EXTEND & PRETEND: Its either RICO Act or Control Fraud

Stock-Markets / Market Manipulation May 29, 2010 - 06:41 AM GMTBy: Gordon_T_Long

We are entering the Age of Rage.

We are entering the Age of Rage.

It is presently most visible in Europe as austerity programs that potentially could shred a half century of social entitlement advances are met with increasingly violent street demonstrations. It is seen in the US Tea Party rallies with their fury that the very fabric which the US capitalist system is based on is being destroyed and discarded. Unfortunately these demonstrations of rage are focusing on the effects and not the cause. The cause is a systemic plaque of unenforced financial control fraud.

Americans witnessed CEOs arrested during the nightly news coverage of the S&L Crisis of the early 90’s. They were placated as they heard the details of over 1000 indictments of the perpetrators of fraud. In the aftermath of the tech bubble implosion ten years later, injured investors once again witnessed the most senior executives at Enron, WorldCom, Tyco, Qwest and others being led off in handcuffs and disgrace to waiting police cruisers. Retirees with decimated retirement plans felt that some level of restitution had been made when 25 year sentences were meted out to these formerly high-flying felons.

Americans witnessed CEOs arrested during the nightly news coverage of the S&L Crisis of the early 90’s. They were placated as they heard the details of over 1000 indictments of the perpetrators of fraud. In the aftermath of the tech bubble implosion ten years later, injured investors once again witnessed the most senior executives at Enron, WorldCom, Tyco, Qwest and others being led off in handcuffs and disgrace to waiting police cruisers. Retirees with decimated retirement plans felt that some level of restitution had been made when 25 year sentences were meted out to these formerly high-flying felons.After nearly two years since the greatest financial malfeasants in history and ten years since the last public example of financial crime, the public haven’t seen a single CEO sentenced to hard time for the financial meltdown. They have not had their thirst for revenge quenched by a single high level court case. Instead, the public infuriatingly witnesses politically crafted theater in congressional hearings that go nowhere, read watered down legislation that is replete with even richer lobbyist-authored loopholes and only occasionally see small headlines of quiet settlements with insulting token amends payments. Why? Were there no crimes committed? No laws broken?

The public is forced to accept excuses that we have enforcement agencies not enforcing, regulators not regulating and legislators not equipped to legislate properly in our modern fast moving financial world. The public is left with the gnawing concern of whether it is incompetence or something much deeper, more troubling, and more sinister. Confidence and trust in government and our democratically elected politicians continue to worsen from already pathetic levels.

The taxpayer while standing in long unemployment lines, reads in the newspapers of financial institutions that were making mind-numbing profits and paying horrendous executive bonuses suddenly being insolvent and needing taxpayer bailouts. Then as their unemployment benefits near exhaustion, they read of the banks’ profits soaring once again. These are the foundations of the emerging new age of public rage.

We have much more than a crisis of integrity. We have fraud that is so pervasive that it is now unknowingly institutionalized into our business and political culture. The sickening part is that it a like a cancer; if it’s not detected early, it will be too late to fight. We need to fully understand and prosecute the tenets of fraud before it is too late.

For the complete Research Report see: TIPPING POINTS – COMMENTARY

FRAUD

Fraud is the act of creating trust then betraying it. Fraud is deceit.

If I was to articulate this definition to the average person, I believe the vast majority (without formal legal training) would immediately respond that this is exactly how they’d describe the financial crisis! So why are there no indictments? Is the fraud of liar’s loans, NINJA (No income, No Job, No Assets) loans, false housing appraisals, false AAA credit ratings and false contingent liability reporting so hard to prove? Not really. It takes an indictment and that’s often a much too political process in America.

Some would argue it was not intentional and therefore can’t be seen as a felony. They‘d say it is more a matter of civil damages. Again, wrong.

CONTROL FRAUD

What emerged from the S&P debacle was the concept of control fraud. At the core of financial control fraud is the notion that a CEO would deliberately use the S&L as a camouflage to make bad loans, thereby gutting the underwriting process while knowing full well that the loans would statistically fail over the long run. By doing this, money is made in the initial stages, exactly in the fashion of a Bernie Madoff Ponzi scheme. Profits are declared and rich bonuses are paid. Stocks soar and rich stock options are executed. Then when the inevitable day arrives as the defaults emerge, the CEO takes the company into bankruptcy with no claw-back provisions, or an even newer and richer approach - the CEO seeks government bailouts to replace the pillaged balance sheet.

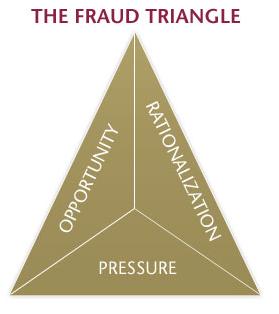

Corporate Control Fraud might be viewed as having four tell-tales:

- Deliberately making bad loans or investments.

- Exceptionally High Growth (because improperly accounted profits are being booked today).

- The use of extraordinary leverage to maximize profits while profits are artificially available.

- False representation of actuarial appropriate loss reserves.

Sound eerily familiar?

The S&L debacle prompted the Prompt Corrective Action (PCA) Law (US Code: Title 12,1831o). William K Black the author of “The Best Way to Rob a Bank is to Own: How Corporate Executives and Politicians Looted the S&L Industry, “ argues that this law is presently being broken through the misrepresentation of bank asset positions. Additionally, because the Prompt Corrective Action Law is not being enforced, the felony of accounting control fraud is being committed.

