaining stubbornly high and this is feeding into the price increases. Were the dollar to come under pressure again there is a risk of a price spiral (see News).

US durable goods orders and new home sales may guide markets later today.

Silver

Silver has range traded from $17.90/oz to $18.01/oz this morning in Asia. Silver is currently trading at $17.96/oz, €13.53/oz and £11.65/oz.

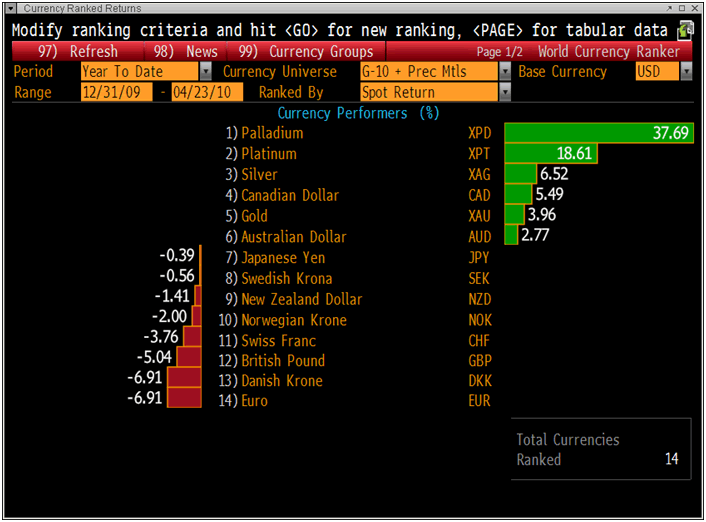

Currencies and Precious Metals Performance (Year to Date)

Platinum Group Metals

Platinum is trading at $1,734/oz and palladium is currently trading at $563/oz. Rhodium is at $2,950/oz.

Platinum and palladium, used in the auto sector and for jewellery, continue to hit pre-recession highs as consumer demand revs up in Asia and internationally and investors bet on a lasting economic recovery. Prices for the two metals are also expected to keep climbing this year, despite some surpluses after massive stockpiling last year when prices were much lower. Platinum, which hit a two-year high of $1,751 (US) an ounce Thursday, is expected to reach up to $1,900 this year, London-based consulting group GFMS said in a report released the same day. Some analysts say the price of platinum could even go higher, driven by investor demand from new exchange-traded funds for the metals that came on the market earlier this year, coupled with the growth of the auto sector, particularly in China.

Prices for palladium, platinum's sister metal, are expected to hit $675 an ounce this year, from about $560/oz today, according to GFMS. Palladium reached a two-year high of $569/oz on Wednesday. Palladium and platinum have risen by about 38 and 19 per cent, respectively, so far this year, compared with a 4-per-cent gain for gold. Palladium is in a better position to grow than platinum this year because it doesn't face the same supply surplus, according to GFMS. Palladium's supply-and-demand balance was even last year was about 7.5 million ounces, while platinum demand of about 6.4 million ounces fell short of 7.3 million ounces of supply.

News

Inflation in the US is deepening as seen in the inflation numbers yesterday. Higher prices for vegetables helped drive US wholesale prices higher by a seasonally adjusted 0.7% in March. The producer price index has risen by 6% in the past year, led by a 23% rise in energy prices, the government agency said. It's the largest year-over-year gain since September 2008. The big story in the March PPI was wholesale food prices, which rose 2.4%, matching the biggest gain in 26 years. Prices of fresh and dried vegetables soared 49.3%, the most in 16 years. Prices of seafood, meat and dairy goods also rose.

Wholesale food prices are up 6.8% in the past year with fresh and dry vegetables up 56.1%, fresh fruits and melons up 28.8%, eggs for fresh use up 33.6%, pork up 19.1%, beef and veal up 10.7% and dairy products up 9.7%.

Gold jewelry demand in India, the world's largest buyer, may have extended gains in the first quarter, according to the World Gold Council. There are signs that jewelry demand in China also climbed in the period, the World Gold Council said in a report on its Web site which was reported by Bloomberg. "In the US, retail activity appears to be improving as the overall economy picks up" and that "may induce higher levels of gold jewelry purchasing than in the previous quarters," it said. "Higher gold prices, however, have resulted in some evidence of demand for lighter weight pieces."

Britain may need to be bailed out by the IMF if the General Election results in a hung Parliament, Ken Clarke warned today. The shadow business secretary said there was a danger that markets would panic if no party had an overall majority after May 6. His comments came with the Lib Dems still riding high in the polls in the wake of Nick Clegg's much-praised performance in last week's first prime ministerial debate. UK Business Secretary Peter Mandelson accused Clarke and the IMF of "talking down" the UK economy.

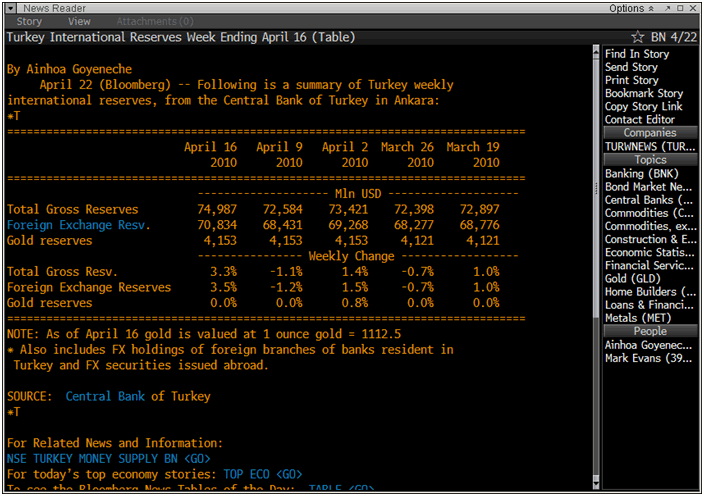

Turkey's gold reserves remained unchanged according to the Central Bank of Turkey and reported by Bloomberg

Summary of Turkey weekly international reserves, from the Central Bank of Turkey in Ankara:

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.