Plausible Gulf Oil Spill Scenario: Underground Blowout and Mudflow

Politics / Environmental Issues Jul 27, 2010 - 03:49 AM GMTBy: Dian_L_Chu

Amid rising fears over a circulating story about a leak and seepage, the federal government's oil spill chief said that seepage detected two miles from BP's oil cap is coming from another well. Meanwhile, BP is on track to use static top kill procedure in Macondo.

Amid rising fears over a circulating story about a leak and seepage, the federal government's oil spill chief said that seepage detected two miles from BP's oil cap is coming from another well. Meanwhile, BP is on track to use static top kill procedure in Macondo.

The static kill option is basically the cousin of the previously failed top kill. According to Platts, “the static kill would pump drilling mud and cement into the well, using the same entry points as the previous top kill procedure. The materials would be forced into the choke and kill lines of the well's blowout preventer (BOP).”

Scenario Apocalypse?

Although BP's new containment cap has stopped the flow of oil, circulating stories about a leak and seepage had caused mounting concern that the cap was displacing pressure and causing leaks deep underground.

One oil industry veteran engineer describes to me an underwater blowout (UGBO) as quite plausible, with the well being capped plus the static kill adding pressure from the top.

That is, capping the well might not be such good news.

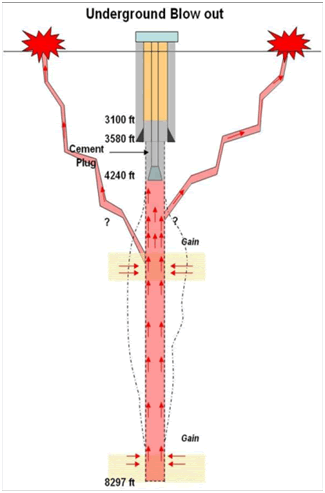

The more they try to restrict the oil gush, the more pressure could be built up within the wellbore (like a soda can.) The increasing pressure could eventually push the leak below leading to a UGBO. (See graph)

(Note: The graph is a general illustration and does not represent the BP Macondo well.

Source: http://www.silentpcreview.com/)

What Is A UGBO?

According to Schlumberger Oilfield Glossary and Wikipedia:

“An underground blowout is a special situation where the uncontrolled fluid flows from one reservoir into the wellbore, along the wellbore, and into another reservoir. Usually this is from deeper higher pressure zones to shallower lower pressure formations.”

“Underground blowouts can be very difficult to bring under control, and are historically the most expensive problem in the drilling arena. If left unchecked the fluids may find their way to the surface or ocean floor nearby.”

While there are sporadic discussions around a possible UGBO at Macondo well, it is still hard to visualize what kind of damage it could actually bring. A look at the ongoing mudflow environmental disaster in Indonesia could shed some light.

Indonesia Mudflow

The Sidoarjo mudflow in east Java, Indonesia has been ongoing since May 2006. The mud volcano was created by the blowout of an exploration well drilled by PT Lapindo Brantas, which triggered the eruption of hot mud.

The hot mud has continued to spew out at a rate of 100,000 cubic meters a day--equivalent to the contents of forty Olympic-size swimming pools--despite government efforts to plug the leak.

News reports described the mud lake is so huge — seven square kilometers in area and 20 meters deep — that it is now visible from space. Experts have warned that the mud may continue to flow for several decades.

Since 2006, the mudflow ha s inundated hundreds of hectares while new mudflows are still opening up. Some 50,000 Indonesians reportedly have been displaced after the drilling accident in May 2006.

Mudflow in the Gulf?

Mudflow in the Gulf?

In the case of the Macondo well, a UGBO could cause a seismic shift of the seafloor, and a potential astronomical increase of oil shooting to the sea surface of the Gulf, and flowing towards coastline. The seabed breach could also bring about a mud volcano and mudflow, similar to what happened in Indonesia, in the Gulf of Mexico deepwater, possibly for decades.

In fact, this is the very same doomsday scenario many scientists and geologists have feared, as there are some early signs of a typical UGBO such as the reported seepage and leak. That is why BP and the U.S. government have been feverishly analyzing underwater data and monitoring the pressure.

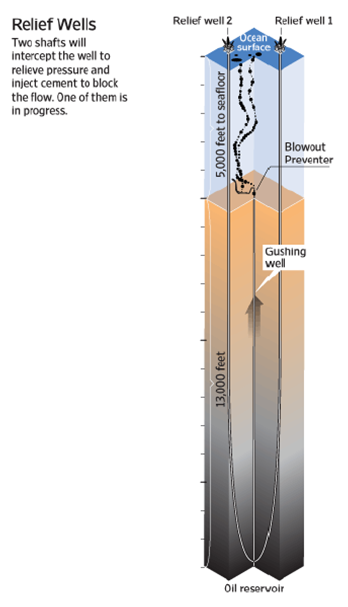

This one oil industry expert I talked to believes that with the failure of the first top kill, and the risk of UGBO, the more prudent course is to just drill the two relief wells as planned (see graph), instead of further risking the well integrity by the trying experimental well cap and another static kill.

Inaction Is Good …., Occasionally?

While this apocalyptic scenario seems beyond the imaginable, and there does not seem to be a previously documented case of a deepwater UGBO, but again, everything regarding this gulf disaster has been unprecedented.

I imagine all the experts in BP’s camp are quite aware that the risk of an UGBO is quite high, but with mounting public criticism towards BP and the Administration, any cautionary (i.e., non-action) note most likely will not be taken into serious consideration by the people in charge.

Crucial - Implementing Lessons learned

There are plenty of lessons learned and yet to be acted upon for the spill response and remedial side of the oilfield technology to catch up with the technology on the drilling and production side. The new rapid response system for the Gulf deepwater announced by the four oil majors--Chevron, ConocoPhillips, ExxonMobil and Shell-- seems to be a good start towards that direction.

Meanwhile, let’s hope a deepwater UGBO remains as a scenario-based discussion only.

(Many thanks to the silent co-contributor of this article.)

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.