I have written extensively about the degree to which the banks 10K and 10Q balance sheets do not represent current fair market value of their assets. When the FDIC continuously takes over banks and declares that asset values are 25- 35% overvalued, there’s no further proof required. The banks, which are sold as part of the regular FDIC “Friday night bank lottery” continuously see no CEOs indicted for falsely representing FDIC-insured assets. We the taxpayers are then unwittingly presented with the tab.

Above, I made the assertion that indictments are too political a process in America. Control Fraud isn’t unique to just CEOs. Heads of sovereign governments and their empowered representatives also fall within this type of fraud. We once again see ourselves moving upwards hierarchically towards people in authority, who are charged with a fiduciary and judiciary responsibility, taking positions that enrich or politically benefit themselves at the expense of the innocent. This is fraud. Though we find ourselves asking, where are they when we most need them, we should be asking, who will bring them to justice?

If you think this is not widespread, how do you rationalize that it was recently reported that Goldman Sachs never had a trading day loss in April yet its clients in eight out of ten cases lost money. Incompetence? Stupidity? The Financial Times reports "The trading operations of Goldman Sachs and JPMorgan Chasemade money every single business day in the first quarter ... Goldman's trading desk recorded a profit of at least $25m(£16.8) on each of the quarter's 63 working days, making more than $100m a day on 35 occasions, according to a regulatory filing issued on Monday ... JPMorgan also achieved a loss-free quarter in its trading unit - making an average of $118m a day, nearly $5m an hour". Morgan Stanley reported trading profits on a mere 93% of the first quarter trading days. This defies any sort of logic in a freely trading markets, unless the markets are controlled and the game fixed. These are better odds than owning a casino.

The famous Barnum & Bailey carnival barkers used to snidely boast "there’s a sucker born every minute". The carnival games were notoriously fixed so the 'sucker' almost certainly lost. I’m not indicting anyone here (I will leave that to our alarmingly incompetent regulatory and enforcement agencies), but rather I’m only reinforcing why we have entered an age of public rage and why I felt compelled to write the Extend & Pretend series of articles.

RACKETEER INFLUENCED AND CORRUPT ORGANIZATIONS (RICO) ACT

Under RICO, a person who is a member of an enterprise that has committed any two of 35 crimes—27 federal crimes and 8 state crimes—within a 10-year period can be charged with racketeering. Racketeering activity includes:

Under RICO, a person who is a member of an enterprise that has committed any two of 35 crimes—27 federal crimes and 8 state crimes—within a 10-year period can be charged with racketeering. Racketeering activity includes:

- Any act of bribery (lobbying?), counterfeiting (naked shorting?), theft, embezzlement, fraud, obstruction of justice, money laundering,

- Embezzlement of union funds (talk to the SEIU about Interest Rate Swaps!);

- Bankruptcy fraud or securities fraud (where do we begin!);

- Money laundering and related offenses;

- Acts of terrorism (Financial - High Frequency ‘flash crash’ Trading?).

In addition, the racketeer must forfeit all ill-gotten gains and interest in any business gained through a pattern of "racketeering activity." RICO also permits a private individual harmed by the actions of such an enterprise to file a civil suit; if successful, the individual can collect treble damages.

It seems it is the same names I continue to read about in the press. Do these financial institutions settle to avoid the magic ‘2 committed felony’ threshold qualification for a RICO indictment?

On March 29, 1989, financier Michael Milken was indicted on 98 counts of racketeering and fraud relating to an investigation into insider trading and other offenses. Milken was accused of using a wide-ranging network of contacts to manipulate stock and bond prices. It was one of the first occasions that a RICO indictment was brought against an individual with no ties to organized crime. Milken pled guilty to six lesser offenses rather than face spending the rest of his life in prison. On September 7, 1988, Milken's employer, Drexel Burnham Lambert, was also threatened with a RICO indictment under the legal doctrine that corporations are responsible for their employees' crimes. Drexel avoided RICO charges by pleading no contest to lesser felonies. While many sources say that Drexel pleaded guilty, in truth the firm only admitted it was "not in a position to dispute the allegations." If Drexel had been indicted, it would have had to post a performance bond of up to $1 billion to avoid having its assets frozen. This would have taken precedence over all of the firm's other obligations—including the loans that provided 96 percent of its capital. If the bond ever had to be paid, its shareholders would have been practically wiped out. Since banks will not extend credit to a firm indicted under RICO, an indictment would have likely put Drexel out of business. Is this really what is behind too big to fail prosecution? (5)

You don’t need a fancy high priced Philadelphia lawyer to tell you that “when the glove fits you can’t acquit!” - A little old fashion common sense is all that is required.

CONCLUSION

The Age of Rage during the French revolution cost people their heads when the guillotine administered public justice daily for the angry masses. Political and bureaucratic heads will also roll in the future if justice is not soon administered. As Marie Antoinette learned too late, it may be much worse than merely the loss of an elected position with all its trappings.

It takes public rage for someone to spend the time to create expressions of frustration like the above graphic represents!

Sign Up for the next release in the Euro Experiment series: Commentary

The previous EXTEND & PRETEND article: EXTEND & PRETEND: Shifting Risk to the Innocent

(1) US Code: Title 12, 1831o. Prompt Corrective Action

(2) April 2009 William K. Black on The Prompt Corrective Action Law Bill Moyers Journal

(3) Accounting Control Fraud Google Scholar

(4) 02-23-09 Why Is Geithner Continuing Paulson's Policy of Violating the Law? The Huffington Post

(5) RICO - Wikipedia

(6) 05-12-10 Goldman’s Perfect Quarter Eric Fry The Daily Reckoning

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.